Moove, an African mobility fintech that offers vehicle financing to ride-hailing and delivery app drivers, has raised $100 million in a funding round as it plots expansion into new markets.

Moove says it plans to use the new capital to expand its revenue-based vehicle financing platform to 16 markets by the end of 2025.

Moove takes a two-pronged approach to vehicle financing.

The vehicles provided to Moove customers vary from traditional options like Toyotas and Suzukis to electric vehicles (EVs) such as Teslas.

The vehicle financing startup operates large EV fleets in the UAE and the U.K.

The long-running dearth of IPOs could be coming to a close, partly due to Reddit’s upcoming public debut.

Expected to list this month, Reddit saw its valuation soar during the pandemic.

If Reddit’s IPO does well, it could wiggle open the public-offering window just a little bit wider than we’ve seen in quarters and quarters.

Of course, the public offering could also fizzle out like an unpopular opinion downvoted to hell on the site.

But with an AI-friendly growth story to tell, Reddit may have timed its ramp towards the public markets just right.

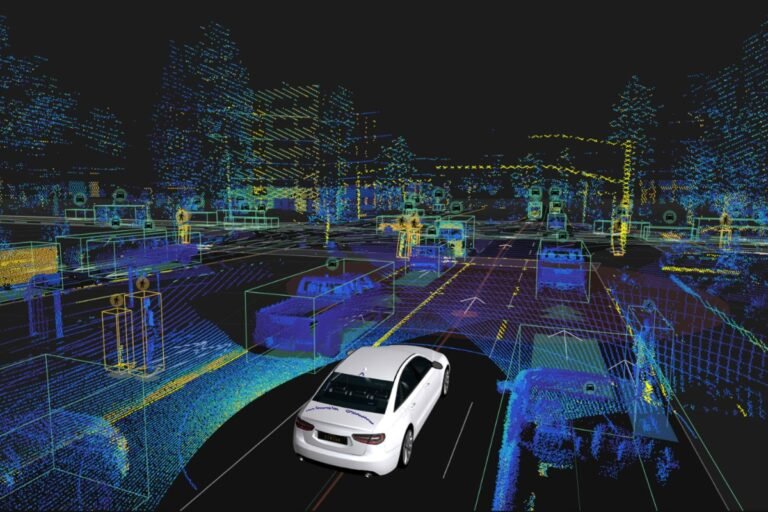

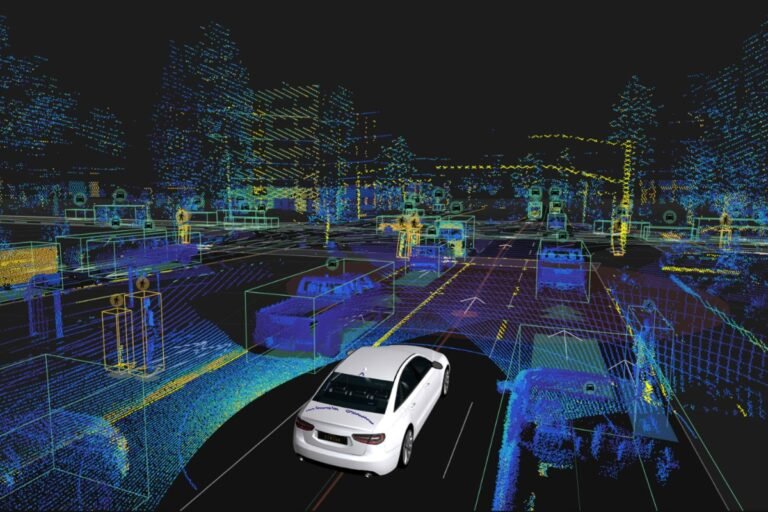

Autonomous vehicle software company Applied Intuition has raised $250 million in a round that values the startup at $6 billion, as it pushes to bring more artificial intelligence to the automotive, defense, construction and agriculture sectors.

The eye-popping funding round is the latest example of investor fervor for AI.

Lux Capital, Elad Gil, and Andreessen Horowitz all previously led funding rounds for Applied Intuition.

Founded in 2017, Applied Intuition creates software that automakers and others use to develop autonomous vehicle solutions.

“When they think like, ‘I have this software or AI problem,’ we generally want them to think about us,” Younis says.

At the low end of this range, $31 billion, though Reddit would be worth $4.93 billion based on an expected 158.98 million shares outstanding.

With $804.0 million in 2023 revenue, Reddit is on track to trade for a multiple of 6.9x to 8.0x its revenue, depending on the valuation estimate you want to use.

Reddit’s game plan for AI is one good reason why it’s pricing its shares closer to Meta than Snap.

Reddit data constantly grows and regenerates as users come and interact with their communities and each other.

Investors might consider Reddit a side-bet on AI itself, even if the company’s core business isn’t creating AI models.

Welcome to Startups Weekly — your weekly recap of everything you can’t miss from the world of startups.

Meanwhile, you wait for months for a good acquisition story, and then a ton of them come along all at once!

The company just bagged a cool $430 million, hitting a lofty $5 billion valuation and making the financial world do a double take.

A bit rich, if you ask yours truly, given everything else we know about Musk, but there you go.

The underachievers — the bottom 10% — get their own badge of shame, a digital dunce cap signaling to travelers to swipe left.

Baron Capital, an investor in Indian food delivery startup Swiggy, has increased the value of its stake in the Indian firm, implying a valuation of $12.16 billion, surpassing the $10.7 billion post-money valuation at which Swiggy secured funding in early 2022.

The valuation uptick at the end of December is a noteworthy development for Swiggy and, more broadly, the Indian startup ecosystem.

This is particularly significant given that Swiggy’s valuation had previously been marked down to a low of $5.5 billion.

Swiggy commands roughly 45% market share in the Indian food delivery sector and is “well positioned to benefit from structural growth in online food delivery in India,” Baron Capital wrote in a separate filing.

Swiggy, which is also a key player in the instant-grocery delivery space in India, is increasingly broadening its offerings.

It has solutions to address blockchain transactions and solutions for data exchange around artificial intelligence training and usage.

It has also built and posted four libraries to carry out that work on GitHub and claims that 3,000 developers are using these.

Zama’s technology is the key to build multiplayer, privacy-preserving applications,” said Kyle Samani, managing partner of Multicoin Capital, in a statement.

That still doesn’t represent useful speeds for most of the world’s transactions, but given that blockchain transactions themselves are typically slow-moving, that presented an opportunity to offer Zama’s solutions to crypto developers.

In the meantime, companies like Zama are continuing to work on algorithms and techniques to compress the work involved to carry out homomorphic encryption on existing infrastructure.

London-based fintech company Monzo raised a late stage funding round of $430 million (£340 million), confirming a report from the Financial Times from a few weeks ago.

Founded in 2015, Monzo provides UK current accounts, debit cards and several financial products with a digital-first approach.

That’s why Monzo is sort of defying the odds with this new funding round, with Google playing a big part in this investment.

Monzo reached a post-money $4.5 billion valuation in 2022.

Now, Monzo has nine million retail customers in the U.K.

As an extension round, the valuation is also remaining flat, at $2.6 billion.

(Prior to that, the company raised a $100 million round in 2021 at a $1.2 billion valuation.)

“I didn’t feel the need to increase the valuation from the last round,” CEO and founder Dean Sysman, answered when asked about the decision.

Axonius is one of a group of specialist firms building platforms to help manage this.

“We’ve been a longstanding partner of Axonius, and we like to double down into our best performing companies.

A couple of years ago, payments orchestration was a foreign term to many large companies Juan Pablo Ortega would speak to.

Today, Yuno has facilitated transactions in over 40 countries worldwide and is working with enterprise clients like McDonald’s, Rappi, Avianca and inDrive.

The global payments orchestration market is forecasted to reach nearly $7 billion in value by 2032.

Many of Yuno’s competitors focus on solving payment orchestration for small and medium businesses, and not many were building the infrastructure for large enterprises, Ortega says.

That new round of capital gives Yuno a valuation of $150 million, Ortega said.