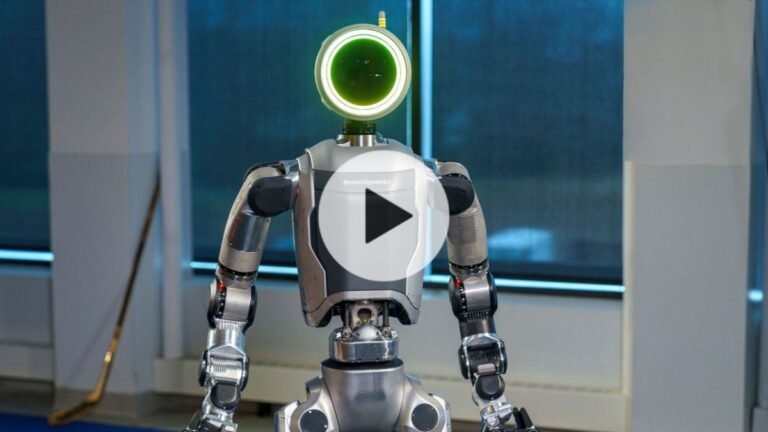

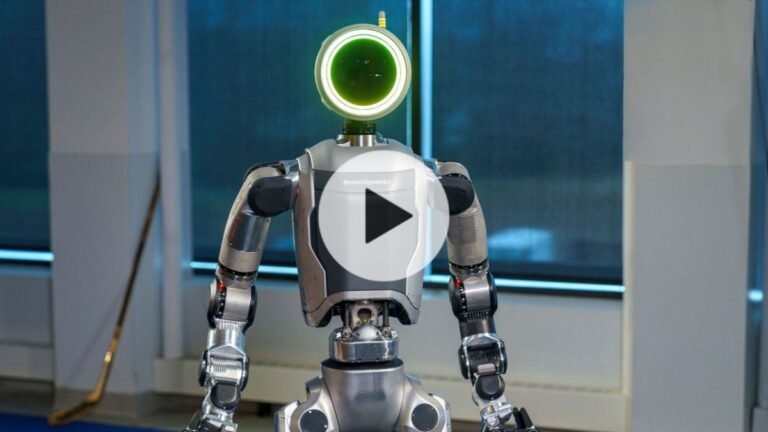

This week Boston Dynamics retired its well-known Atlas robot that was powered by hydraulics.

Then today it unveiled its new Atlas robot, which is powered by electricity.

Its new Atlas robot is leaner, and appears to have improved range-of-motion.

Size and ability to contort and maneuver are not cosmetic elements to a humanoid robot — they can unlock new use cases and possible work environments.

Happily for those of us who want a domestic robot to handle household chores and hold our hands whilst we cry, there are other startups working on the humanoid robot project.

The digital currency hit a new all-time high for the first time since November 2021 when it passed $69,000 on Tuesday morning, as demand surged in recent weeks following the spot bitcoin ETF approvals in the U.S. and the pending bitcoin halving in late April.

Bitcoin halving, which is usually referred to as “the halvening,” is a periodic decline in bitcoin mining rates, which means the number of bitcoin miners can potentially get for each block mined is cut in half.

This process is meant to control the supply of bitcoin over time and once the number of bitcoin in circulation hits 21 million, its total supply, the process will end.

The price jump increase is also being driven by the 11 spot bitcoin ETFs the U.S. Securities and Exchange Commission approved in January.

The total market cap across the spot bitcoin ETF products is $53.74 billion, according to Blockworks data.

Binance will discontinue its naira (NGN) services in response to heightened regulatory scrutiny in Nigeria, it said in a blog post today.

The cryptocurrency exchange will begin delisting any existing NGN spot trading pairs by Thursday, March 7.

Any remaining NGN balances in users’ spot and funding wallets will be converted to USDT on Friday, March 8, it noted.

This development follows recent regulatory actions by the Nigerian government, which imposed restrictions on both local and foreign cryptocurrency exchanges, including Binance.

What followed was the reported detention of two Binance officials after they were invited to Nigeria to discuss the regulatory restrictions.

Like a tenacious balloon, no matter how hard crypto gets knocked down, it tends to float back up again.

I’ve found that to be true in all the years I have covered the decentralized market and economy since 2013.

After a lengthy downturn — a crypto winter, if you want — blockchains and their constituent tokens and services seem to be on a rebound.

Data paints the picture: Spot trading volumes reached a 12-month high earlier this month, the total value of crypto tokens has appreciated materially in recent months, and even NFTs are showing signs of life.

Yet, despite the run of positive news, venture capitalists’ interest in web3 startups continued to decline in Q4 2023, dipping further underneath a severely depressed third-quarter figure.

Bitcoin spot ETF volume rose, Coinbase went to court, Solana Mobile announces new device and Google cuts crypto apps in IndiaWelcome to TechCrunch Crypto, formerly known as Chain Reaction.

To get a roundup of TechCrunch’s biggest and most important crypto stories delivered to your inbox every Thursday at 12 p.m. PT, subscribe here.

Prior to the U.S. Securities and Exchange Commission’s approval of the spot bitcoin ETFs, some experts told me they expected trading volumes to hit $10 billion in a year, not a week.

Monica has spent the last 10 years at Ripple, working her way up from the director of communications to now, president.

What else we’re writingWant to branch out from the world of web3?

How low can bitcoin ETF fees drop before it hurts a business?

On Thursday, Franklin Templeton’s Franklin Bitcoin ETF ranked sixth among the 11 for first day trading volume at $65.45 million by the end of the day.

(Note: A number of issuers, Franklin included, are waiving fees for a limited time.)

There’s reason to believe that spot bitcoin ETFs and other related products that may come to market will see strong demand over time, and major investment houses want a piece of the action.

An additional preexisting $2.3 billion from Grayscale’s GBTC fund, which converted into a spot bitcoin ETF on Wednesday, brought the 11 issuers’ total to $4.6 billion.

Fast-forward to Wednesday and the SEC approved the first spot bitcoin ETF applications for 11 issuers (TC+).

I spoke with two executives from Grayscale and Valkyrie about what’s in store for their spot bitcoin ETFs.

Anyways, that’s enough housekeeping and spot bitcoin ETF news for today.

And now, Grayscale’s bitcoin spot ETF was approved.

We dive into what a spot bitcoin ETF approval means for GBTC and market demand.

It’s been a long road for spot bitcoin ETF filers – and today the U.S. Securities and Exchange Commission finally approved all 11 standing applications from issuers.

“We always knew the investor sentiment would get there, regulators would get there and the financial advisor community would get there.”Grayscale, a digital asset investment firm that was one of the 11 firms to file for a bitcoin spot ETF, is best known for its Grayscale Bitcoin Trust (GBTC), which has now been converted, or “uplisted,” into its new bitcoin spot ETF product.

The 10 other issuers are BlackRock’s iShares Bitcoin Trust, ARK 21Shares Bitcoin ETF, Bitwise Bitcoin ETP Trust, WisdomTree Bitcoin Fund, Fidelity Wise Origin Bitcoin Trust, VanEck Bitcoin Trust, Invesco Galaxy Bitcoin ETF, Valkyrie Bitcoin Fund, Hashdex Bitcoin ETF and Franklin Bitcoin ETF.

While futures ETFs marked a big milestone in 2021, Sonnenshein believes the most critical one that brought these bitcoin spot ETF approvals was the D.C.

Circuit Court of Appeals’ ruling in favor of Grayscale against the U.S. Securities and Exchange Commision in the case of a bitcoin spot ETF in the Summer of 2023.

It’s been over a decade since the first application for a spot bitcoin ETF was filed.

After a number of denials over the years, the U.S. Securities and Exchange Commission has approved all 11 applications from spot bitcoin ETF issuers, marking a potential watershed moment for the crypto industry and potentially opening the floodgates by making it easier for institutional investors and consumers alike to invest in the biggest digital asset.

The issuers are BlackRock’s iShares Bitcoin Trust, Grayscale Bitcoin Trust, ARK 21Shares Bitcoin ETF, Bitwise Bitcoin ETP Trust, WisdomTree Bitcoin Fund, Fidelity Wise Origin Bitcoin Trust, VanEck Bitcoin Trust, Invesco Galaxy Bitcoin ETF, Valkyrie Bitcoin Fund, Hashdex Bitcoin ETF and Franklin Bitcoin ETF.

In 2021, BITO, the first bitcoin-linked futures ETF in the U.S., launched and immediately saw a lot of demand during its first year.

It eventually grew to become one of the largest and most traded crypto ETFs., according to ProShares data.

SEC’s X account hacked, sharing ‘unauthorized tweet’ regarding spot bitcoin ETF The agency has "not approved" the listing and trading of spot bitcoin ETFs, chair Gary Gensler saysThe U.S. Securities and Exchange Commission’s X account has been hacked, a spokesperson confirmed with TechCrunch on Tuesday afternoon.

The unauthorized tweet regarding bitcoin ETFs was not made by the SEC or its staff,” the spokesperson said.

The unauthorized post has since been deleted.

Around 4:30 p.m. EST, SEC Chair Gary Gensler tweeted, “The @SECGov twitter account was compromised, and an unauthorized tweet was posted.

The SEC has not approved the listing and trading of spot bitcoin exchange-traded products.”After the fake post went out, Bitcoin’s price spiked near $48,000 but has since fallen around $45,700, according to CoinMarketCap data.