Welcome to Startups Weekly — your weekly recap of everything you can’t miss from the world of startups.

Ron has been working from home as a writer for almost as long as I’ve been alive.

Moar transpoLook, I’m trying my best to have a balance of everything here on Startups Weekly.

The Apple falls far from the car: Apple, after packing in its electric car project, let go of 600 staff who were reportedly working on the project.

I’d pay good money to see the prototypes …Apple, after packing in its electric car project, let go of 600 staff who were reportedly working on the project.

Maximize your team’s impact at DisruptWith four conference passes included, ScaleUp Startup Exhibitors can make the most of all three days of the event.

Access to the TechCrunch Disrupt press list.

Upon intent to participate, the ScaleUp Exhibitor Packages are $3,500 and, if your startup is accepted, that fee is non-refundable.

The ScaleUp Startups Exhibitor Program is for Series A to B startups with $35 million or less in funding and costs $3,500 to participate if accepted.

Book your package now to become a ScaleUp Startup Exhibitor at Disrupt and unlock unparalleled opportunities for growth and visibility.

Cendana, Kline Hill have a fresh $105M to buy stakes in seed VC funds from LPs looking to sellIf you ask investors to name the biggest challenge for venture capital today, you’ll likely get a near-unanimous answer: lack of liquidity.

Cash-hungry venture investors, whether VCs themselves or their limited partners are increasingly looking to sell their illiquid positions to secondary buyers.

“We simply passed the hat around to our existing LPS at Kline Hill and Cendana,” said Kim.

It then passes these opportunities to Kline Hill, which values, underwrites and negotiates the transaction price.

Traditional secondary investors, such as Lexington Partners and Blackstone, recently raised their largest secondary funds ever.

Guesty — which has built a platform for accommodation managers to manage all aspects of their business on platforms like Airbnb, Vrbo and directly to travellers — has raised $130 million.

Guesty’s close competitor Hostaway raised $175 million in May last year (its first ever big funding round).

And Mews, which like Guesty builds SaaS but for hoteliers, raised $110 million at a $1.2 billion valuation last month (March 2024).

First of all, Guesty wants to continue expanding its existing platform for current customers.

Third of all, Soto said that Guesty wants to consider more acquisitions.

Venture capitalists’ appetite for fusion startups has been up and down in the last few years.

The road to true fusion power remains long, but the kicker is that it’s no longer theoretical.

He added the timeline was to be able to get to fusion energy by the mid-2030s.

If we manage to get to that then the middle of the 2030s is possible.”The startup’s investors are equally convinced.

And there are at least 43 other companies developing nuclear fusion technologies.

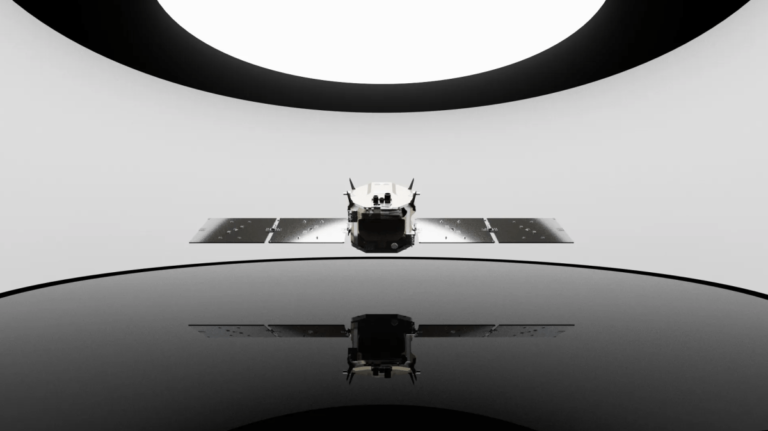

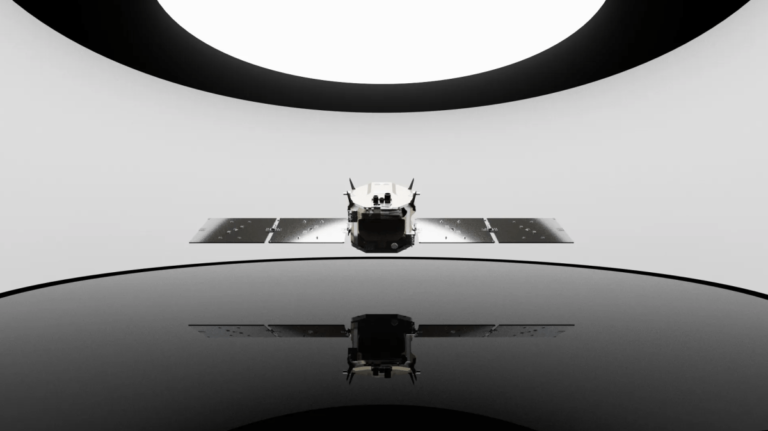

True Anomaly‘s first mission didn’t go as planned by any stretch of the imagination, but the space and defense startup’s CEO, Even Rogers, said he doesn’t consider it a failure.

The aim of this first mission, Mission X, was to demonstrate these capabilities on orbit for the first time.

True Anomaly closed a $100 million Series B round last year to accelerate those plans.

By all accounts, the outcome of Mission X has not slowed the company down whatsoever: True Anomaly is planning on flying at least twice more in the next twelve months.

“The success story of Jackal Mission X is twofold,” Rogers said.

Verod-Kepple Africa Ventures (VKAV) plans to back up to 21 growth-stage companies across the continent after closing its first fund at $60 million.

The pan-African VC hit the milestone following fresh backing from Nigeria’s SCM Capital formerly Sterling Capital Markets Limited, and the only non-Japanese investor.

Verod-Kepple is the latest African VC to get capitalized, amid an ongoing investment downturn, allowing it to provide much-needed capital to series A and B startups even as local capital pools for growth-stage companies remain limited.

We think there’s still a need for more growth stage capital with locally based investors,” she said.

How VKAV makes investmentsThe VKAV fund backs startups that are building infrastructure for the digital economy, solving inefficiencies encountered by businesses, and market creators for the emerging consumer population.

Metalab goes from quietly building the internet to investing in itNearly 20 years after finding success in helping startups build products, Canadian interface design firm Metalab launches Metalab Ventures to invest in many of those product-led startups.

Then Metalab “lets them loose” to grow, CEO Luke Des Cotes told TechCrunch.

With Metalab Ventures, the venture arm will play the role of a long-term value investor, essentially “putting our money where our mouth is,” Des Cotes said.

When determining who to invest in Metalab Ventures, the process includes getting to know the founders and if the firm can add value.

“We’ve already operated very much like a venture fund,” Des Cotes said.

TechCrunch is searching for 200 trailblazing startups to feature in the Startup Battlefield 200 at TechCrunch Disrupt in San Francisco this October.

Apply NowShowcasing global innovatorsFrom the Startup Battlefield 200, we’ll handpick 20 companies for the Startup Battlefield competition.

The only way early-stage, pre-series A startups can exhibit on the show floor at Disrupt is through Startup Battlefield, and the only way to become a Startup Battlefield finalist is to be selected for Startup Battlefield 200.

How to Join TechCrunch Startup Battlefield 200The process is straightforward.

Is your company interested in sponsoring or exhibiting at TechCrunch Disrupt 2024?

Welcome to TechCrunch Fintech!

One thing that stood out to me was just how much fintech representation in their cohorts is shrinking.

So there was one-third the percentage of fintech companies this year compared to two years ago.

Analysis of the weekFintech funding slid by 16% quarter-over-quarter during the three-month period ended March 31, according to CB Insights’ Q1 2024 State of Venture Report.

During the three-month period, 904 investments were made into fintech startups, which was higher than 786 in the previous quarter, signaling smaller deal sizes.