GGV Capital announced last fall that was splitting up its team amid growing tensions between U.S. and China, though it never cited the atmosphere as the explicit driver of the move.

The thinking in abandoning the GGV Capital brand, per a source familiar, was that because both teams are operating separately going forward, they felt it was best to develop new brands.

Oren Yunger, the newest member of GGV Capital, also remains on team Notable.

Another longtime managing director at GGV Capital, Eric Xu, who is based in Shanghai, will continue to oversee the original firm’s independently operated yuan-denominated funds.

Roughly 2.5 years ago, GGV Capital announced it has raised $2.5 billion for its new funds, marking its largest family of funds ever.

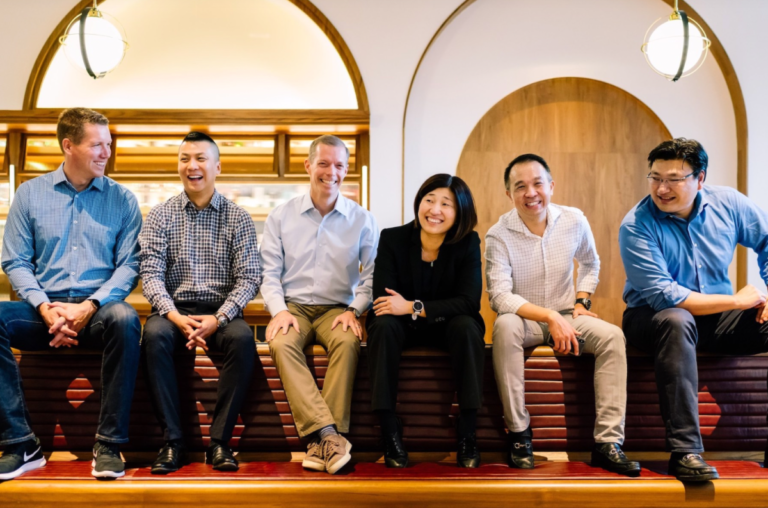

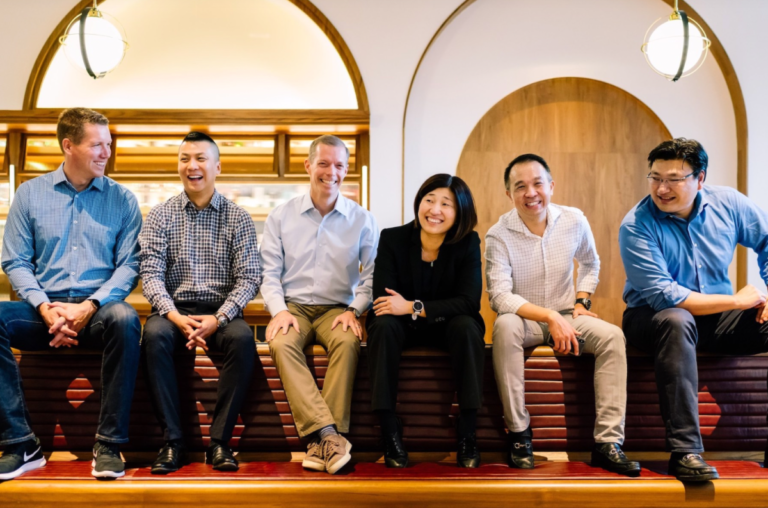

The left-hand side of the slide has too much info (why are funding, product and customers on the team slide?)

Three things that Protecto could have improvedPitch deck design isn’t usually that important, but the design of this deck is particularly bad.

These case studies aren’t case studiesIn a 14-slide deck, Protecto wastes slide 4 as an interstitial (it just says “our platform”).

The full pitch deckIf you want your own pitch deck teardown featured on TechCrunch, here’s more information.

Also, check out all our Pitch Deck Teardowns all collected in one handy place for you!

Don’t miss out on your chance to shine at “So You Think You Can Pitch,” our highly anticipated segment at TechCrunch Early Stage 2024, happening in Boston on April 25.

At TC Early Stage, three lucky founders will present their pitch decks for 4 minutes each in front of a panel of expert judges, gaining invaluable insights to refine their approach.

Selected finalists will have the opportunity to meet with the TechCrunch team in advance for session preparation.

About TechCrunch Early Stage 2024TechCrunch’s founder summit on April 25 in Boston, Massachusetts, is designed to empower early-stage entrepreneurs at every phase of their journey, from pre-seed to growth stages.

Is your company interested in sponsoring or exhibiting at TechCrunch Early Stage 2024?

Mermaid, the open source diagramming and charting tool, has long been popular with developers for its ability to create diagrams using a Markdown-like language.

They were watching ‘The Little Mermaid.’ That’s why I named that eight years ago.”Early on, Mermaid was mostly about flowcharts, but over time Sveidqvist added other diagram types — and the community quickly made it its own, too.

Firestone told me that the cloud version of the open source project had 4 million users last year.

That’s a market Mermaid Chart is looking to address by building easier-to-use tools for this group of users.

“Mermaid Chart is expanding the community by bringing the benefits of Mermaid to all types of business users, leveraging AI as a catalyst.

One path, which is particularly well trodden, is to start a venture fund.

Instead of launching a VC fund, they’re starting with an incubator called Montauk Climate, TechCrunch has exclusively learned.

Montauk Climate is one of the latter.

Montauk Climate will remain shareholders in its spinout companies and have seats on their boards.

As the number of incubated companies expands, Montauk Climate expects to raise its own venture fund to help support them.

In June 2023, Inflection announced it had raised $1.3 billion to build what it called “more personal AI.” The lead investor was Microsoft.

Today, less than a year later, Microsoft announced that it was essentially eating Inflection alive (though I think they phrased it differently).

Co-founders Mustafa Suleyman and Karén Simonyan will go to Microsoft, where the former will head up the newly formed Microsoft AI division, along with “several members” of their team as Microsoft put it — or “most of the staff,” as Bloomberg reports it.

Ultimately Microsoft got a bit of extra leverage on the company instead of eating it alive.

Whether it was OpenAI or Inflection, Microsoft was feeding their cash and compute addictions, whispering in their ear about partnerships, and then as soon as they tripped, out came the hidden fork and knife.

TigerEye CEO Tracy Young and her husband and CTO Ralph Gootee helped build their previous startup, PlanGrid, into a $100 million ARR business before selling it to Autodesk for $850 million in 2018.

Yet in spite of that success, they always felt they left business on the table because of an inability to forecast business changes accurately.

“TigerEye is a business simulation engine that helps companies predict their future,” Young told TechCrunch.

The couple was advising other startups at Y Combinator in 2021 when they decided it was time to build TigerEye.

The following year, they brought a bunch of the core members of the PlanGrid team back together and started working on the problem.

Tech aficionados, startup enthusiasts, marketing wizards, and venture capitalists on the rise — seize the opportunity to showcase your expertise at TechCrunch Disrupt 2024, happening from October 28–30 in San Francisco.

Apply to speak at TechCrunch DisruptWe’re assembling a lineup of industry experts spanning the startup landscape to lead engaging breakout sessions or facilitate roundtable discussions.

The TechCrunch team will review each application and select finalists who will proceed to the Audience Choice voting round.

TechCrunch Disrupt takes place from October 28–30, but the deadline for content applications is April 26.

Is your company interested in sponsoring or exhibiting at TechCrunch Disrupt 2024?

Twenty-two slides might seem like too many (the optimal length for a slide deck is around 16 slides these days), but there are some interstitial slides and an appendix in this one, and those don’t really count.

This team slide came as a bit of a surprise:Putting this slide at the end of the deck makes me wonder about the seriousness of this startup.

If it has five business units and 70+ team members, it throws the rest of the deck out of whack.

On slide 12, the company noted it had $7.5 million worth of revenue from just its case study clients.

The full pitch deckIf you want your own pitch deck teardown featured on TechCrunch, here’s more information!

Zscaler, a cloud security company with headquarters in San Jose, California, has acquired cybersecurity startup Avalor 26 months after its founding, reportedly for $310 million in cash and equity.

But what sets Avalor apart is the ability to handle data from virtually any source in any format, and its unique set of vulnerability risk management and prioritization tools.

Prior to the Zscaler acquisition, Avalor managed to secure $30 million from investors including TCV, Salesforce Ventures, Jibe Ventures and Cyberstarts.

And Raz sees Zscaler taking the business — and its ~80-person team spread across the U.S. and Israel — further.

As Crunchbase’s Chris Metinko noted earlier today, Zscaler’s acquisition — along with others in the cybersecurity space — could help spark activity in a slow-to-stagnant cyber M&A market.