Stock-trading platform Robinhood is diving deeper into the cryptocurrency realm with the acquisition of crypto exchange Bitstamp.

With Bitstamp under its wing, Robinhood says that it will be better positioned to target retail and institutional crypto investors across Europe, Asia, and the U.S., with Bitstamp currently holding more than 50 licenses and registrations to operate in these markets.

“The acquisition of Bitstamp is a major step in growing our crypto business,” Robinhood’s crypto general manager Johann Kerbrat said in a statement.

“The Bitstamp team has established one of the strongest reputations across retail and institutional crypto investors.

Through this strategic combination, we are better positioned to expand our footprint outside of the U.S. and welcome institutional customers to Robinhood.”

Kiki World, a beauty startup launched last year, wants consumers to co-create products and co-own the company with the help of web3 technology.

Kiki co-founder Jana Bobosikova said she believes that being a loyal user of a brand in the Web 2.0 world could be a net negative experience.

Kiki is flipping that model by allowing its community members to vote on the features they want before the beauty products are made.

Although members’ product votes are recorded on Ethereum, Bobosikova said some participants don’t need to know they are taking action on blockchain.

But, as Simpson pointed out, Kiki has plans to eventually expand beyond the world of beauty.

Nearly everything else that’s being built on or enabled by blockchains replaces something that’s already being done fairly well.

Yes, there are companies that facilitate crypto trades like Coinbase and Block (formerly Square).

But there’s no actual company that’s developed economic value by doing something brand new or better on a blockchain.

Energy drives the real-world economy, and unless Sam Altman or somebody successfully unlocks fusion and delivers energy that’s truly “too cheap to meter,” it’s going to remain a real asset with real value for some time.

In fact, it wouldn’t surprise me in the least if Satoshi had some kind of connection to the energy industry.

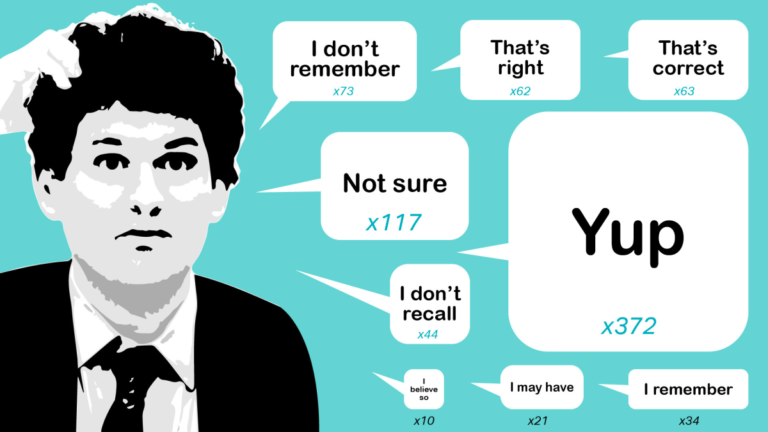

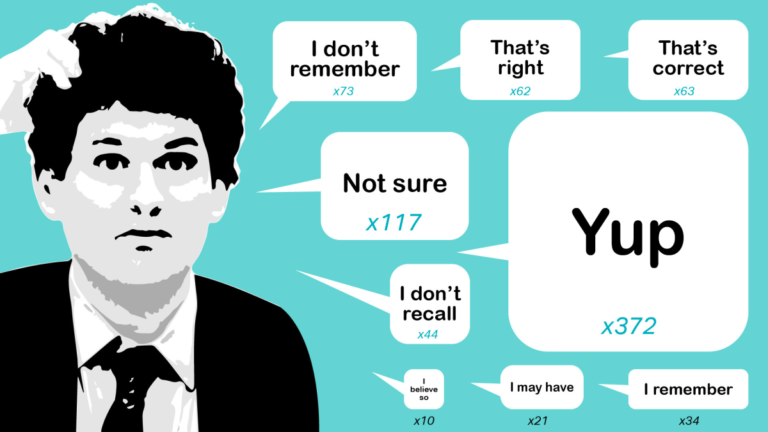

SBF sentenced, Worldcoin hit with another ban order and big web3 pre-seed rounds are backWelcome to TechCrunch Crypto, formerly known as Chain Reaction.

This week in web3Crunching numbersThis week the crypto market prices were a bit more chipper, with the top cryptocurrencies being green on the week.

The second-largest crypto, ether, increased 2.6% on the week to $3,550, according to CoinMarketCap data.

Zero-knowledge proofs are a cryptographic action used to prove something about a piece of data, without revealing the origin data itself.

Scott and I discuss Space and Time’s origin story, how data warehouses work in Web 2.0 versus web3 and the importance of data transparency.

0G Labs, a web3 infrastructure firm,” has raised $35 million in a pre-seed round, the team exclusively told TechCrunch.

“In order to build the basic technology, we wanted to raise $5 million, originally,” said 0G co-founder Michael Heinrich.

0G, sometimes called ZeroGravity, is creating a modular AI blockchain that aims to alleviate the pain points of on-chain AI applications in the web3 ecosystem, like speed and cost efficiency.

On-chain AI and gaming requires a fast data pipeline.

It also plans to enable new use cases and things that were not possible before like on-chain AI, on-chain gaming and high-frequency decentralized finance (DeFi).

Welcome to TechCrunch Crypto, formerly known as Chain Reaction.

Hello and welcome back to the TechCrunch Crypto newsletter.

This week in web3Crunching numbersThis week the crypto market prices were lower, but still relatively strong compared to previous months.

Bitcoin was down 6.5% on the week at $67,300 and 32% higher on the month, at the time of publication.

This kickstarted her career in web3, data and AI solutions.

Blockchain is back and Bitcoin is hot, the Ethereum blockchain seeing price gains, lots of folks are stoked about ETFs.

But one less-mainstream blockchain is perhaps making the biggest waves in crypto lately: Solana.

TechCrunch has reported on Solana’s massive, recent price appreciation, digging into its rapid ascent and the reasons why.

The answer is not something new, but instead a return of something that we’ve seen in the past.

Not that the Dogwifhat folks are worried — they’re probably too busy having a great time.

Appzone is one of the standout local fintech software providers for banks and fintechs, providing better pricing and flexibility.

As such, it rebranded to Zone, a licensed blockchain-enabled payment infrastructure company–and carved out its original banking-as-a-service business into a separate standalone company, Qore.

Today, Zone, its blockchain network that enables payments and acceptance of digital currencies, is announcing that it has raised $8.5 million in a seed round.

Therefore, the fintech is developing an interoperable payment infrastructure using blockchain technology — known for its ability to scale infinitely — to connect banks and fintech companies, facilitating transaction flow without intermediaries.

“We are excited by the potential for Zone’s technology to be replicated across borders to advance payment innovation globally.

Two months ago, media giant Fox Corp. partnered with Polygon Labs, the team behind the Ethereum-focused layer-2 blockchain, to tackle deepfake distrust.

Fox and Polygon launched Verify, a protocol that aims to protect their IP while letting consumers verify the authenticity of content.

“When you put that content on chain, you can now validate that content was created by a certain individual or brand,” Blank said.

This story was inspired by an episode of TechCrunch’s podcast Chain Reaction.

Subscribe to Chain Reaction on Apple Podcasts, Spotify or your favorite pod platform to hear more stories and tips from the entrepreneurs building today’s most innovative companies.

Bitcoin hits new high, Solana price jumps as memecoins mania rises and Worldcoin faces heat in SpainWelcome to TechCrunch Crypto, formerly known as Chain Reaction.

Hello and welcome back to the TechCrunch Crypto newsletter.

This week in web3Crunching numbersAs mentioned, this week the crypto space saw all-time highs for bitcoin, again.

Memecoins across the Ethereum, Solana and Avalanche blockchains have seen a huge rally as the crypto market continues to expand.

It’s important to remember that while some memecoins will retain price support for an extended period of time, some can plummet within days, or hours.