Kenyan B2B e-commerce company MarketForce is winding down its B2B e-commerce business that served informal merchants (mom-and-pop stores) after a turbulent two-year period that saw it scale down operations severely.

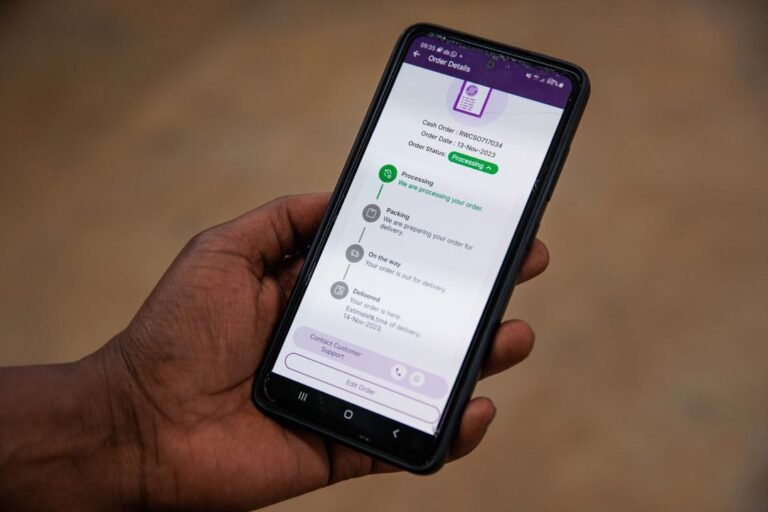

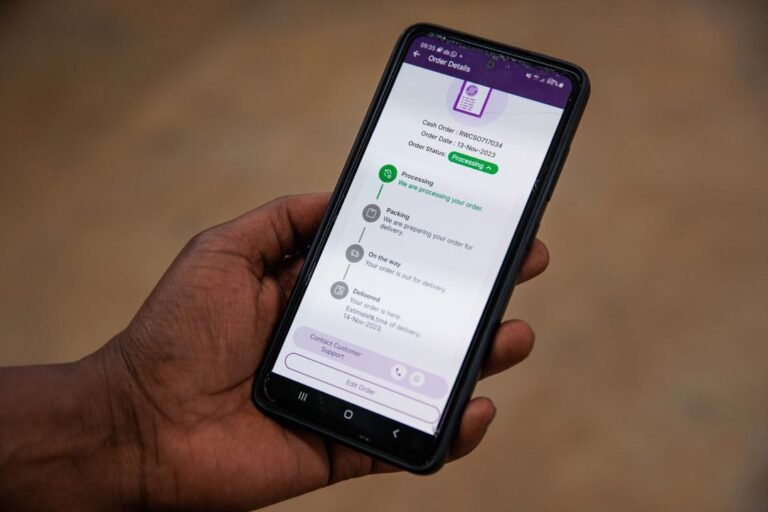

The shutdown of the B2B e-commerce arm dubbed RejaReja comes months after MarketForce withdrew the service from all its markets, including Nigeria and Kenya, save for Uganda.

At its peak, it employed more than 800 people and served 270,000 informal merchants.

MarketForce had raised $42.5 million, including $40 million debt-equity in a Series A round in 2022 at over $100 million valuation, to fuel the business.

Several B2B e-commerce companies in Africa have also scaled back operations as the funding crunch persists.

The capital, which brings total funding raised by the startup to $6.2 million, will enable it to serve more brands.

For diverse brands in particular, there are a lot of economic hurdles that these groups face, which makes it even harder for them to access capital.

Its other offering is a labor marketplace for brands not in a position to hire full-time teams but require talent occasionally.

Its community of brands recommends the talent or manufacturer, who are listed on the marketplace after several stages of vetting.

Brands gain access to the labor marketplace, capital and other resources, upon signing up (at a cost) on the startup’s main product, the B2B marketplace and SaaS product.

VNV Global attributes its fair value estimate to a valuation model based on trading multiples of public peers rather than historical funding rounds.

Funding and interest in B2B startups took off in the last decade and saw a bump in the wake of COVID-19.

African startups, including B2B e-commerce platforms like Wasoko, have followed the same playbook as their counterparts further afield: layoffs; cost cuts; and closures are not uncommon.

In the lead-up to its merger with MaxAB, Wasoko shuttered hubs in Senegal and Ivory Coast and laid off staff in Kenya.

It operates a food and grocery B2B e-commerce platform in Egypt and Morocco, expanding to the latter following its acquisition of YC-backed WaystoCap in 2021.

Giant Ventures in January closed two new funds totaling $250 million that it will invest in startups on both sides of the Atlantic, and today, TechCrunch has learned exclusively that Frontline Ventures has also raised $200 million across two funds, named Frontline Growth and Frontline Seed.

Frontline has historically invested in both Europe and North America, and its new funds will continue to follow that strategy, betting on B2B software companies.

The new seed fund will favor European ventures, while the growth fund will focus on U.S. startups.

Expansion roadmapO’Donnell told TechCrunch that when it helps portfolio companies navigate expansion to another market, Frontline focuses on four aspects: timing, go-to-market strategy, talent, and organizational design and location.

That’s by order of importance, and a company’s location should be a derivative of the previous three aspects, O’Donnell said.

Nala set out to offer remittance services, it’s building a B2B payment platform too It says, this is to guarantee reliability to its app users and businesses making payments into and out of AficaPayments company Nala pivoted to offer remittance service in 2021, tapping the growing money transfer market in Africa, and demand for reliable and affordable services.

For markets like Kenya, they have integrated with mobile money service M-Pesa enabling users living in the diaspora to pay local bills directly.

However, building the service on the payment rails of other providers meant that the fintech could not guarantee dependability.

This drove the decision to develop its own platform that directly integrates with banks and mobile money providers.

The remittance business growth coincides with reports that remittance flows to sub-Saharan Africa will continue on a growth trajectory.

Save for fintech and cleantech, B2B e-commerce and retail was the leading destination for venture capital dollars over the last five years.

Most B2B e-commerce startups have struggled to keep subsidizing their products and expanding operations, leading to retreats, closures, downsizing and mergers.

Building a B2B e-commerce business in tech winterB2B e-commerce platforms provide convenience to FMCG manufacturers like Unilever and P&G for distributing their products to the last mile.

As a result, many B2B e-commerce startups have opted for asset-heavy models to reach their customer base.

The Lagos-based B2B e-commerce startup is currently in the middle of securing a new round of equity and debt to propel its expansion.

When you think about commerce platforms, chances are the first names that come to mind are big names like Adobe Commerce or Salesforce Commerce Cloud.

That’s why a French startup called Catalog wants to build a software-as-a-service product that seamlessly manages B2B sales across several sales channels.

But these tools don’t necessarily work well for B2B companies.

This way, the company hopes it can handle the majority of B2B orders for companies that have decided to use Catalog.

By focusing on small and medium businesses, Catalog could start offering a wide range of services that are specifically tailored for these small manufacturing and commerce companies.

The average company was using 130 software-as-a-service (SaaS) apps as of 2022, according to Statista — a volume that’s impacting productivity.

Today, Zuercher leads Prismatic, an iPaaS startup designing a solution to help business-to-business (B2B) SaaS companies connect their products to the other products their customers already use.

Zuercher co-founded Prismatic with Beth Harwood and Justin Hipple in 2019, aiming to streamline app integration development to let SaaS companies more easily connect to third-party software.

“SaaS companies are spending huge amounts of time and resources on integrations,” Zuercher said.

“We’re seeing intense demand across our portfolio of B2B software companies for a platform to help augment integration capabilities.

Egyptian B2B e-commerce startup MaxAB and Wasoko, a Kenya-based e-commerce player with operations in Tanzania, Rwanda, Uganda and Zambia, are in talks to merge operations, TechCrunch has exclusively learned from multiple sources.

The merger talks come as B2B e-commerce companies in Africa continue to scale back operations due to funding scarcity.

TechCrunch learned that the company had only received $30 million by the time merger talks, which are said to be investor-led, started.

As of last year, the prospect of a merger between MaxAB and Wasoko, both asset-heaving B2B e-commerce startups, seemed unlikely.

The eight-year-old B2B e-commerce company has since expanded to Zambia and the Democratic Republic of Congo.

Alvaro Morales and Kshitij Grover wanted more freedom to price their software-as-a-service product the way they saw fit, without needing approval from the finance department. So, they left Asana to…