One way a company can reduce its budget without slowing down growth in the near term is to consider cutting unnecessary expenses. For example, a company could reduce its marketing spend by focusing on more effective campaigns that resonate with its target audience. Additionally, businesses could strive to be more efficient in their operations by consolidating shipments and eliminating redundant processes. By making these necessary reductions, companies can manage their budgets while still achieving responsible growth in the short term.

Based on our research and analysis, we found that first-degree, gross-margin-enhancing businesses are those that have the potential to increase their margins significantly and improve their bottom line. These businesses are typically well positioned to capitalize on growth opportunities and boast strong competitive advantages.

If you want to keep investors interested, don’t just improve your quarterly results – make meaningful and long-term changes. Doing so will show that you’re committed to being a successful company and not just a moneymaking machine.

Trying to minimize costs without optimizing for growth will not provide a satisfactory return on investment. Likewise, maximizing growth with little concern for costs is also risky and could lead to an underperforming business in 2023. In order to achieve a successful business outcome, both cost optimization and stability are necessary

The Ibex Investors investment company has been in business for over sixty-five years and is one of the oldest and most experienced institutional investors in the world. The

Emerging companies that can effectively support organizations in their efforts to deliver growth while optimizing and managing costs in the near and long term are those that focus on vertical integration. By combining complementary skills and expertise, these companies can provide a valuable pathway for organizations to achieve sustainable success. They understand how businesses work, what needs to be done to succeed, and how best to do it without breaking the bank.

Given the market right now, investors want to see companies following forecasts more than ever.

There is a lot of pressure on companies to follow forecasts and meet investor expectations, but it seems that this pressure may be starting to have an impact. Between 2014 and 2015, the number of company failures following forecast errors increased by 60%. This trend could be bad news for investors, as it suggests that companies are more likely to miss their targets if they are pressured to do so. This could lead

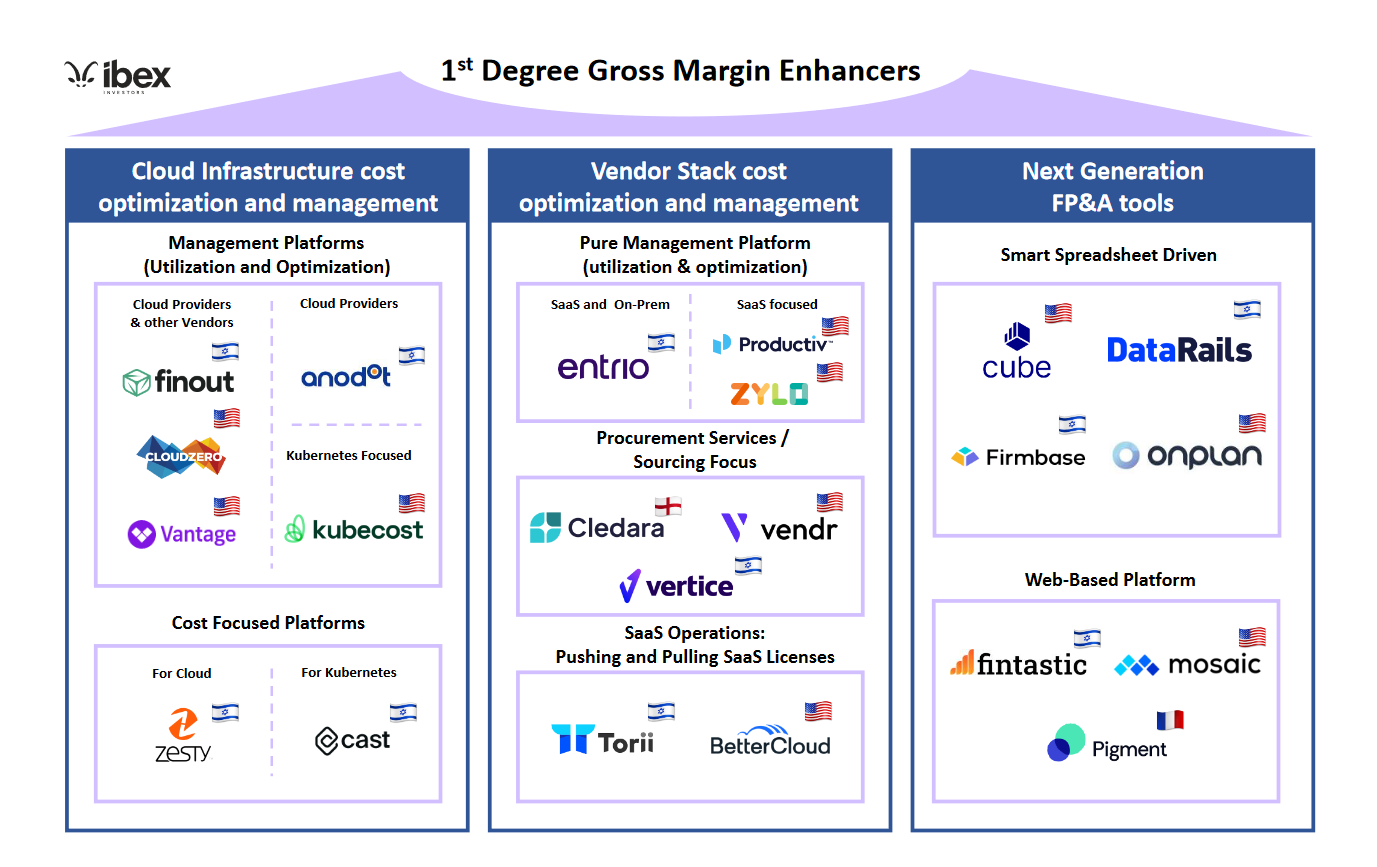

Some of the companies in this mappingoffer comprehensive gross margin enhancement solutions that can help businesses increase their margins through a variety of means, such as streamlining processes and cutting costs. These companies can help businesses optimize and reduce costs while continuing their growth journey, so any business could benefit from their services.

- Cloud infrastructure cost optimization and management.

- Vendor stack cost optimization and management.

- Next generation FP&A tools.

Cloud infrastructure cost optimization and management

There is a constant struggle to balance stepping on the gas to improve product (i.e., raise cloud spend) and pushback from the CFO’s office when it is time to cut back. Often times, this balancing act can be difficult, but it is an important part of keeping your business running smoothly. By ensuring that both your product and financial goals are met, you will be able to stay ahead of the competition and maintain a positive ROI for your organization.

Looking to drastically cut cloud costs, but unsure of how much change could actually impact revenue? Don’t worry, as top-line impact is a KEY concern for companies when it comes to cloud budget changes. With cutting Cloud Transformation Projects (CTP) taking time and having multiple execution risks – it can often prove difficult for companies to accurately quantify the negative effects on their overall business. However, there are several ways to control/reduce cloud expenses without negatively impacting business performance:

Design/implement data intensive applications or solutions in-house: This decision may seem costly at first blush however this can quickly pay off with improved agility and control over business processes which ultimately translates into an increased bottom line. Outsourcing certain infrastructural or general IT services will also be less costly than deploying externally managed clouds in the long run – yielding similar results. Restrict usage based pricing models: Charging by user instance hour (UHE) instead of flat monthly rates allows businesses more flexibility when making decisions about how much they’re willing to pay for particular cloud services; this lowers overall costs while providing customers with an increased ability to allocate resources where they are most needed minimizing waste. Modify infrastructure requirements: By increasing server processing power and memory, some companies have been able “to cut AWS instances by two thirds while adding no statistically significant[ly]

Given that the cloud is becoming increasingly popular and necessary for modern business models, it is no wonder that various companies are solving various challenges with regards to managing the cloud. Some focus on supporting key providers such as Amazon Web Services (AWS) or Google Cloud Platform (GCP), while others provide a comprehensive solution for managing everything from Kubernetes clusters to clouds from multiple vendors.

Companies that focus on Kubernetes tend to be more expensive than companies that only focus on management, but they may offer other benefits such as cutting costs.