The UK threw a splashy event in New York this week to woo more American VCs Welcome to the new UK: the Unicorn KingdomA 3-D hologram, dubbed the Ever-Changing Statue, will be on display at the Rise by Barclays workspace in New York until April 4.

Dealroom data shows that UK startups raised $31 billion in venture capital in 2022 and $41 billion in 2021.

It’s also still more than the $18 billion the UK raised in 2019 and the $12 billion raised in 2018.

Between 2009 and 2019, only 38 UK Black founders raised venture capital funding—that number now stands at 80, according to an updated report by Extend Ventures.

“The UK tech ecosystem has made significant strides, but work remains to reach the scale and influence of Silicon Valley,” Taylor told TechCrunch.

New Summit Investments is raising a new $100 million impact fund, according to documents filed with the SEC.

This is the firm’s fifth fund and marks a sizable jump from the $40 million its previous fund, which closed back in 2022.

New Summit has supported marginalized fund managers by launching initiatives like its partnership with investment firm Gratitude Railroad to source and underwrite underrepresented fund managers.

New Summit Investments’ was founded in 2016 as an impact investment firm focusing on climate, health, and economic opportunities.

New Summit Investments’ first fund closed for $20 million in 2016, followed by $36 million in 2018, according to Pitchbook.

VNV Global attributes its fair value estimate to a valuation model based on trading multiples of public peers rather than historical funding rounds.

Funding and interest in B2B startups took off in the last decade and saw a bump in the wake of COVID-19.

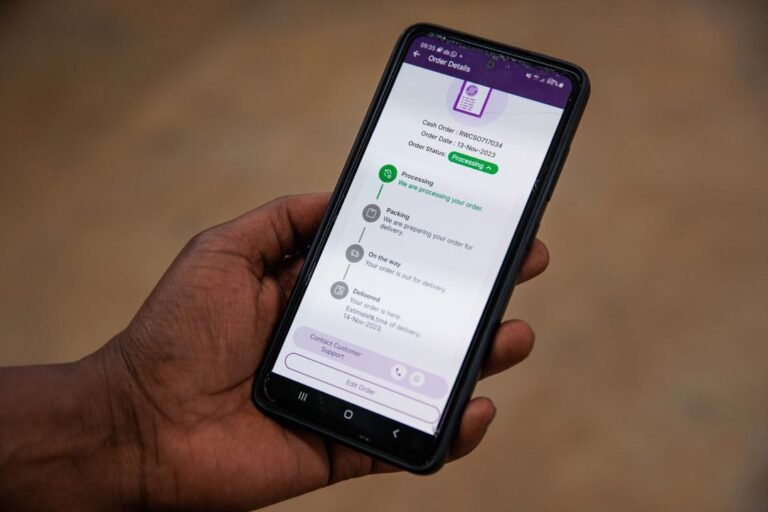

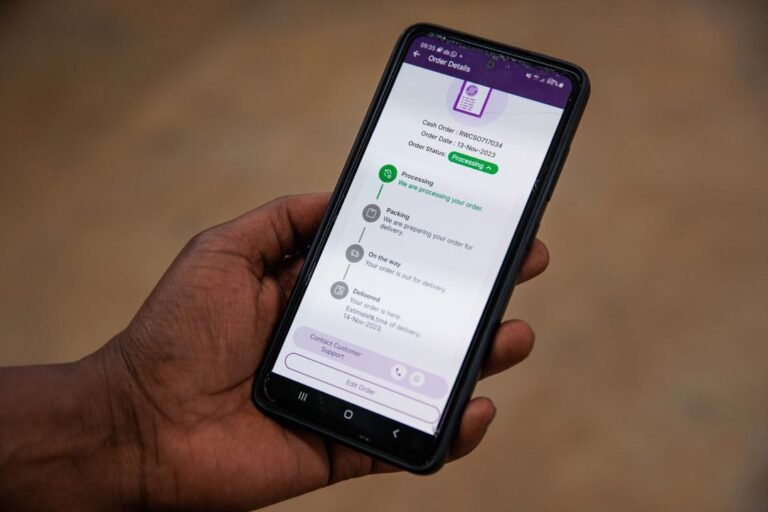

African startups, including B2B e-commerce platforms like Wasoko, have followed the same playbook as their counterparts further afield: layoffs; cost cuts; and closures are not uncommon.

In the lead-up to its merger with MaxAB, Wasoko shuttered hubs in Senegal and Ivory Coast and laid off staff in Kenya.

It operates a food and grocery B2B e-commerce platform in Egypt and Morocco, expanding to the latter following its acquisition of YC-backed WaystoCap in 2021.

PayPal Ventures’ latest investment is in an Indonesian startup that provides personal insurance products covering a variety of risks, including accidents, phone screen damage, and ticket cancellations.

Qoala has secured $47 million in a new round co-led by PayPal Ventures and MassMutual Ventures, the five-year-old startup said Wednesday.

Qoala, headquartered in Jakarta, is an insurance broker that works with top local insurers and e-commerce firms to offer customers personalized and affordable products.

The startup sells these insurance both through its website and app as well as through offline engagements.

“It is commendable to see what Qoala has achieved in a short period of time,” said Alexandros Bottenbruch, Principal at PayPal Ventures in a statement.

Borderless Capital, an investment firm that specializes in web3, announced Tuesday that it is acquiring CTF Capital, a quantitative trading and asset management firm headquartered in Miami, with technology and operation teams in Latin America.

With this acquisition, Borderless Capital will add AI-infused quant trading expertise to its own business.

After combining with CTF Capital, Borderless will have over $500 million in assets under management (AUM).

All the existing funds managed by CTF Capital will be merged into Borderless’s Multi-Strategy Fund V LP., launched last year with $100 million under management today.

“Borderless already has significant exposure through several portfolio companies from this geography [Latin America].

Tinder-owner Match Group has appointed two new members to its board of directors and signed an agreement with Elliott Management, the company announced on Monday.

Chief marketing officer at Instacart, Laura Jones, and Zillow co-founder Spencer Rascoff, will be joining the board, effective immediately.

Match said in a press release that the appointments followed a “a constructive dialogue” with the activist investor, as the two companies have entered in an “information-sharing” agreement.

“We appreciate the collaboration with management and the Board over the past several months, and we are confident that Laura Jones and Spencer Rascoff are strong additions to the Board.

The activist investor’s push for change at the dating firm follows board shakeups at Crown Castle and Etsy.

Lucid Motors is raising another $1 billion from its biggest financial backer, Saudi Arabia, as it looks to blunt the high costs associated with building and selling its luxury electric sedan.

The fresh funding comes just a few weeks after Lucid told investors that it only plans to build around 9,000 of its Air electric vehicles this year, a slight bump over last year’s output.

It lost $2.8 billion in 2023 and finished the year with just shy of $1.4 billion in cash and equivalents.

Lucid also plans to start building its electric Gravity SUV at the end of this year.

Lucid announced the investment less than three weeks after CEO Peter Rawlinson told the Financial Times that he was wary of relying too heavily on Saudi Arabia to keep shoveling money into its proverbial furnace.

1991 Ventures is the brainchild of Ukrainian brothers Denis and Viktor Gursky, who are better known for running incubation and accelerator programs inside Ukraine.

The Gursky brothers previously backed over 200 startups between 2016 and 2024, via their incubator Social Boost and their 1991 Accelerator.

Startups backed to date include LegalTech startup AXDRAFT; European toll payment app eTolls; and cybersecurity company Osavul.

Finally, TA Ventures is perhaps the best known and most active Ukrainian VC internationally, headed up by the almost-ubiquitous Viktoriya Tigipko.

Of course, many of the tech companies Ukraine will produce in the forthcoming years are likely to be either ‘dual-use’ or related to defence.

A $700M SAFE, IPOs are back, and how one venture fund is transcending bordersHello, and welcome to Equity, a podcast about the business of startups, where we unpack the numbers and nuance behind the headlines.

This is our Friday episode, in which we dig through the most critical stories from the week and chat through new and emerging themes.

This week we had Mary Ann, Becca, and Alex aboard.

Becca of course is one of the two hosts of TechCrunch’s Found podcast, which talks to founders about how they built what they did, and how they did it!

Today on Equity, however, here’s what we got into:We are back Monday with more!

The U.K.’s Competition and Markets Authority (CMA) has confirmed that it’s launching a formal “phase 2” investigation into the planned merger between Vodafone and Three UK.

The CMA says that the deal could lead to higher prices for consumers, while also impact future infrastructure investments.

However, the CMA has given both parties a token five working days to address its concerns with “meaningful solutions” before it formally progresses the investigation.

Such a scenario is precisely why the U.K. introduced the National Security and Investment Act back in 2022, with previous form in blocking deals between U.K. entities and Chinese companies.

“This case has more moving parts than the CMA’s other recent big decisions, and is arguably more important for the U.K. economy,” Smith said.