Hello, and welcome back to Equity, a podcast about the business of startups, where we unpack the numbers and nuance behind the headlines.

This is our Monday show, where we dig into the weekend and take a peek at the week that is to come.

We’ll talk more about Wednesday, but this is Y Combinator Demo Day week, so expect a deluge of startup news.

On the podcast today we dug into the latest news from Discord that indicates it is moving towards opening its gates for advertisements.

Equity is TechCrunch’s flagship podcast and posts every Monday, Wednesday and Friday, and you can subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

And Manish wrote about the resignation of Stability AI founder and CEO Emad Mostaque late last week.

AI-powered itineraries: In an upgrade to its Search Generative Experience, Google has added the ability for users to ask Google Search to plan a travel itinerary.

Using AI, Search will draw on ideas from websites around the web along with reviews, photos and other details.

Robinhood’s new card: Nine months after acquiring credit card startup X1 for $95 million, Robinhood on Wednesday announced the launch of its new Gold Card, powered by X1’s technology, with a list of features that could make Apple Card users envious.

Bonus roundSpotify tests online learning: In its ongoing efforts to get its 600 million+ users to spend more time and money on its platform, Spotify is spinning up a new line of content: e-learning.

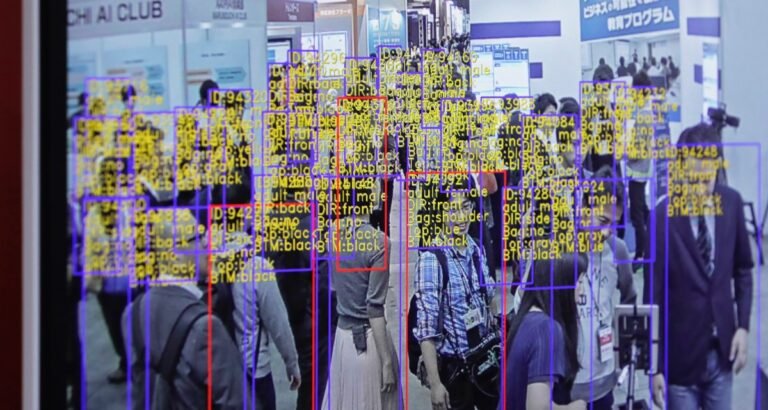

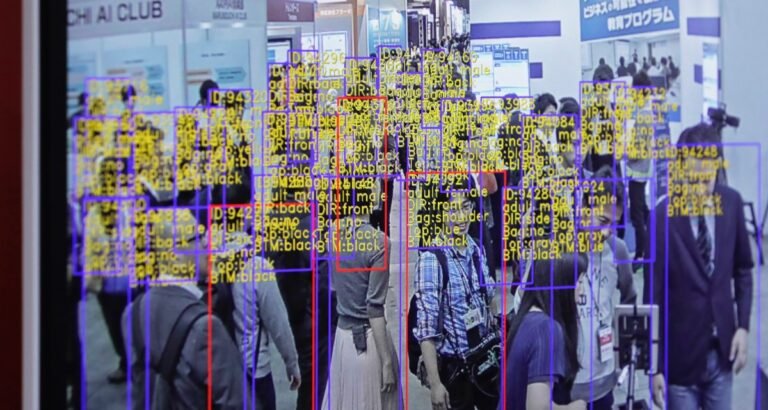

This week in AI, I’d like to turn the spotlight on labeling and annotation startups — startups like Scale AI, which is reportedly in talks to raise new funds at a $13 billion valuation.

Labeling and annotation platforms might not get the attention flashy new generative AI models like OpenAI’s Sora do.

Without them, modern AI models arguably wouldn’t exist.

Labels, or tags, help the models understand and interpret data during the training process.

Some of the tasks on Scale AI take labelers multiple eight-hour workdays — no breaks — and pay as little as $10.

Hello, and welcome to Equity, a podcast about the business of startups, where we unpack the numbers and nuance behind the headlines.

This is our Friday episode, in which we dig through the most critical stories and themes from the week.

But while the SBF news was a big deal, there was so very much more to cover on today’s news roundup episode of Equity.

We also dug into two companies building startups focused around kids.

Then, to wrap up, a look at just who unicorn founders really are, and a new $100 million fund that to back climate tech.

SBF sentenced, Worldcoin hit with another ban order and big web3 pre-seed rounds are backWelcome to TechCrunch Crypto, formerly known as Chain Reaction.

This week in web3Crunching numbersThis week the crypto market prices were a bit more chipper, with the top cryptocurrencies being green on the week.

The second-largest crypto, ether, increased 2.6% on the week to $3,550, according to CoinMarketCap data.

Zero-knowledge proofs are a cryptographic action used to prove something about a piece of data, without revealing the origin data itself.

Scott and I discuss Space and Time’s origin story, how data warehouses work in Web 2.0 versus web3 and the importance of data transparency.

The UK threw a splashy event in New York this week to woo more American VCs Welcome to the new UK: the Unicorn KingdomA 3-D hologram, dubbed the Ever-Changing Statue, will be on display at the Rise by Barclays workspace in New York until April 4.

Dealroom data shows that UK startups raised $31 billion in venture capital in 2022 and $41 billion in 2021.

It’s also still more than the $18 billion the UK raised in 2019 and the $12 billion raised in 2018.

Between 2009 and 2019, only 38 UK Black founders raised venture capital funding—that number now stands at 80, according to an updated report by Extend Ventures.

“The UK tech ecosystem has made significant strides, but work remains to reach the scale and influence of Silicon Valley,” Taylor told TechCrunch.

Following Elon Musk’s xAI’s move to open source its Grok large language model earlier in March, the X owner on Tuesday said that the company formerly known as Twitter will soon offer the Grok chatbot to more paying subscribers.

In a post on X, Musk announced Grok will become available to Premium subscribers this week, not just those on the higher-end tier, Premium+, as before.

Previously, Grok was only available to Premium+ subscribers, at $16 per month or a hefty $168 per year.

Most notably, Grok has the ability to access real-time X data — something rivals can’t offer.

Of course, the value of that data under Musk’s reign may be diminishing if X is losing users.

The Reddit and Astera Labs IPOs last week ate up a lot of media oxygen.

And with good reason, the two tech IPOs priced well and traded with even more gusto.

After a long dearth for technology offerings, seeing two large, multi-billion dollar offerings in the same week was part of a much-needed win for private-market tech companies, and sigh of relief for the same.

But there was another offering last week that has a tech-angle to it: Trump Media and Technology Group, which is the company behind Truth Social.

More from TechCrunch here, but the gist is that after much back-and-forth, it merged with its chosen SPAC and started to trade.

The negotiations between Fisker and a large automaker — reported to be Nissan — over a potential investment and collaboration have been terminated, a development that puts a separate near-term rescue funding effort in danger.

Fisker revealed in a Monday morning regulatory filing that the automaker terminated the negotiations on March 22.

Fisker said in the filing that it will ask the unnamed investor to waive the closing condition.

In February, Fisker laid of 15% of its staff (around 200 people) and last week reported having just $121 million in the bank.

Fisker had held talks with other automakers, including Mazda, but only Nissan recently remained at the table.

Welcome to TechCrunch Fintech (formerly The Interchange)!

TC reporter Tage Kene-Okafor reported on how Uber led a $100 million investment into African mobility fintech Moove as the startup’s valuation hit $750 million.

He also wrote about how Zone raised $8.5 million to scale its decentralized payment infrastructure.

Dollars and centsNon-sexy industries can appeal to investors too.

The YC-backed startup raised $4.1 million last year with the goal of serving high-earning millennials and Gen Zers.