A South Korean startup called QuotaLab is on a quest to follow in the footsteps of Carta, the cap table management company that’s used by a host of startups and investors in the U.S.Carta started life as “eShares” in 2012 as a cap table management service that startups could use to issue equity to their investors and employees.

Today, its stable of offerings has expanded to include everything from valuation and equity management, to bookkeeping, risk assessment and brokerage services.

A Y Combinator alum, QuotaLab also started off as an equity management service (called QuotaBook) for startups and investors in South Korea.

It also offers investment management such as investments, returns, asset changes, markdowns, valuations, accounting, e-approvals and risk management,” Choi added.

According to Choi, the equity management market has many sides you can tackle.

Remofirst raises $25M to take on Deel and Rippling in the global HR tech spaceIn the world of HR tech startups, there are the Davids and the Goliaths.

Deel and Rippling are the Goliaths, both having raised millions of dollars in venture capital.

But Remofirst, which just secured $25 million in Series A funding, is proving to be a very worthy David.

Remofirst, an HR tech startup, touts that it hires its clients’ employees and contractors in more than 180 countries on their behalf without those companies having to set up local entities.

“We see SMBs as an underserved segment of the market,” Serik told TechCrunch.

Saudi Arabia is poised to become one of the largest global construction hubs owing to its trillion-dollar infrastructure and the real estate projects that are underway in the country.

BRKZ is today emerging from stealth backed by a $8 million Series A round co-led by Beco Capital and 9900 Capital.

Aramco’s Wa’ed Ventures, Knollwood Investment Advisory, RZM Investment and MISY Ventures also participated in the round.

Following the fresh capital injection, the B2B marketplace aims to expand in Saudi Arabia and the MENA region to facilitate contractors in procuring materials and manufacturers in selling, with a focus on same or next-day delivery.

He added that the startup can process commonly ordered building materials within minutes, but more time is required for “specialized materials”.

Enter Underscore VC’s Lily Lyman, who is coming to TechCrunch Early Stage 2024 in Boston to discuss how founders can build investor relationships with the right venture capitalists.

She will discuss how to build venture relationships ahead of time, and how founders can — and should!

In today’s more stringent venture environment, founders can’t run a 2021-era playbook (unless they are building an AI foundational model company, I suppose).

So, bring your notebooks and questions to Lyman’s Early Stage session coming up next month.

She’ll be joined by a bevy of other startup folks who will be on hand to share their hard-earned wisdom.

The Harness offering also has two other components, serving as a marketplace for discovery of advisors and services and consumer financial insight tools.

In order to fill that need, Harness partnered with experienced tax advisors who in most cases already had a significant roster of clients.

So when those advisors partnered with Harness, many of those clients became clients of Harness as well.

Put simply, the new platform “powers the collaboration between tax advisors and their clients,” the company said.

About 75% of Harness’ clients come through advisors that join the platform.

In an unexpected move, Miles Grimshaw announced today that he is rejoining Thrive Capital after working as a general partner at Benchmark for the past three years.

Grimshaw first joined Thrive, a New York-based venture firm that Joshua Kushner founded, in 2013.

He is returning as a general partner.

When joining storied venture firm Benchmark in December of 2020, then-29-year-old Miles Grimshaw became its fifth general partner.

He had similarly joined a team of four other partners at Thrive back in 2013.

London-based fintech company Monzo raised a late stage funding round of $430 million (£340 million), confirming a report from the Financial Times from a few weeks ago.

Founded in 2015, Monzo provides UK current accounts, debit cards and several financial products with a digital-first approach.

That’s why Monzo is sort of defying the odds with this new funding round, with Google playing a big part in this investment.

Monzo reached a post-money $4.5 billion valuation in 2022.

Now, Monzo has nine million retail customers in the U.K.

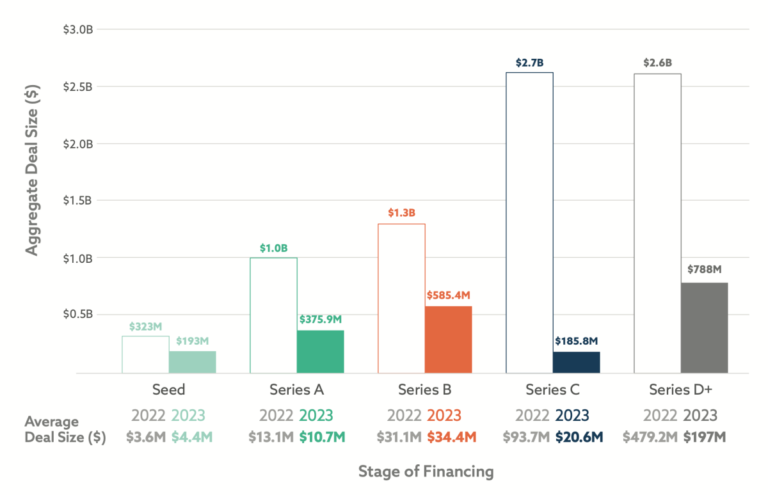

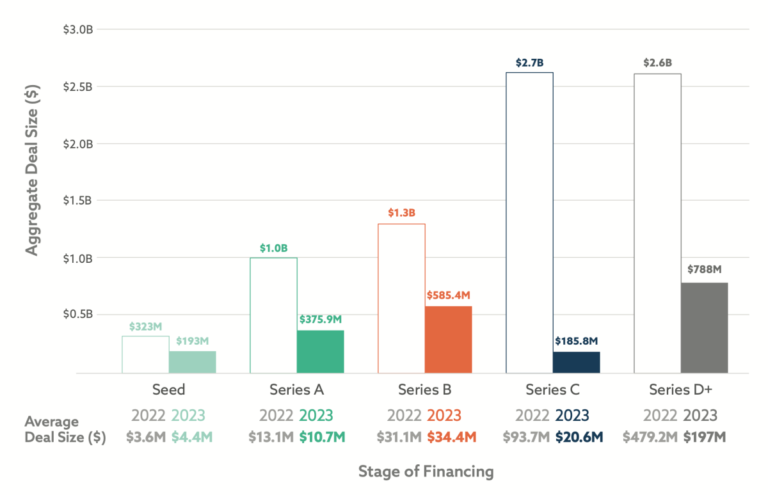

New report confirms Europe’s tech investment doldrums, but there are signs of lifeEurope is suffering from a big hangover after the tech investment party of the 2020-2021 period.

That said, compared to pre-pandemic levels, VC investment in European startups is up, historically speaking, and reached $60 billion, according to a new report.

2023 marked a reset and major correction in investment levels globally.

According to the report, Europe is sitting on “record levels of dry powder” and “producing more new founders than the U.S.”, funding remains slow.

Climate Tech overtook FinTech as Europe’s most popular sectorAI’s share of total investment in Europe soared to a record high of 17%5.

Sam Blond is leaving Founders Fund, as well as the profession of venture capitalist, just 18 months after he joined the storied Silicon Valley firm.

For now just immense gratitude to FF and all the incredible people and… — Sam Blond (@samdblond) March 4, 2024Before joining the VC firm, Blond was best known as the former Chief Revenue Officer at Brex.

Brex is not a Founders Fund portfolio company, although Founders Fund is an investor in one of Brex’s biggest competitors: Ramp.

We hope to have the opportunity to work with him again,” Founders Fund spokesperson Erin Gleason tells TechCrunch.

But this is the second splashy departure of a Founders Fund partner over the past couple of months.

Berlin’s Razor Group has acquired U.S.-based Perch, and on top of this it has raised just over $100 million led by Presight Capital with other undisclosed investors participating.

The news is the latest development in a wider consolidation and reordering taking place in the world of e-commerce aggregation.

Perch, we have heard from multiple sources, had been looking for a buyer for the better part of a year.

Perch and Razor do happen to have some investors in common, such as Victory Park Capital, which may well have been central to the negotiations between the two.

He claims that this deal solidifies Razor as the “market leader”, and that it is on track for $1 billion in revenues in the next four to eight quarters.