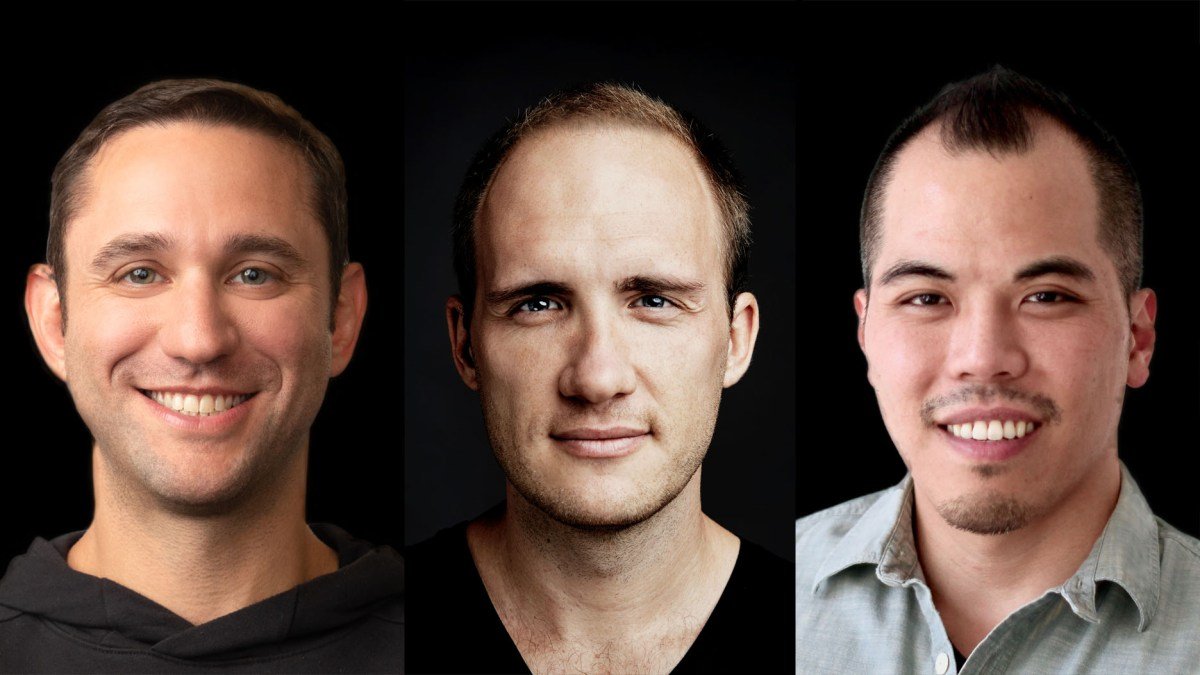

“Artificial intelligence, clean technology, and B2B software startups at the early stage now have an opportunity to gain more capital,” announced Chris Fisher, Tim Chiang, and Dean Mai, founders of the newly formed Myriad Venture Partners, with excitement.

“Our careers have been diverse and complementary, which aligns with the Parsons theory and the inspiration behind our name: our ecosystem,” said Fisher, who previously held senior positions at Xerox Corp. and was the founder and managing partner at Xerox Ventures, a venture capital firm established in 2021.

Myriad’s first fund has secured $100 million in capital commitments and is on track to reach a total of $200 million, as confirmed by Fisher to TechCrunch. The fund currently supports 14 companies, including metal additive manufacturing company Seurat Technologies, LinkSquares, Anvilogic, and Mojave. However, with the eventual closing of the fund, Fisher expects to invest in a total of 25 to 35 startups.

Despite the current challenges faced by the venture market, such as higher interest rates and low company valuations, Fisher believes that traditional corporations will be disrupted by more innovative startups. In fact, clean technology remains a hot sector, and the integration of software technology has continuously accelerated over the past decade, according to Fisher.

“For companies to stay ahead, they must continue to accelerate, whether it’s through R&D, expansion, or investing in AI software, like ChatGPT,” explained Fisher. “The need for more efficient and cost-effective interactions with employees and customers is a common goal for these organizations.”

Furthermore, Fisher expressed how Myriad is well-positioned to participate in this evolving landscape, thanks to its team’s diverse skills in operations, strategy, and venture investment.

To further strengthen their approach, Myriad has formed an advisory council that includes corporate partners Xerox and HCLTech. This council will have access to deal flow and help foster the development of new business models and go-to-market strategies.

Xerox, in particular, is also the anchor investor for the new fund, with Chief Transformation and Administrative Officer Louie Pastor sharing their excitement for Myriad’s potential.

“As an internal venture capital firm, Xerox Ventures lacked the ability to scale. With Myriad now operating independently, the possibilities are limitless,” stated Pastor. “We are thrilled to see Myriad grow, bring on new partners, and contribute to the evolution of Xerox as a limited partner and member of the advisory council.”

With a strong team, diverse skill set, and support from corporate partners, Myriad is poised for success in the world of venture capital. And for early-stage startups working on AI, clean tech, and B2B software, this means access to a valuable new source of capital and potential partnerships.