Flipkart co-founder Sachin Bansal is in talks to raise capital for his new startup, Indian fintech Navi.

Bansal is talking to investors to raise at a valuation of around $2 billion, three sources familiar with the matter told TechCrunch.

The Bengaluru-headquartered startup Navi has been largely self-funded up to now — Bansal owns 97% of the company — and this would be its first large outside fundraise since it was founded in 2018.

After a particularly rough 2023 in which overall startup funding fell 73% in the country, this could be a signal that growth stage funding rounds are back on the table.

Even if this might become Navi’s first external raise, that doesn’t mean Bansal has not been talking to interested parties.

Some may help businesses build a website, whereas others may just be useful for getting listed on search engines.

The startup also uses AI to ease businesses’ journey to digitize thousands of stores in one go.

Tarun Sobhani, co-founder and CEO of SingleInterface, told TechCrunch that the startup helps businesses grow their revenues by 15–20% using its products.

Sobhani and Harish Bahl, the founder of consumer internet investor and venture-building firm Smile Group, co-founded the startup in 2015.

Sobhani said the startup plans to add many people in the Asia-Pacific region to grow its presence.

Ghost Autonomy, a startup working on autonomous driving software for automaker partners, has shut down, TechCrunch has learned.

“We are proud of the substantial technical innovations and progress the Ghost team made on its mission to deliver software-defined consumer autonomy,” the note on its website reads.

“The path to long-term profitability was uncertain given the current funding climate and long-term investment required for autonomy development and commercialization.

We are exploring potential long-term destinations for our team’s innovations.”The shutdown comes just five months since the startup partnered with OpenAI through the OpenAI Startup Fund to gain early access to OpenAI systems and Azure resources from Microsoft.

Like so many startups trying to commercialize autonomous vehicle technology, Ghost has shifted its approach over the years.

Faraday Future has avoided getting evicted from its Los Angeles headquarters — for the time being.

The resolution comes as Faraday Future is once again strapped for cash.

There, BXP Realty claimed that Faraday Future stopped making lease payments in December and that it owed $127,311.16.

Faraday Future does not appear to have formally responded to the lawsuit, and in early March, a default order was entered.

It’s unclear if Faraday Future still occupies the space.

But it’s unlikely that startups’ fundraising slog will become much easier soon, mostly because of venture capitalists’ own capital-gathering challenges.

In Q1, U.S. VC funds raised only $9.3 billion, according to PitchBook data.

At this pace, VC fundraising will end 2024 at just above $37 billion, the lowest capital raised since 2013 and a 54% decline from last year.

PitchBook estimates that dry powder, the amount of capital VCs still have to invest from previous funds, remains high.

“One low fundraising quarter is not going to make or break the future of VC,” said Kyle Stanford, lead venture capital analyst at PitchBook.

Venture firm Maniv has grown by nearly every measure since it launched eight years ago in Israel — from its investor base and 40-startup portfolio to its geographic focus, footprint and fund size.

There are, however, some notable evolutions that hint at the Maniv’s investment strategy with its third and latest fund known as Maniv III, TechCrunch has exclusively learned.

Maniv, once firmly focused on Israeli startups, continues to expand its geographic focus and now has active portfolio companies in nine countries.

The VC firm has also largely stopped using the once trendy umbrella term “mobility,” (often leaving it out of its original name Maniv Mobility) and has opted instead to talk about deep tech, decarbonization and digitization of the transportation sector.

“I thought the trajectory of that term (mobility) was going to continue to clarify overtime, but in fact, I think the opposite has happened for a bunch of reasons,” Granoff explained, adding that while the term mobility might not be used as often, it is still very much central to its mission.

Nvidia might be clouding the funding climate for AI chip startups, but Hailo is still fightingHello, and welcome back to Equity, a podcast about the business of startups, where we unpack the numbers and nuance behind the headlines.

This is our Wednesday show, when we take a moment to dig into a raft of startup and venture capital news.

No big tech here!

Keep in mind that Y Combinator’s demo day kicks off today, so we’re going to be snowed-under in startup news the rest of the week.

Consider today’s show the calm before the storm.

SiftHub’s AI assistant is built on open-source large language models (LLMs), and is supported by retrieval augmented generation (RAG) technology, which uses additional data sources to fine-tune the quality of content generated by AI.

All that eventually brought her focus to sales and presales teams.

“Sales teams have a shadow team — a presales team or solutions engineers — and they are usually the unsung heroes of the organization.

Sales and presales teams lack the necessary tooling to handle this new selling environment.

We are excited to back the SiftHub team and be a part of their ambitious journey,” said Sanjay Nath, a partner at Blume Ventures.

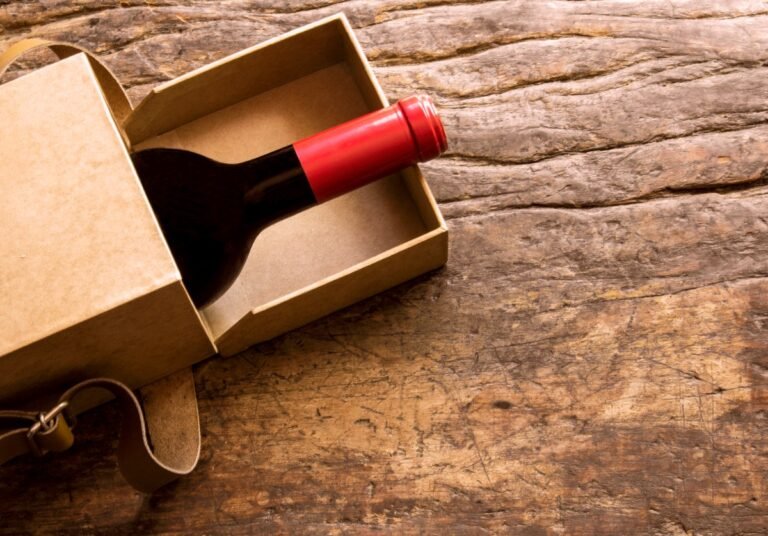

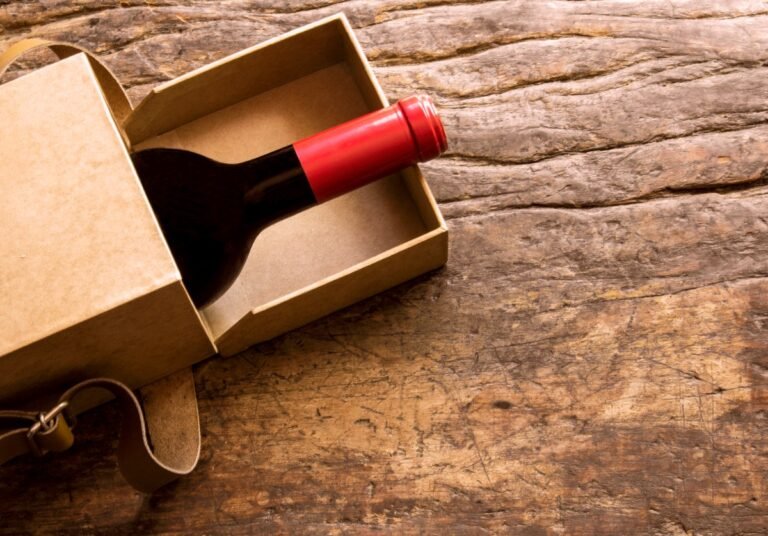

Full Glass Wine, a brand acquisition management startup that specializes in acquiring wine marketplaces, has raised $14 million in a Series A round to continue acquiring DTC (direct-to-consumer) wine marketplaces, aiming to lead the DTC wine market.

The deal is Full Glass Wine’s third acquisition in a year and will enable the startup to expand its subscription-based model.

DTC wine brands sell wine directly to wine lovers, bypassing traditional distribution channels“By uniting Winc, Wine Insiders, and Bright Cellars, we offer a one-stop shop for all things wine, catering to a wider range of wine drinkers than most traditional retailers, grocers, or single-brand DTC companies,” Neha Kumar, co-founder and COO of Full Glass Wine, told TechCrunch.

“However, there are also some misconceptions consumers might have about DTC wine.

“We’re looking at a total of at least a few dozen employees now at Full Glass Wine,” Kumar said.

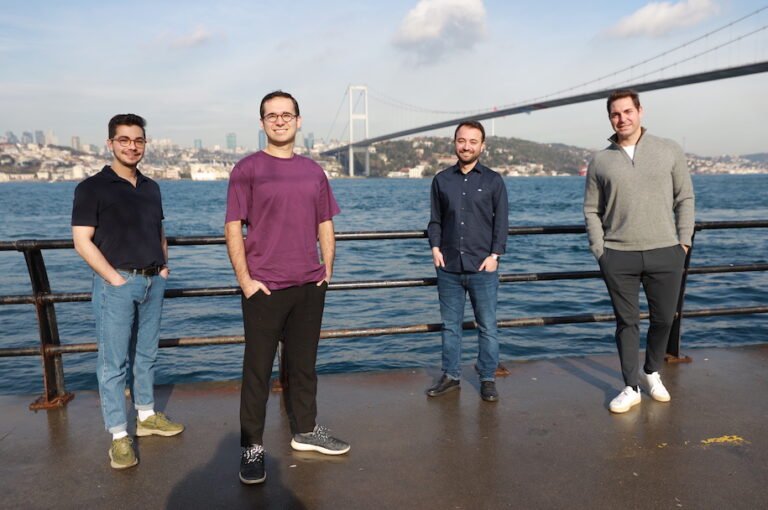

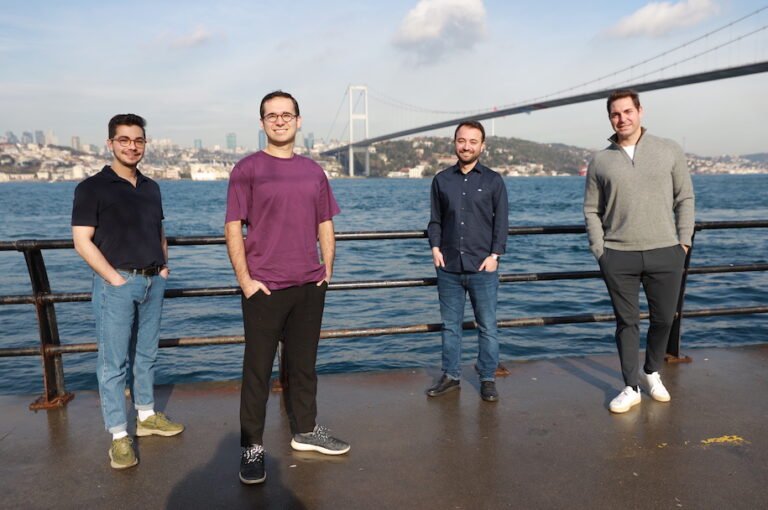

Turkey has gained a well-earned reputation as a veritable cauldron of mobile games startups, leading to the rise of VCs dedicated to the sector.

The latest to join this coterie is Laton Ventures, a new gaming-focused VC that has raised a $35 million fund.

Indeed, between 2018 and 2022 Turkish gaming start-ups raised more than $1 billion in funding.

There are now at least 25 VC funds that invest in video games startups based out of Turkey.

“We’re positioning as a bridge between the Turkish gaming ecosystem, which is booming, and the international gaming ecosystem.