BIRA also takes aim at Amazon’s “Buy Box,” claiming that Amazon manipulated which retailers were selected for the coveted placement.

BIRA and its legal team say that the claim is the biggest ever collective action to be launched by retailers in the country.

Making itself a must use for retailers, Amazon has then proceeded to cause damage and financial loss to retailers by misusing their confidential data that Amazon was entrusted to keep safe and by preferencing its own retail operations.

Retailers in the U.K. were entitled to be treated better and fairly by Amazon.

The U.K. is its largest international market, where it made $33.6 billion in revenues in 2023 (out of $575 billion in global revenues).

Sources tell us that Lacework — a cloud security startup that was valued at $8.3 billion post-money in its last funding round — is in talks to be acquired by another security player, Wiz, for a price of just $150–$200 million.

Wiz — valued at around $10 billion — is one of them.

The company is positioning itself as a one-stop-shop for all things cloud security en route to its IPO.

Earlier this month Wiz acquired Gem Security for $350 million, and it sounds like the M&A will not end with Laceworks.

We are always exploring compelling M&A opportunities that will enhance both our technological capabilities and business expansion, as we strive to build the world’s leading cloud security platform.”

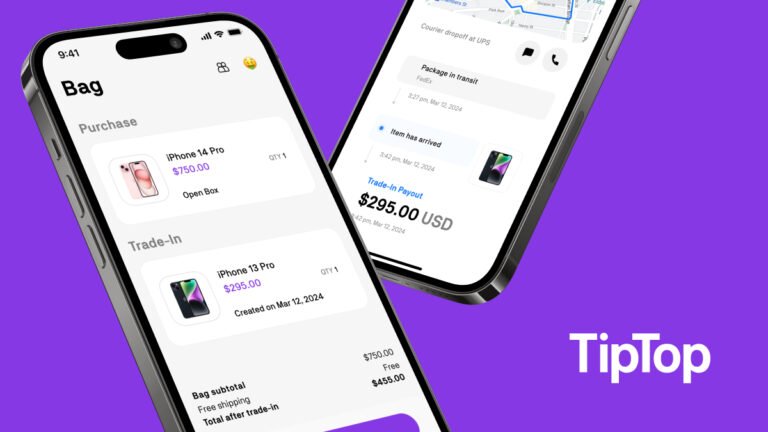

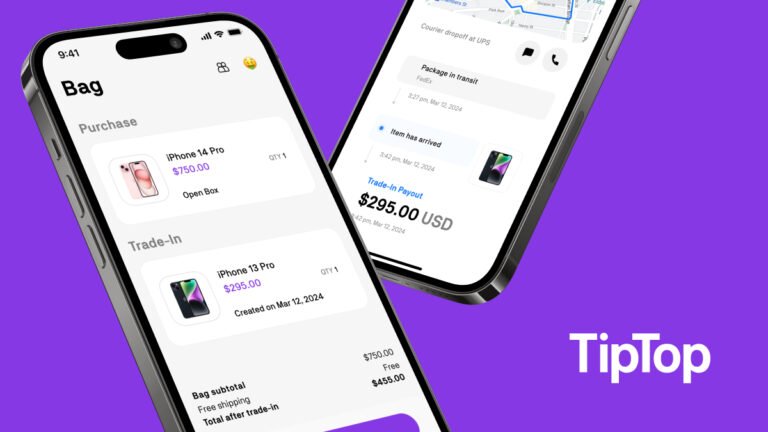

TipTop, the new app from Postmates’ founder and CEO, now lets you buy devices with trade-ins and cashTipTop, the startup that offers instant cash for electronics, is launching TipTop Shop: a way for users to purchase and trade in devices.

TipTop Shop builds on the success of TipTop Cash, which was released late last year.

It lets people get instant payouts for electronic devices like smartphones, iPads, cameras, game systems and more.

People can buy new, open-box and refurbished devices through cash and trade-ins.

Unlike on platforms like eBay and Facebook Marketplace, consumers aren’t buying products on TipTop from other consumers, as the devices are owned by the startup itself.

Spotify said today that it has submitted a new version App Store that shows pricing and feature information about the audio company’s different plans in the EU.

The update, which is pending approval from Apple, also includes a link for users to buy subscription plans from Spotify’s website.

Earlier this week, the European Commission fined Apple a massive €1.84 billion ($ 2 billion) for the company’s anti-competitive practices in the music streaming market.

Buoyed by this decision, Spotify has submitted this new version with information about subscriptions, offers, and a link to buy those, as per The Verge.

In response, Apple said it plans to appeal EC’s decision and said that Spotify has been “the biggest beneficiary” of the App Store.

But it’s a fragmented market with different streaming apps, channels and live sports leagues.

But even if you remove the big names, there are quite a few different ad-supported streaming services, such as FAST (free advertising-supported streaming television) services like Pluto, big OTT platforms like Fubo, and of course broadcasters themselves like Paramount, Warner Bros., CNN, etc.

We have Benjamin Antier on the board — he’s the founder of Publica, the biggest ad server for streaming apps.

Using Vibe’s ad platform is pretty straightforward.

After picking the streaming apps and channels where you want to show your ads, you can select a geographical area and an audience based on various interests.

If you hurry, you can get $40,000 off a 2023 Toyota Mirai, a fuel-cell vehicle which retails for $52,000.

Toyota’s discount comes on the heels of Shell’s announcement three weeks ago that it’s closing its hydrogen filling stations in California.

Of those that remain, about a quarter are offline, according to the Hydrogen Fuel Cell Partnership.

So why are Toyota and Honda (and Hyundai and others) still so bullish on hydrogen?

If today’s hydrogen startups succeed, and if they’re able to build enough capacity to satiate industrial and shipping demand, then it might make sense to start selling fuel-cell vehicles to the masses.

Reddit users wonder if the next big meme stock is Reddit itself Reddit invites power users in on its IPO, but other Redditors are also considering an investmentJeremiah Johnson says he has “an embarrassing amount” of Reddit karma.

They’re also wondering if Reddit could be the next meme stock, which could prove lucrative or disastrous.

Though she wasn’t invited to invest early, she plans to buy stock in Reddit once it officially goes public.

“Reddit is really dependent on power users who moderate the site, and because they’ve given those power users actual power, power users did for a day or two literally make the site unusable,” Johnson said.

Max Spero, a startup founder in his twenties, plans to buy Reddit stock post-IPO because he’s a fan of the platform, which he’s been using for 11 years.

FairMoney, a digital bank based in Lagos and headquartered in Paris, is in discussions to acquire Umba, a credit-led digital bank providing payroll and financial services to customers in Nigeria and Kenya, in a $20 million all-stock deal, sources tell TechCrunch.

Umba, founded by Tiernan Kennedy and Barry O’Mahony in San Francisco in 2018, was launched as a credit-led digital bank targeting emerging markets.

To date, the digital bank has secured around $20 million in funding, per PitchBook data.

FairMoney could likely be more interested in Umba’s microfinance license, obtained in 2022 through acquiring a majority shareholding in Daraja Microfinance Bank.

For FairMoney, acquiring Umba could streamline entry into Kenya, bypassing the lengthy licensing process that took Umba three years.

With governments tightening the screws on Big Tech companies trying to buy smaller firms, a key exit avenue could be closed to startups in the near term.

That fact makes Reddit feeling out its own IPO valuation all the more important.

What could help tech companies avoid another 2023 (a year that had precious few public debuts) is a massive, winning public offering.

Too high, and the stock could lose ground from its IPO price.

But private tech companies want good IPO news that sticks, and public market investors won’t gain confidence if Reddit clears a bar that it set too low.

As Amazon initiates job cuts across its entire business, including its streaming division, the e-commerce giant is now laying off employees within its Buy with Prime segment.

Launched in 2022, Buy with Prime is a service that enables third-party merchants to offer Prime benefits like free shipping and returns.

Buy with Prime expanded its availability in early 2023, adding more U.S. brands like BigCommerce and Sustainable Glam.

“Buy with Prime is a top priority for Amazon, with strong adoption from merchants and positive feedback from customers, and we will continue investing significant resources in Buy with Prime to build on that momentum.

Earlier this month, Amazon laid off 500 Twitch workers and hundreds of employees at Prime Video and MGM Studios.