Two years ago, he launched Ballistic Ventures with an inaugural $300 million fund, a laser focus on cybersecurity, an interesting business model, and a who’s-who of investing partners.

Now Ballistic has already closed a second fund, even bigger than the first.

“We set out to raise a second $300 million fund and stopped at $360 million,” Schlein told TechCrunch.

Ballistic formally registered its plans for a second fund just four months ago, in November, TC was first to report.

The Ballistic team also includes general partner Kevin Mandia, the former CEO of Mandiant, which sold to Google in 2022.

Deep tech is on the rise in Europe, fueled in part by the match between AI and a local flavor of math excellence.

The deep tech fund will focus on computing, industry and life science.

The report, which was published this Wednesday, highlights 50 European deep tech companies, but more as an editorialized showcase than as a ranking.

While the firms may overlap in investments, they don’t fully see eye to eye on the “deep tech” term.

“For us, deep tech is a natural fit, as we’ve always been very close to research at Elaia,” she said.

With the second fund, Ada says it will invest between £250,000 and £1.5 million in pre-seed and seed stage startups, with a “significant amount” allocated for follow-ons.

So far, 12 investments have been made from the second fund.

Ada claims 30% of the investments from Fund I and Fund II were sourced this way.

Warner retorted: “There are 350+ fantastic female VC partners in Europe.

: “I think every leader of every VC fund needs to do whatever we can to attract the best talent in the industry.

New report confirms Europe’s tech investment doldrums, but there are signs of lifeEurope is suffering from a big hangover after the tech investment party of the 2020-2021 period.

That said, compared to pre-pandemic levels, VC investment in European startups is up, historically speaking, and reached $60 billion, according to a new report.

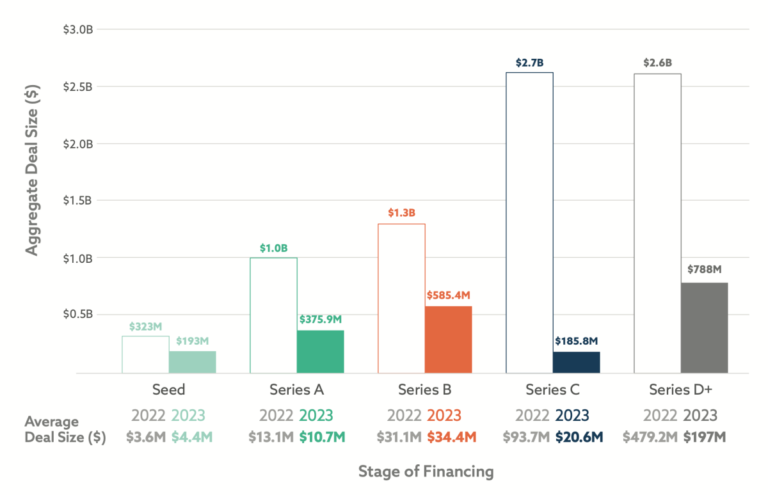

2023 marked a reset and major correction in investment levels globally.

According to the report, Europe is sitting on “record levels of dry powder” and “producing more new founders than the U.S.”, funding remains slow.

Climate Tech overtook FinTech as Europe’s most popular sectorAI’s share of total investment in Europe soared to a record high of 17%5.

Sam Blond is leaving Founders Fund, as well as the profession of venture capitalist, just 18 months after he joined the storied Silicon Valley firm.

For now just immense gratitude to FF and all the incredible people and… — Sam Blond (@samdblond) March 4, 2024Before joining the VC firm, Blond was best known as the former Chief Revenue Officer at Brex.

Brex is not a Founders Fund portfolio company, although Founders Fund is an investor in one of Brex’s biggest competitors: Ramp.

We hope to have the opportunity to work with him again,” Founders Fund spokesperson Erin Gleason tells TechCrunch.

But this is the second splashy departure of a Founders Fund partner over the past couple of months.

We are thrilled to collaborate with some of the most influential players in the startup ecosystem to craft an exceptional experience at TC Early Stage 2024.

In addition, Latham & Watkins LLP will host an engaging roundtable session, offering their unique perspectives on topics relevant to startup success.

TechCrunch Early Stage 2024 takes place on April 25, 2024, in Boston, Massachusetts, and we’ll announce more pivotal partners in the weeks ahead.

Remember: Buy a TC Early Stage pass by March 29 and save $200.

Is your company interested in sponsoring or exhibiting at TC Early Stage 2024?

The Qatar Investment Authority (QIA) is launching a $1 billion venture capital (VC) fund of funds for international and regional venture capital funds, the sovereign wealth fund announced on Monday.

Similar to typical fund-of-funds structures, QIA’s initiative will invest indirectly through other VC funds but also make targeted co-investments with participating funds.

These funds, aiming to reduce reliance on oil, have increasingly poured money into tech startups in the region, hoping to nurture a thriving venture capital industry.

However, unlike Jada, the PIF’s $1 billion fund of funds and Saudi Venture Capital (SVC), which targets both venture capital and private equity funds, QIA’s fund of funds focuses solely on venture capital funds, marking the first of its kind in the region.

Historically, these wealth funds have backed foreign startups primarily in the U.S. and Asia, with limited ties to the Gulf region.

“It’s the single best time to invest in [crypto] companies,” according to 10T Holdings and 1RoundTable Partners’ CEO, Dan Tapiero.

Crypto reporter Jacquelyn Melinek has the inside scoop on why his firm is taking the long view to ride out the volatility of the web3 landscape as it raises its fourth fund.

Get the TechCrunch+ Roundup newsletter in your inbox!

I’m interested in working in space technology and will be applying for jobs in that field while I’m on OPT.

I’ve heard that most space tech companies are reluctant to hire individuals on F-1 student visas due to export rules and other compliance issues.

Who knew M&A would be the thing we couldn’t shut up about?

Listen here or wherever you get your podcasts.

Hello, and welcome back to Equity, the podcast about the business of startups, where we unpack the numbers and nuance behind the headlines.

This is our startup-focused, Wednesday episode, so today we’re counting down important venture rounds, and chatting our way through other startup and VC news.

Here’s what we got into:We’ll be digging into the Brex situation on Friday, so stay tuned for more about fintech soon!

Now, Plural itself is scaling up, with a fresh €400 million fund to back what Hogarth refers to as “transformational” startups in the region, bringing more operational know-how to get them running as businesses.

Just six months before, Atomico reported, in its annual survey, that startups in Europe had raised a record $100 billion 2021.

Plural’s €250 million debut fund itself was arguably a product of that: it was actually intended to be €150 million.

Even Plural has sat on some of its money: Hinrikus said in an interview that it’s still making investments out of its first fund.

“[With] AI right now, there’s a huge number of people building businesses that look identical to 500 other startups.