At the end of 2022, like many, I made some predictions about what 2023 would bring to the technology investing ecosystem.

AI and data continue to dominate the funding landscape.

U.S. VC deals fall from $275 billion in 2022 to $200 billion in 2023, and sustain at about $200-$220 billion next year.

Valuations will remain relatively steady, except for AI businesses, which will command a premium of about 10-15% to the market.

While VC deals fell dramatically between 2022 and 2023, 2024 won’t see as sharp of a decline.

According to DocSend data, investors aren’t scouring pitch decks as earnestly as they were in the past.

“For founders now, perfecting the pitch, having an efficient sales strategy, and scoping the product with urgency will create a strong foundation for success that attracts investors.”Thanks for reading and happy holidays!

KaryneAsk Sophie: Is it easier yet for AI founders to get green cards?

— All About AIGet the TechCrunch+ Roundup newsletter in your inbox!

“The drier funding climate of 2023 only served to weed out the weaker businesses that had managed to secure capital in 2021,” she writes.

There is no question that 2023 was a tough year for the venture and tech ecosystem.

Seed valuations have remained steady through 2022 and 2023, yet achieving the necessary traction for these rounds has become more challenging, which can create misaligned expectations for founders.

In 2020–2021, it was relatively common for $3 million to $5 million seed rounds to get done with very little, if any, traction, and they were typically getting done at $12 million to $25 million valuations, depending on the space and the founders’ background.

The bar is much higher to raise an institutional seed round, and a founder/company often needs to prove a lot more in today’s market than they used to.

This dynamic means that many founders have to first raise a pre-seed round to get to those milestones and therefore raise multiple rounds to get to a Series A.

Here in the States, the $2 trillion industry employs around eight million people — that’s nearly one New York City.

Even in financial boom times, however, these jobs can be difficult to keep filled, owing to physical demands and other potential dangers.

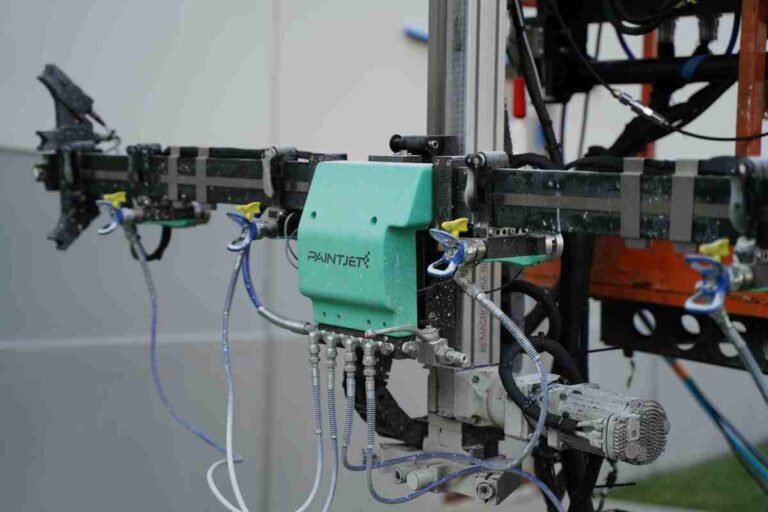

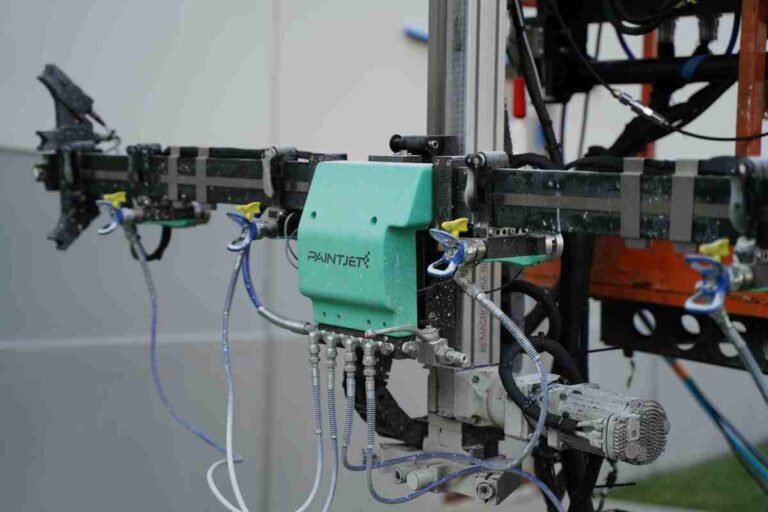

As evidenced from videos released by PaintJet, those sorts of older technologies remain intact here — albeit with an automated twist.

CEO Nick Hegeman tells TechCrunch, that in spit of looking like a fairly standard piece of heavy machine, “We have created 100% of the robotic system.

Of course, PaintJet is far from the only company vying to introduce robots to the world of industrial painting.

Salesforce has announced plans to acquire Spiff, a platform that automates commission management for sales teams.

The deal also constitutes the latest in a line of ecosystem companies that Salesforce has eventually brought in-house.

Back in September Salesforce acquired Airkit, a low-code platform for building AI customer service agents.

And similar to Spiff, Airkit was also available on AppExchange.

So it’s clear that Salesforce continues to see tried-and-tested ecosystem companies as a safe bet for its M&A endeavors, with “low-code” playing a key factor too.

Lingrove is taking on laminates — thin layers of wood and other materials — with a carbon-negative option that they claim performs better while looking as good.

Lingrove has developed a wood veneer alternative out of flax fiber and plant-based resins that’s carbon-negative yet results in a material they say is “very high stiffness, durable, and resistant,” i.e.

They call it “ekoa” — yes, in lowercase — and hope to make inroads in cars and other interior surfaces with a new $10 million funding round.

The Series B round was led by Lewis & Clark Agrifood and Diamond Edge Ventures, with participation from Bunge Ventures and SOSV.

You may wonder, as I did, why not use actual wood — things like sawdust and wood chips already coming out of industrial wood-handling processes?

TechCrunch Early Stage returns to Boston on April 25, 2024, and the agenda for our flagship founder event is shaping up.

For builders who are just starting on their founder journey, TechCrunch Early Stage is absolutely the place to be.

Submit your application to our call for content by the January 10 deadline, and you could win a roundtable slot at TechCrunch Early Stage.

TechCrunch Early Stage 2024 takes place in Boston on April 25.

Is your company interested in sponsoring or exhibiting at TechCrunch Early Stage 2024?

Opendoor co-founder Eric Wu is stepping down to return to his startup rootsOpendoor co-founder Eric Wu is stepping down from the real estate tech company, according to an SEC filing.

In a statement, Wu said: “After ten years, I am called to get back to my startup roots and create and build again.

Last December, Wu announced he was stepping down from his role as CEO to serve as Opendoor’s president of marketplace.

In November 2022, Opendoor announced it was letting go of about 550 people, or 18% of the company, across all functions.

Jack Altman also announced he would be stepping down from Lattice, a software startup he founded in 2015.

The traditional role of the real estate agent has long been challenged as the internet has made it easier for people to search for, and tour, homes.

The buyers’ agent commission varies from transaction to transaction depending on what is offered by the seller.

In a scenario where the buyer’s agent commission is 3%, for example, the home buyer would receive up to 1.5% as a rebate and Prevu as a company would retain the other 1.5%.

Buyers receive the commission rebate via check after closing.

Making home buying “more attainable”So besides rebates, what is Prevu doing that’s different from its competitors?

Lolli, a bitcoin and cashback rewards application, has raised an $8 million Series B round, TechCrunch has exclusively learned.

Its rewards program awards its users with bitcoin or cashback when they shop online or in person at restaurants and stores.

The app gives up to 30% back on purchases, with an average of 7% back in bitcoin or cashback rewards.

Since its inception, Lolli has given over $10 million in bitcoin rewards, in addition to cashback rewards, Adelman said.

The company plans to use the momentum in the markets to “drive more revenue to partners and bring more major companies into offering bitcoin rewards,” Adelman said.