Zora co-founder Jacob Horne and Goens see crypto and AI as two complementary technologies that can benefit from one another.

“Crypto wants information to be on-chain so that it can be valued and add value to the system,” Goens said.

“And then AI wants information to be on-chain so that it can be freely accessed and utilized by the system.

“We need systems that can help bring all of these things on-chain and that’s what we’re trying to do at Zora,” Goens said.

This means these AI creators have the ability to capture value from their models’ outputs when people mint them and the payouts are split in half automatically.

A South Korean startup called QuotaLab is on a quest to follow in the footsteps of Carta, the cap table management company that’s used by a host of startups and investors in the U.S.Carta started life as “eShares” in 2012 as a cap table management service that startups could use to issue equity to their investors and employees.

Today, its stable of offerings has expanded to include everything from valuation and equity management, to bookkeeping, risk assessment and brokerage services.

A Y Combinator alum, QuotaLab also started off as an equity management service (called QuotaBook) for startups and investors in South Korea.

It also offers investment management such as investments, returns, asset changes, markdowns, valuations, accounting, e-approvals and risk management,” Choi added.

According to Choi, the equity management market has many sides you can tackle.

The Harness offering also has two other components, serving as a marketplace for discovery of advisors and services and consumer financial insight tools.

In order to fill that need, Harness partnered with experienced tax advisors who in most cases already had a significant roster of clients.

So when those advisors partnered with Harness, many of those clients became clients of Harness as well.

Put simply, the new platform “powers the collaboration between tax advisors and their clients,” the company said.

About 75% of Harness’ clients come through advisors that join the platform.

Co-founders Ozgun Erdogan and Umur Cubukcu previously built Citus Data, where they also met Daniel Farina, who previously was instrumental in building Heroku PostgreSQL.

Citus Data wouldn’t have been possible without,” Cubukcu said.

“Fifteen years ago, all those service [that are on the Ubicloud roadmap] did not have open-source data plane components.

These days, for the core services, all of those now have good open-source alternatives, barring maybe one or two,” he said.

The company currently has 10 employees, split between San Francisco, Amsterdam (where the Citus Data team built a small engineering team during the team’s Microsoft days) and Istanbul.

However, harvesting stem cells is a controversial process, since a major method involves harvesting during pregnancy.

To date, most stem cells are harvested from adult stem cells or post-termination foetal tissue.

Cellcolabs will specialize in Mesenchymal stem cells (MSCs), which are scarce and expensive.

In an interview with TechCrunch, Bernow said, “The promise of stem cells or what it holds, is really mind boggling.

“We’ve built this facility, which we believe is one of the world’s largest facilities, solely dedicated for production of this kind of stem cell.

Australian remote sensing startup Esper wants to capture hyperspectral imagery from space at a fraction of the price of its competitors.

Armed with just $1 million in pre-seed funding and assistance from the Australian government in their first mission, Esper is aiming to beat out its better-capitalized peers with lower-cost tech.

That’s what really separates us from all the other spectrometers and hyperspectral hardware that’s being put up there,” Esper CEO and co-founder Shoaib Iqbal said.

There’s a lot of software that really comes into play to make sure it works that way.

Esper is planning on launching a second demonstrator satellite with identical hardware later this spring with India’s ISRO.

Apple says it plans to appeal the historic €1.84 billion fine issued today by the European Commission over Apple’s anticompetitive practices in the streaming music market.

Apple again stressed that Spotify pays Apple nothing in terms of App Store commissions because it sells its subscriptions only on Apple’s website.

“They want to use Apple’s tools and technologies, distribute on the App Store, and benefit from the trust we’ve built with users — and to pay Apple nothing for it,” Apple says.

“In short, Spotify wants more.”Apple says that while it respects the European Commission, the facts don’t support the decision, and ” as a result, Apple will appeal.”“Every day, teams at Apple work to keep that dream alive,” Apple wrote.

“We do it by making the App Store the safest and best experience for our users.

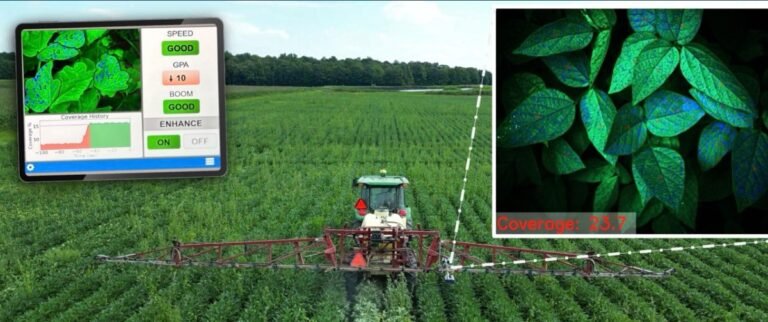

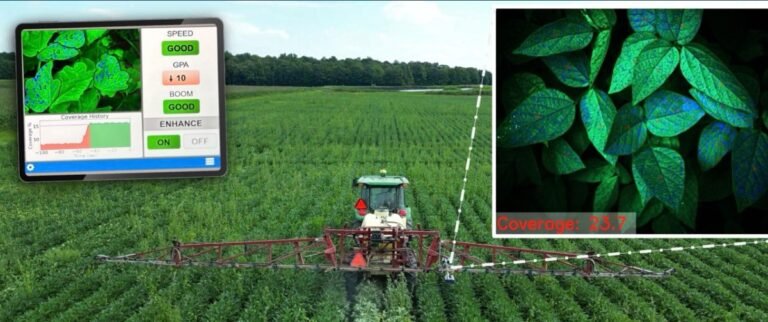

A 2021 study found that if farmers didn’t use pesticides, they would lose 78% of fruit production, 54% of vegetable production, and 32% of cereal production.

At the same time, the way pesticides are delivered is not ideal: The only way to guarantee enough pesticide distribution is to spray too much.

By reducing foliar pesticide usage by 30% to 50%, AgZen’s technology might help mitigate these impacts, aligning with the critical need for improved spray efficiency highlighted in recent reports.

AgZen is preparing to launch RealCoverage commercially later this year through a lease-to-own program, which helps put the system into financial range for farmers.

The company suggests that by reducing the amount of chemicals used, the system pays for itself within a season.

If you hurry, you can get $40,000 off a 2023 Toyota Mirai, a fuel-cell vehicle which retails for $52,000.

Toyota’s discount comes on the heels of Shell’s announcement three weeks ago that it’s closing its hydrogen filling stations in California.

Of those that remain, about a quarter are offline, according to the Hydrogen Fuel Cell Partnership.

So why are Toyota and Honda (and Hyundai and others) still so bullish on hydrogen?

If today’s hydrogen startups succeed, and if they’re able to build enough capacity to satiate industrial and shipping demand, then it might make sense to start selling fuel-cell vehicles to the masses.

That’s where Codified, an early stage startup that was nurtured last year inside venture capital firm Madrona Ventures, comes into the picture.

The company was built from the ground up from a data veteran with an eye toward solving the data compliance problem, and today it announced a $4 million seed round.

Company founder and CEO Yatharth Gupta sees that data is at the center of today’s technology, yet companies struggle to control access to it.

Both jobs, he says, were heavily involved in data and he saw the kinds of problems he’s trying to solve with Codified.

Investors in today’s round include Vine Ventures, Soma Capital and Madrona Venture Labs where Codified incubated last year.