Feishu, ByteDance’s workplace collaboration app, has seen consistent growth in its revenue over the past few years. In 2017, the app reached $100 million in annual recurring revenue and Xie Xin, the chief executive of Feishu, suggested that this success is due to their user-friendly and efficient platform. The app allows users to communicate with each other more easily and efficiently than traditional communication methods such as email or text messages can. Additionally, Feishu offers a variety of features that appeal to employees such as job notifications and salary tracking capabilities. With its strong economy and growing population, India seems to be a promising market for ByteDance-owned apps like Feishu.

In late 2021, ByteDance’s workplace tool received strategic importance, becoming one of the company’s six individual business groups. This move announced the tool’s importance within the company and its potential to grow and change how employees collaborate and work. As part of this growth, ByteDance is investing in AI technology to make it easier for workers to find common ground and share ideas.

With a subscription-based revenue model in place, it is not surprising that ARR has been decreasing for Feishu. Although the company’s gross margin may be high due to its high conversion rate, its cash burn could be a major issue in the long term.

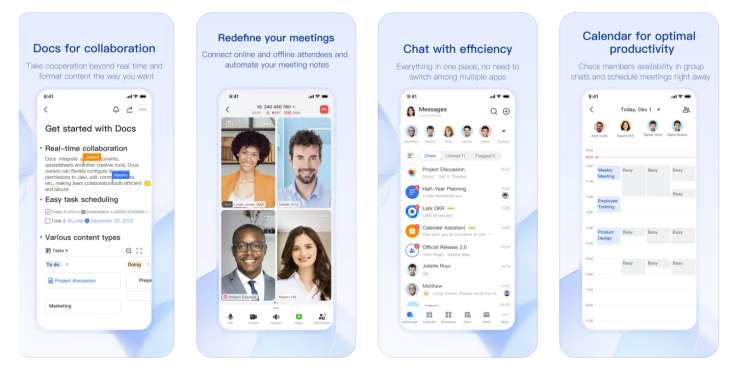

The differences between the two messaging platforms are stark. Slack is a more open platform that integrates with a plethora of applications, while Feishu spent plenty of resources building its own all-encompassing features. This allows Feishu to stand out as a formidable tool for work communication.

The sheer size of Feishu’s workforce is indicative of the huge costs associated with delivering a frictionless user experience. However, this massive investment has paid off, as users report Feeling Engaged and Being Motivated by Feishu’s products. Despite its high costs, in-house development is the most effective way to create a customer loyal base that will keep returning for more.

Slack has grown quickly since its inception in 2013, and plans to continue expanding its employee base and pursuing new opportunities. With an annual revenue of $902.6 million in 2021, Slack is one of the most successful startups in the tech industry. The company is known for its popular messaging platform and supported by a strong ecosystem of integrators, merchants, and developers. With continued growth, Slack may soon challenge giants like

According to GBV data, by 2020, China’s enterprise software market will be worth $106.2 billion. Megaworld is currently the world’s largest enterprise software company, and ByteDance is currently the world’s second-largest enterprise software company. This heavy investment in Feishu is telling of the state of enterprise software in China: at a time when Silicon Valley investors are heralding product-led growth—services that convert users through their products, as exemplified by Calendly—software in China are still largely counting on sales, marketing and services to recruit users.

Interestingly, the tight labor market in China has yet to drive companies to invest more in acquiring skilled tech workers, even as the return on these investments has surpassed that of other opportunities available. In fact, many startups are turning to overseas expansion in order to avoid becoming beholden too much to a single geography. This is especially true for generative AI startups, as their technology poses unique challenges that cannot easily be mimicked by domestic counterparts. Nonetheless, despite the challenges and hurdles they face, most founders continue push forward with their ambitious plans.

In China, companies that rely on customer support staff to retain users may have a hard time competing against companies that build product-led software. This is in part because customer support staff are not as expensive to hire as engineers, and because product-led software does not require as many of these staffers.