When it comes to news items that we love at TechCrunch, IPOs rank pretty darn high.

Another great newsy bit that comes along less frequently than we’d like is a startup buying another startup.

These deals are often very interesting as they either bring a gob of talent, or technology to an already growing company, potentially accelerating it.

So it was with joy that the Equity Podcast crew dug into Automattic buying Beeper for $125 million.

But certainly we are an ocean or two away from the heady days we saw back in 2021.

News that Yahoo is buying Artifact stirred the technology watercooler yesterday.

Artifact was an interesting app, employing AI to help its users find and consume more, and more targeted news.

It had some devoted fans, but never reached the sort of scale that would have made it an attractive long-term project.

Regardless of whether or not you were an Artifact user — I was for a time — that Yahoo is still feeling acquisitive under its current ownership structure matters.

Artifact is hardly the only startup project in the market today that might be looking for a new home, after all.

Part of the shift to AI comes internally by building, some come via acquisitions and some come from partnering widely, says VP of corporate business development Philip Kirk.

Lara Greden, an analyst at IDC who covers ServiceNow, says going beyond building is a big part of every company’s strategy when it comes to AI.

“Like other major waves of technology innovation, breakthrough capabilities in generative AI are coming through entities that have laser focused on the tech itself, in other words: startups.

“ServiceNow’s focus has been on integrating generative AI to improve entire workflows, not just single processes or tasks.

They also play an important role in guiding customers with best practices around data governance and control.”The Washington release is available starting on Wednesday for all ServiceNow customers.

Arjun Sethi speaks with the confidence of someone who knows more than other people, or else who knows that sounding highly confident can shape perception.

Namely, if Termina is so good, why are Sethi and Tribe giving other investment firms a way to better compete?

Relatedly, why should other investors trust Termina, which ingests its customers’ data to improve over time?

This may prove doubly true given Termina’s ties to Tribe Capital.

Among these is Alex Chee, who cofounded MessageMe with Sethi, joined him at Social Capital, and subsequently co-founded both Tribe and Termina with him.

The U.S. National Security Agency is buying vast amounts of commercially available web browsing data on Americans without a warrant, according to the agency’s outgoing director.

The NSA did not say from which providers it buys commercially available internet records.

Previous reporting shows the Defense Intelligence Agency bought access to a commercial database containing Americans’ location data in 2021 without a warrant.

A week later, the FTC brought similar action against InMarket, another data broker, saying the company did not obtain users’ explicit consent before collecting their location data, and banned the data broker from selling consumers’ precise location data.

When reached by email, NSA spokesperson Eddie Bennett confirmed the NSA collects commercially available internet netflow data, but declined to clarify or comment on Nakasone’s remarks.

Solana Mobile is swinging for the stars after it announced a second, cheaper web3 phone phone dubbed “ Chapter 2 ” earlier this week.

Demand for the Chapter 2 is apparently so high, Solana Mobile hit its 7-day sales goal within the first 24 hours, Raj Gokal, co-founder of Solana and president of Solana Labs, exclusively told TechCrunch.

In the first 24 hours after the phone was announced, Solana Mobile saw over 25,000 preorders, and by the 30-hour mark, it had 30,000 preorders, Gokal said.

“For developers, Solana Mobile is creating a massive opportunity for crypto app teams looking to incentivize their users,” Gokal said.

“Giving back to the community has a snowball effect: As more developers start releasing crypto-incentivized apps to Solana Mobile users, we’ll see even greater adoption,” Gokal said.

Maka, an African fashion and beauty e-commerce platform, has raised a $2.65 million pre-seed round led by Pan-African venture capital firms 4DX Ventures and Janngo Capital.

She said launching Maka began during the pandemic when she was in Ghana and struggled to find inclusive fashion inspiration.

To address the trust element, Maka leverages videos as a means to connect users with trusted creators.

Notably, the platform offers a review option, allowing customers who make purchases to share their feedback through video reviews, usually between 30 and 60 seconds long.

Furthermore, creators can download their reviews from Maka and share them on other social media platforms, earning additional points for each share.

Tech startups are often known as nimble and innovative. Some hit a jackpot with an early success and grow rapidly, while others fizzle out. What’s the secret to long-term success…

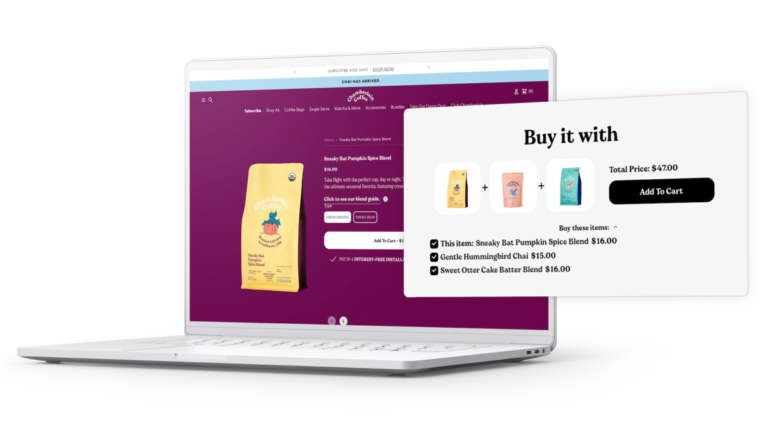

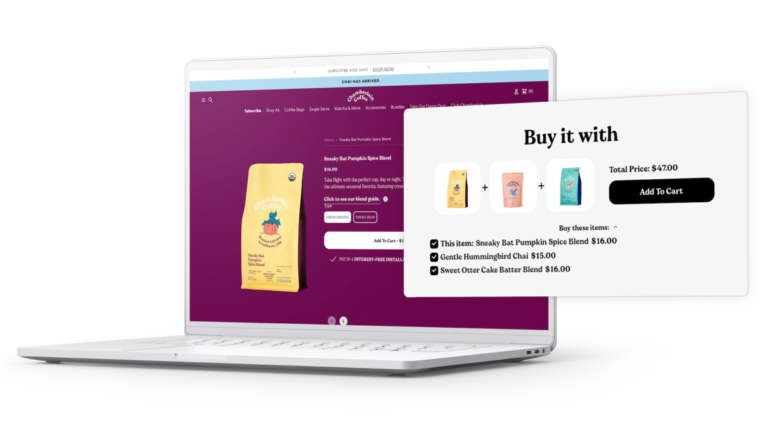

There is a lot of competition out there for shoppers’ attention, which can be difficult for small businesses to overcome. However, Shopify seems to have found a way to be…