Welcome to TechCrunch Fintech (formerly The Interchange)!

This week, we’re exploring the latest and most exciting developments in the fintech world. From new credit card offerings to challenges in the banking-as-a-service space, there’s a lot to cover. And don’t miss the story of how a small startup caught the attention of industry giant Stripe.

Subscribe to our newsletter and get a roundup of the biggest and most important fintech stories delivered straight to your inbox every Sunday at 7:30 a.m. PT.

The big story

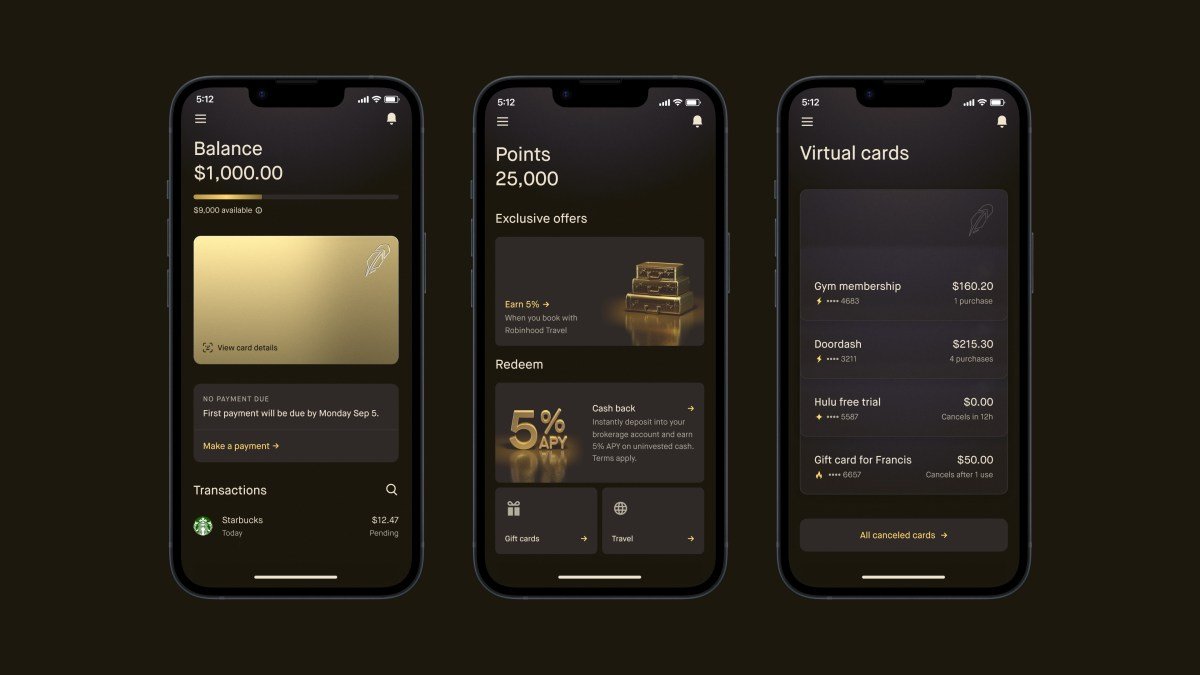

Last week, Robinhood unveiled its highly anticipated Gold Card to much excitement. This new credit card offers a range of impressive benefits, including 3% cash back and the ability to invest that cash back through Robinhood’s brokerage account. Customers can also choose to deposit their cash back into Robinhood’s savings account, which boasts an impressive 5% APY.

We’re eager to see how this new offering will impact Robinhood’s bottom line, but we’re also intrigued by the technology behind it. After acquiring startup X1 for $95 million last summer, Robinhood has leveraged their technological assets to create a potentially lucrative new product.

Analysis of the week

The banking-as-a-service (BaaS) industry is facing its fair share of challenges. Recently, BaaS startup Synctera had to restructure and lay off about 15% of its employees to preserve cash. But they are not the only VC-backed BaaS company to take this route in the past year. Others, such as Treasury Prime, Synapse, and Figure, have also had to make difficult decisions in order to stay afloat.

In another development, the FDIC announced consent orders against Sutton Bank and Piermont Bank, emphasizing the need for closer monitoring of compliance with the Bank Secrecy Act and money laundering regulations.

Dollars and cents

In the world of venture capital, PayPal Ventures made a recent investment in Indonesian startup Qoala. This company offers personal insurance products that cover a variety of risks, such as accidents and phone screen damage. MassMutual Ventures also participated in Qoala’s new $47 million round of funding.

Meanwhile, Mill Valley-based company New Retirement secured $20 million in funding for their software that helps people plan for their financial retirement.

And in Europe, Swedish B2C buy-now-pay-later provider Zaver closed a $10 million extension to its Series A funding round, bringing their total funding to $20 million.

What else we’re writing

Learn how Supaglue, a tiny four-person startup, caught the attention of Stripe. Previously known as Supergrain, Supaglue offers an open source developer platform for user-facing integrations. Their team will be assisting Stripe with real-time analytics and reporting for their Revenue and Finance Automation suite.

Additionally, Justin Grooms, Bolt’s global head of sales, has replaced Maju Kuruvilla as interim CEO of the one-click checkout company. Kuruvilla, a former Amazon executive, took over as CEO in January 2022 after founder Ryan Breslow stepped down. The Information has more about Bolt’s recent struggles.

High-interest headlines

- Inside Mercury’s unexpected fall from fintech hero to target of federal scrutiny

- RealPage and Plaid team up to combat rental fraud

- In the battle between HR software providers, Rippling gains ground against Deel at a cost

- Is Chime preparing for an IPO? They currently have more primary customers than Chase

- Explore the bold claims of a CEO from a hot fintech startup, previously covered by TechCrunch

- Cloverleaf raises $7.3 million in Series A extension funding

- Abrigo acquires TPG Software in a recent business deal

Have a tip or story to share? Contact me at maryann@techcrunch.com or message me through Signal at 408.204.3036. For a more secure form of communication, click here to reach out to the whole TechCrunch team. You can use SecureDrop or encrypted messaging apps for added security.

[…] to Telegram founder Pavel Durov, the company plans to launch AI-powered chatbots for businesses in the future. This could potentially pose […]