Tech sovereignty has become a looming priority for a number of nations these days, and now a startup working in semiconductors has received a major boost in aid of that effort for Germany and Europe.

The sum is one of the largest to date raised by a European startup working in semiconductors.

Black is a spin-out from the University of Aachen co-founded by brothers Daniel and Sebastian Schall (respectively the CEO and CFO).

The funding, a Series A, is important not just for its size but also because of the intention behind it.

Porsche Ventures and Project A Ventures are co-leads, with participation from Scania Growth, Capnamic, Tech Vision Fonds, and NRW.BANK.

Fresh off the success of its first mission, satellite manufacturer Apex has closed $95 million in new capital to scale its operations.

The Los Angeles-based startup successfully launched and commissioned its first spacecraft, a model called Aries, in March.

The company is on track to manufacture five Aries this year alone, Apex CEO and co-founder Ian Cinnamon told TechCrunch.

Apex was founded on the thesis that the one of the main bottlenecks facing the growth of the space industry was satellite bus manufacturing.

The company is approaching fifty people and that number is likely to double by the end of this year.

Torpago, a commercial credit card and spend management provider, is no different, but with one caveat — banks are who it builds technology for, particularly community banks.

“We started as a competitor with Brex and Ramp, as well as American Express and Capital One,” Jackson told TechCrunch.

The Torpago Powered By tools and infrastructure enable means that those banks’ to customers don’t have to leave the bank’s brand domain to get sophisticated fintech features.

Banks have all the customers, and they have all the card volume, but “they have the absolute worst credit card tools and technology,” he said.

Since making the shift to banks as customers, that was whittled down to 300 companies while it goes after bank customers.

But as the data analytics and AI boom drives organizations to expect more of data models, many of the old paradigms are proving difficult to manage — and exceptionally brittle.

Now, five years later, Keydunov and Tiunov have a veritable business on their hands, having launched a subscription-based service built on Cube — Cube Cloud — that adds automated workflows and enterprise-focused governance and deployment tooling.

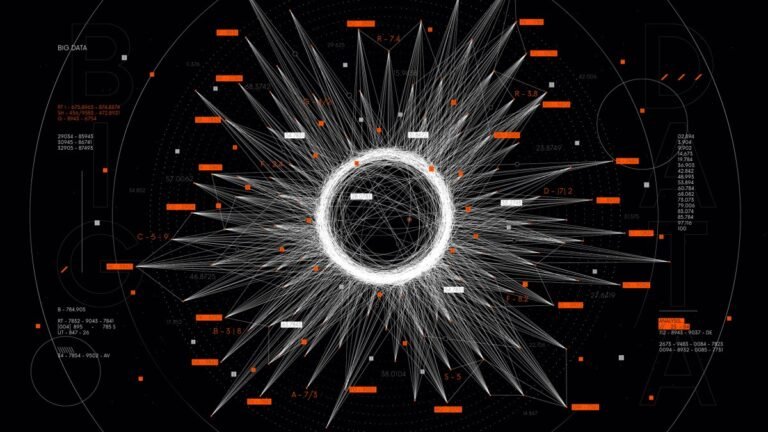

An illustration of Cube’s semantic data layer.

Image Credits: Cube“Cube Cloud is a universal semantic layer that is an independent, yet interoperable, part of the modern data stack that sits between your data sources and data consumers,” Keydunov said.

Keydunov says that the open source Cube project has surpassed 10 million downloads, while Cube Cloud is now installed on around 90,000 servers.

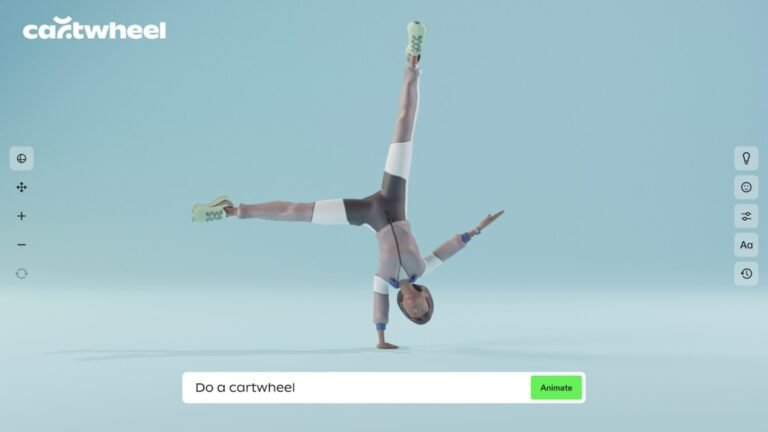

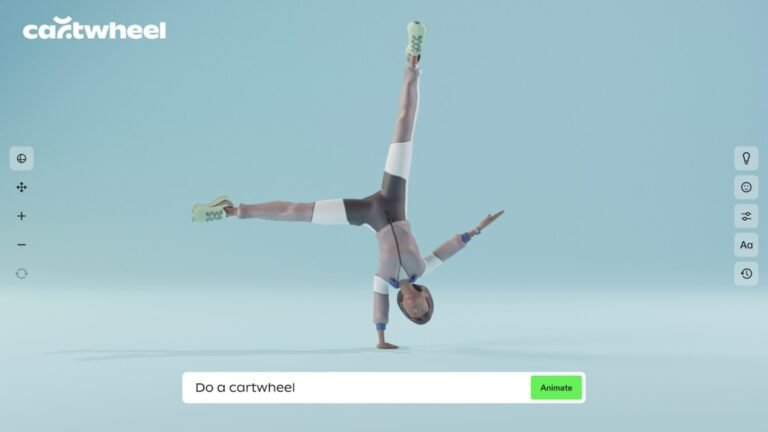

Animating a 3D character from scratch is generally both laborious and expensive, requiring the use of complex software and motion capture tools.

Cartwheel wants to make basic animations as simple as describing them, generating a basic movement with AI and letting creators focus on more expressive tasks.

There’s a lot of value in just quickly getting it out of your head and moving.

“There’s this notion of AI replacing creative work, and as someone who does creative work, it’s like… no!

This leads to more animation, more motion, one person doing more,” said Jarvis.

It’s been more than a minute since Tesla went public, but the EV company was inescapable on TechCrunch this week.

From layoffs to pricing changes and more, it was a week dyed deeply in Tesla colors so we had to chat through the latest.

But that was just one element of what we got into on Equity this week.

We also dug into Mary Ann’s reporting about Ramp’s latest round — and up valuation — that fit neatly next to Rippling’s own impending fundraise.

Equity is back tomorrow with a special interview between Mary Ann and Notable Capital’s Hans Tung, so stay tuned!

That’s privacy by design.”The funding is notable in part because Cape appeal to users is not yet proven.

The latest round is being co-led by A* and Andreessen Horowitz, with XYZ Ventures, ex/ante, Costanoa Ventures, Point72 Ventures, Forward Deployed VC, and Karman Ventures also participating.

Those jobs may exposed him to users (government departments) who treated the security of personal information and privacy around data usage as essential.

(Cape today also announced a partnership with USCellular — which itself provides a MNVO covering 12 cellular networks, and Doyle said that it’s talking with other telcos, too).

Although payments for this might be anonymous, a user’s data is still routed through the network infrastructure of the underlying carrier, making a users movements and usage observable.

Humans have cast metal parts in basically the same way for thousands of years: by pouring molten metal into a mold, often made of compacted sand and clay.

To make those parts, Magnus Metals borrows elements of sand casting and 3D printing to perform what it calls digital casting.

Magnus Metals plans to sell its machines to customers as well as the proprietary ceramic that’s used to produce the bases.

And unlike 3D printing, which usually requires specific feedstocks, Magnus Metals said its system can use customer specified materials.

The method doesn’t require expensive tooling to create the bases, unlike molds for sand casting, according to the Magnus Metals.

Clay Canning had an idea while in high school: smartphone screen protectors that featured logos, right on the screen.

“In December 2022, I resigned from my job to pursue building Screen Skinz with Clay full time.”Now, Screen Skinz can officially announce the closing of a $1.5 million seed round led by South Loop Ventures and Abo Ventures.

The company produces custom, patent-pending phone screen protectors that feature personalized logos or slogans that are visible when the phone screen is black and then disappear when the phone is in use.

The latest fundraise allowed Screen Skinz to move manufacturing from Asia to the U.S., allowing it to more easily control its supply chain.

Screen Skinz next has some partnerships lined up and is focused on customer acquisition and deepening licensing relationships.

Climate investor Bay Bridge Ventures is raising a new $200 million fund, TechCrunch has exclusively learned.

Bay Bridge filed paperwork Monday for the new climate fund with the U.S. Securities and Exchange Commission.

And Congruent Ventures raised a $275 million fund in 2023, turning down $325 million in additional LP interest.

Bay Bridge Ventures is new, having been founded in 2022 with a focus on ESG more broadly and sustainability in particular.

Still, that doesn’t mean Bay Bridge lacks experience.