As anticipation for the highly-anticipated public debut of $65 billion payments technology giant Stripe grows, numerous smaller startups are emerging in the market to capture a larger share of the payments industry. One of these is Danish company Flatpay, which specializes in providing payment solutions for small to medium-sized physical merchants, including shops, restaurants, and salons. In its most recent development, Flatpay has secured an impressive €45 million ($47 million) in funding led by Dawn Capital.

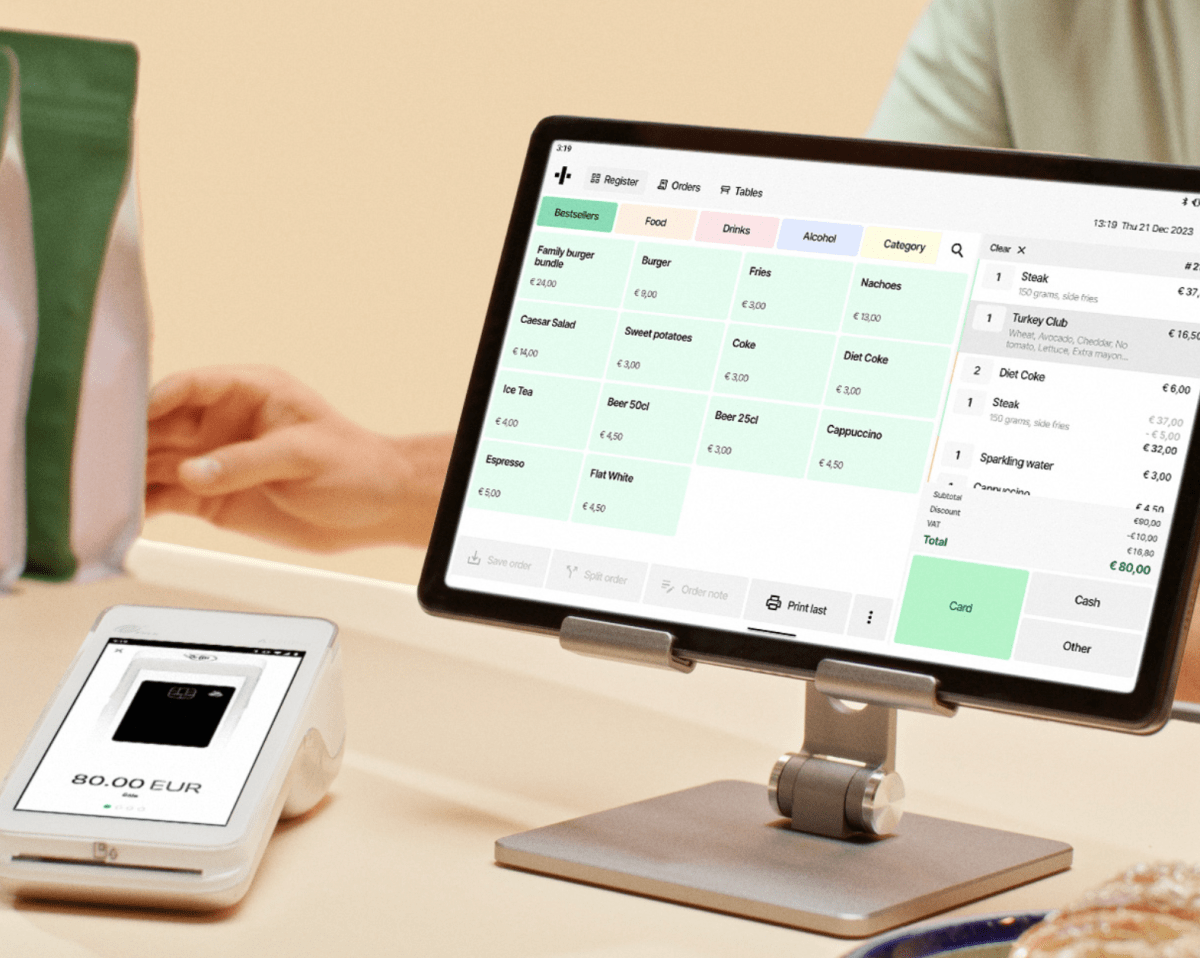

Flatpay had previously raised almost $21 million, but with this new Series B funding, the company’s valuation has surpassed $100 million. The influx of funds will enable Flatpay to expand into new European markets and develop additional products to complement its existing point-of-sale and card terminal offerings. While some of these products may incorporate AI technology, Flatpay’s CEO Sander Janca-Jensen stresses that it will only serve as a supporting tool rather than a core service.

Janca-Jensen states, “We have been able to secure funding without relying on the buzzword of AI, which seems to be a rarity in today’s market.”

€45 million is a significant amount for a Series B round in the current European market, especially for a relatively young startup. Founded in 2022, Flatpay currently has approximately 7,000 customers across its current market in Denmark, Finland, and Germany.

Despite its monthly growth rate of 15% for both revenue and customer base, Flatpay’s business remains small in comparison to the vast number of potential merchants in Europe. With over 24 million small and medium-sized businesses and more than 17 million point-of-sale terminals in the region, the competition for payments services is fierce. From industry giants like Stripe, Adyen, and PayPal to smaller players like SilkPay, all are targeting the same customers as Flatpay.

However, investors see great potential in Flatpay and are willing to bet early and strongly, despite the current economic climate. Janca-Jensen, along with co-founders Rasmus Busk, Rasmus Hellmund Carlsen, and Peter Lüth, identified a gap in the market for simple and convenient payment solutions for merchants who may not have the technical expertise to troubleshoot and integrate complex systems into their business flow.

To address this gap, Flatpay has adopted a three-pronged approach. Firstly, the company only works with a specific size of customer: merchants who process more than €100,000 annually. Additionally, these customers cannot be operating as part of multiple-location chains or franchises. Janca-Jensen explains that Flatpay regularly turns away potential customers who do not meet these criteria.

On the technology front, Flatpay has tailored its payment solutions to suit its target customer size, resulting in basic, flat fees of 0.99% for terminal transactions and 1.49% for point-of-sale purchases. The company also does not impose a minimum charge for single transactions and does not charge fees for international card payments. Janca-Jensen acknowledges that this model may result in occasional losses on transactions, but the overall goal is to lower the barriers to usage and encourage more spending for higher revenue.

Most interestingly, despite its focus on innovative technology, Flatpay employs a sales strategy that relies solely on in-person sales visits. The company does not offer online sales, virtual visits, or any plans to introduce these methods in the future. Janca-Jensen attributes this approach to a fondness for direct field sales, which he and his co-founders developed when they were selling home alarm systems in a previous venture.

Janca-Jensen states, “Security can be a difficult sell, and we found that the only effective way to seal deals was in person.” He adds that the key to successful field sales is having salespeople who possess a deep understanding of the product and can clearly explain its benefits to potential buyers. As a result, the company has set high standards for simplicity in its product development.

“We have to ensure that our salespeople have a thorough understanding of the product so they can effectively communicate its value to customers. This challenge is one that we embrace,” explains Janca-Jensen.

Currently, around half of Flatpay’s 200 employees are dedicated to sales, with responsibilities divided between supporting sales visits and visiting customers in person. Janca-Jensen notes that the company typically hires individuals with a background in retail rather than software sales.

He adds, “We avoid hiring individuals with SaaS backgrounds as I find them to be too lazy and complacent for field sales. SaaS sales are too easy for them.”

While this approach may raise questions about the scalability of Flatpay’s sales strategy, Janca-Jensen and investors are confident in its potential for success. Josh Bell, a general partner at Dawn who specializes in fintech, states, “When executed well, the field sales model is incredibly effective. It allows for localizing and rolling out teams in a cost-efficient manner to communicate the value of a product on a local level.”

He notes that another company Dawn has invested in, iZettle, also utilized field sales to sell its technology to non-technical customers. However, Bell believes that Flatpay has mastered this strategy in a way that sets it apart from its competitors.

Joining Dawn in this funding round is Denmark’s Seed Capital, along with several other unnamed investors. With this strong backing, Flatpay is well-positioned to continue its expansion in Europe and attract even more customers with its simple yet effective payment solutions.