BlackRock, an investor in Byju’s, estimates that its stake of Indian edtech giant, once valued at $22 billion, is now worth nothing.

So it doesn’t come as a surprise that BlackRock has implied a zero valuation to Byju’s.

At the end of October last year, BlackRock had cut the valuation of Byju’s to about $1 billion.

However, the research’s note chart (embedded below) did use zero in the column for estimated value.

The story has also been updated to emphasize BlackRock’s valuation adjustment in its Byju’s stake.

But as the data analytics and AI boom drives organizations to expect more of data models, many of the old paradigms are proving difficult to manage — and exceptionally brittle.

Now, five years later, Keydunov and Tiunov have a veritable business on their hands, having launched a subscription-based service built on Cube — Cube Cloud — that adds automated workflows and enterprise-focused governance and deployment tooling.

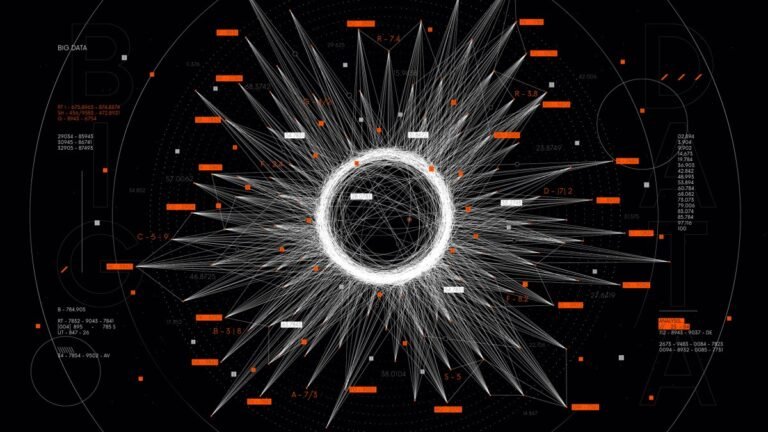

An illustration of Cube’s semantic data layer.

Image Credits: Cube“Cube Cloud is a universal semantic layer that is an independent, yet interoperable, part of the modern data stack that sits between your data sources and data consumers,” Keydunov said.

Keydunov says that the open source Cube project has surpassed 10 million downloads, while Cube Cloud is now installed on around 90,000 servers.

Nearly everything else that’s being built on or enabled by blockchains replaces something that’s already being done fairly well.

Yes, there are companies that facilitate crypto trades like Coinbase and Block (formerly Square).

But there’s no actual company that’s developed economic value by doing something brand new or better on a blockchain.

Energy drives the real-world economy, and unless Sam Altman or somebody successfully unlocks fusion and delivers energy that’s truly “too cheap to meter,” it’s going to remain a real asset with real value for some time.

In fact, it wouldn’t surprise me in the least if Satoshi had some kind of connection to the energy industry.

We’ve seen systems that pick apples and berries, kill weeds, plant trees, transport produce and more.

A huge piece of any of these products’ value prop is the amount of actionable information their on-board sensors collect.

In a sense, Orchard Robotics’ system is cutting out the middle man.

The system cameras can capture up to 100 images a second, recording information about every tree its passes.

Then the Orchard OS software utilizes AI to build maps with the data collected.

Donald Trump’s beleaguered SPAC deal is finally going through, and just in time to pay nearly half a billion dollars owed over several legal actions — if the board agrees to let him sell.

And that’s without reckoning with the questionable success of Truth Social, the partisan social network hurriedly stood up after the former President was booted from Twitter.

TMTG reportedly had a net loss of around $49 million in 2023, on revenues of under $4 million — not exactly hot numbers.

There’s no doubt that many, many shareholders in the newly public TMTG will sell their shares as soon as possible.

But if Trump wanted to finance his current liabilities, he’d have to sell some 12 million shares at the current price — around 15% of his total stake.

Telegram founder and CEO Pavel Durov said on his channel today that the company secured $330 million in investment through bond sales last week.

“This bond offering was oversubscribed, and we were delighted to have global funds of the highest caliber with impeccable reputations as participants.

The maturity for the bonds is either 2026 or when Telegram goes public, whichever is earlier.

The chat app, which has more than 900 million users, issued bonds worth $210 million last year.

Earlier this month, the company announced that personal users can convert their accounts to business accounts by paying a subscription fee.

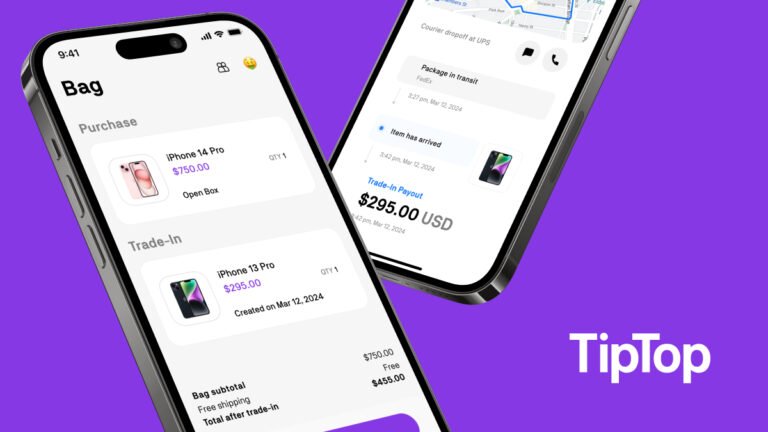

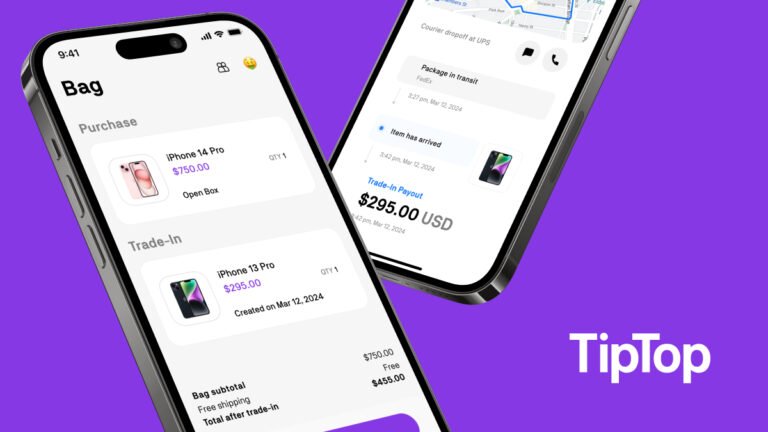

TipTop, the new app from Postmates’ founder and CEO, now lets you buy devices with trade-ins and cashTipTop, the startup that offers instant cash for electronics, is launching TipTop Shop: a way for users to purchase and trade in devices.

TipTop Shop builds on the success of TipTop Cash, which was released late last year.

It lets people get instant payouts for electronic devices like smartphones, iPads, cameras, game systems and more.

People can buy new, open-box and refurbished devices through cash and trade-ins.

Unlike on platforms like eBay and Facebook Marketplace, consumers aren’t buying products on TipTop from other consumers, as the devices are owned by the startup itself.

The movie later went on to win 7 Oscars, including Best Picture, Best Director, and Best Screenplay.

And this is why it’s so hard to find fulfillment in this current system.

“Which brings me back to AI,” Kwan continued, to a thunder of applause and cheers.

“So imagine what this technology will do within this current system, within this current incentive structure.

“I also want to say, we’re not saying ‘don’t use AI.’ I don’t believe in dogmas.

Telegram founder Pavel Durov said that the company expects to hit profitability next year with eyes on going public in the future.

While Telegram is not looking to raise a mega round, the company is open to investment in exchange for smaller equity.

The company also offers ad solutions for one-to-many channels and plans to launch ad revenue sharing with channel owners this month.

Durov told FT that ad solutions currently are limited to certain geographies and the company mandates agencies to spend between €1mn and €10mn.

Apart from these solutions, Telegram has also experimented with blockchain-based projects through the TON foundation.

Facebook plans to shut down its news tab in the U.S. and AustraliaMeta is trying to distance itself from news media-related regulations and payment complexities as it is planning to remove the news tab on Facebook in the U.S. and Australia.

The social media company said that the number of people using Facebook News in Australia and the U.S. dropped by 80% in the last year.

“This is part of an ongoing effort to better align our investments to our products and services people value the most.

The fate of Facebook News’ shutdown is due to regulatory moves and Meta’s withdrawal from investing in new products.

Legislations passed in countries Australia and Canada resulted in authorities asking platforms to pay online publishers for their content.