UPI, built by a coalition of Indian banks, has become the most popular way Indians transact online, processing over 10 billion transactions monthly.

In February, a parliamentary panel in India urged the government to support the growth of domestic fintech players that can offer alternatives to the Walmart-backed PhonePe and Google Pay apps.

The NPCI has long advocated for limiting the market share of individual companies participating in the UPI ecosystem to 30%.

The RBI is also weighing an incentive plan to create a more favorable competitive field for emerging UPI players, another person familiar with the matter said.

Indian daily Economic Times separately reported Wednesday that the NPCI is encouraging fintech companies to offer incentives to their users, promoting the use of their respective apps for making UPI transactions.

The transactions include a trading card commercial agreement that aims to provide trading enthusiasts a seamless buying, selling, grading, and storage experience.

As part of the partnership, eBay and PSA plan to introduce a “customer-centric product experience” over the coming months.

Additionally, eBay acquired Collectors’ auction house Goldin, a significant move that will greatly benefit collectors.

eBay is also selling the eBay vault to Collectors, creating a new offering that merges the existing vault services.

Launched in 2022, the eBay vault allows collectors to store trading cards that are valued at more than $750 in a secure, temperature-controlled vault.

The negotiations between Fisker and a large automaker — reported to be Nissan — over a potential investment and collaboration have been terminated, a development that puts a separate near-term rescue funding effort in danger.

Fisker revealed in a Monday morning regulatory filing that the automaker terminated the negotiations on March 22.

Fisker said in the filing that it will ask the unnamed investor to waive the closing condition.

In February, Fisker laid of 15% of its staff (around 200 people) and last week reported having just $121 million in the bank.

Fisker had held talks with other automakers, including Mazda, but only Nissan recently remained at the table.

Apple Pay is no stranger to regulatory controversy.

PayPal — the payments behemoth that has substantial businesses in mobile transactions and point-of-sale technology — was apparently instrumental in the original EU complaint around Apple’s payment monopoly.

The DOJ’s argumentApple today takes a 0.15% fee on any transaction made via Apple Pay.

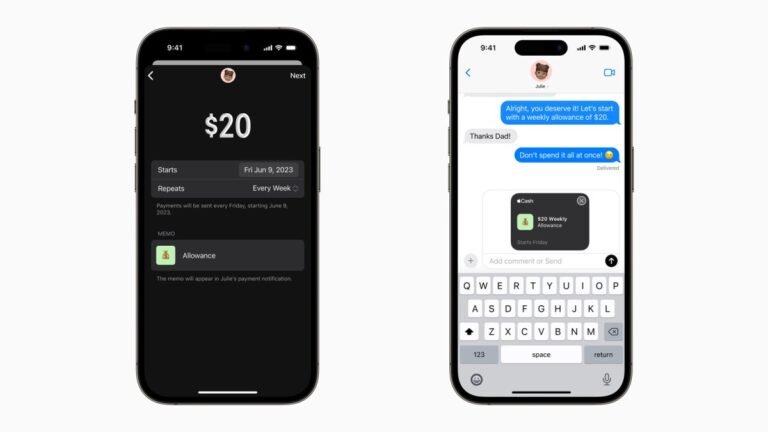

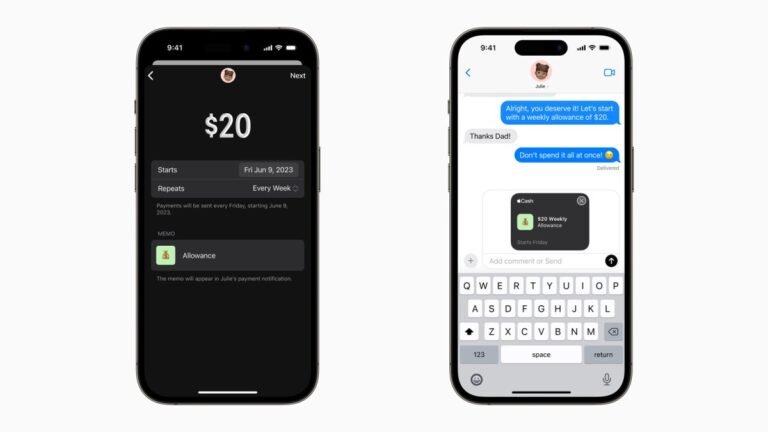

In the meantime, Apple has continued to develop Apple Pay, launching — for example — its own buy now, pay later offering last autumn (pictured above).

Apple Pay and Apple Wallet are both a small part of Apple’s services revenues — which were upwards of $90 billion in 2023 — or indeed overall revenues.

Appzone is one of the standout local fintech software providers for banks and fintechs, providing better pricing and flexibility.

As such, it rebranded to Zone, a licensed blockchain-enabled payment infrastructure company–and carved out its original banking-as-a-service business into a separate standalone company, Qore.

Today, Zone, its blockchain network that enables payments and acceptance of digital currencies, is announcing that it has raised $8.5 million in a seed round.

Therefore, the fintech is developing an interoperable payment infrastructure using blockchain technology — known for its ability to scale infinitely — to connect banks and fintech companies, facilitating transaction flow without intermediaries.

“We are excited by the potential for Zone’s technology to be replicated across borders to advance payment innovation globally.

It has solutions to address blockchain transactions and solutions for data exchange around artificial intelligence training and usage.

It has also built and posted four libraries to carry out that work on GitHub and claims that 3,000 developers are using these.

Zama’s technology is the key to build multiplayer, privacy-preserving applications,” said Kyle Samani, managing partner of Multicoin Capital, in a statement.

That still doesn’t represent useful speeds for most of the world’s transactions, but given that blockchain transactions themselves are typically slow-moving, that presented an opportunity to offer Zama’s solutions to crypto developers.

In the meantime, companies like Zama are continuing to work on algorithms and techniques to compress the work involved to carry out homomorphic encryption on existing infrastructure.

But the company has also released a new API called FinanceKit that lets developers fetch transactions and balance information from Apple Card, Apple Cash, and Savings with Apple.

The most requested credit card integration is now live on Copilot Money 💳 Starting today, Copilot can keep track of your Apple Card, Apple Cash, and Savings accounts.

It released the Apple Card in 2019.

Earlier this year, it said that Apple Card users earned $1 billion in daily cash rewards in 2023.

In April 2023, Apple launched a savings account with a 4.15% APY in partnership with Goldman Sachs.

Some cryptocurrency exchanges in Nigeria faced accessibility issues for users, prompting speculation of imposed restrictions on crypto sites, the Financial Times reported.

On Wednesday, local media reported that Nigeria’s telecom regulator, the Nigerian Communications Commission (NCC), received instructions from the country’s apex bank to suspend access to crypto websites, including Binance, Coinbase and Kraken.

According to Bloomberg, a presidential spokesman confirmed Nigeria’s issuance of a directive instructing telecoms and internet service providers to block access to cryptocurrency trading platforms.

Only users attempting to access the website are impacted, although the app is currently available,” Binance stated.

While several Binance users in Nigeria reported difficulties accessing the site in the early hours of Thursday, it appears that the directive to restrict access has been temporarily halted, as these cryptocurrency trading platforms, including Kraken and Coinbase, are currently accessible.

Although Ripple has been around since 2012, it and the XRP Ledger are doubling down on its global payments journey.

At the same time, it’s also aiming to become the go-to enterprise infrastructure provider, the company’s president, Monica Long, said on TechCrunch’s Chain Reaction podcast.

Distinct from the Ripple network and protocol, the XRP Ledger is a decentralized public ledger with an open source code base that anyone can contribute to or use, Long said.

“Foreign exchange is pretty concentrated in terms of the players who actually have enough capital to provide liquidity for those transactions,” Long said.

“And so when you have a lot of concentration, you have a lack of competitiveness for the pricing.”

Fintech startup Oscilar is hoping to help financial institutions protect online transactions from fraud and theft with its AI-driven platform. The company is currently in development, and expects to launch…