As part of the deal, Lookout will continue to develop its flagship product, oversight platform Security Advisory Pro, and remain a major contributor to the Open Source community. The company’s new owner is familiar with the enterprise security market and has deep expertise in mobile security.

Since its founding, Lookout has garnered a reputation for creating user-friendly smartphone security and data backup solutions. The company has consistently proved successful in garnering investment from notable investors, including Andreessen Horowitz, Accel Partners, Greylock Partners, Morgan Stanley, Deutsche Telekom and Jeff Bezos of Amazon.com. With the advent of ever-more sophisticated smartphones and mounting cyberthreats against society as a whole, Lookout’s objective seems impossible to ignore – providing users with the tools they need to protect their personal information and safety while still enjoying their everyday lives.

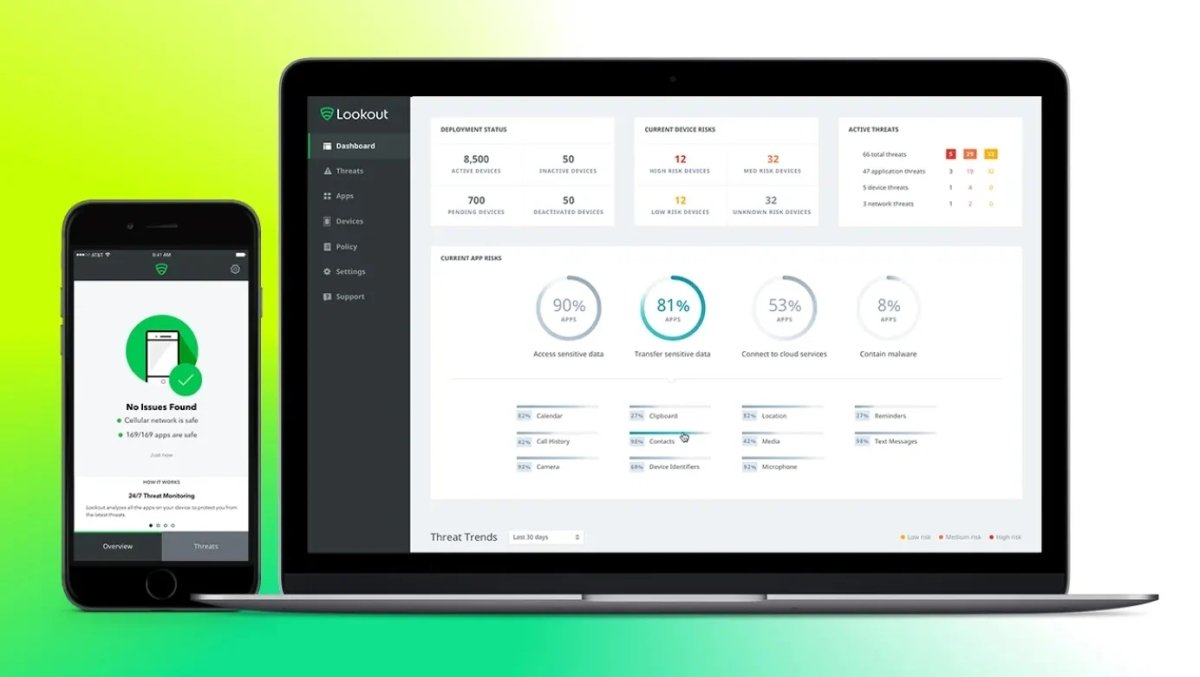

Since its incorporation in 2008, Lookout has prided itself on being a leading provider of mobile security services, with a particular focus on the enterprise. In recent years, however, the company has gone further than simply protecting mobile devices – it’s ventured into the business realm, partnering with some of the world’s most well-known technology firms. With its acquisition of cloud-native cybersecurity startup CipherCloud last year, Lookout cemented its place as one of today’s leading B2B providers of cybersecurity solutions.

The sale of Lookout’s consumer security products to F-Secure is a move that signals the company’s shift closer to the enterprise market. While its antivirus software for smartphones remains popular with consumers, the company has seen increasing demand from businesses for other security products, such as password management tools and antivirus applications. This move allows Lookout to focus on more profitable products while freeing up resources to invest in newer and more innovative technologies.

It is currently unclear how much BlackRock’s investment in Lookout will raise the company’s valuation, as it has not disclosed this information. However, it seems that by becoming a pure-play enterprise company, Lookout intends to focus on mobile endpoint security and cloud security – two booming industries which have seen immense growth in recent years. With the help of BlackRock’s financial backing, Lookout plans to continue investing in its products and expanding its reach into new markets.

While competitors, such as Google and Facebook, are focusing on expanding their consumer-facing platforms into the enterprise space, Lookout is doubling down on creating product and marketing strategies that will enable the company to capitalize on hypergrowth projected in this segment. This includes increasing focus on remote and hybrid work models, cloud-based delivery models, and transitioning to zero-trust architectures.