Two of the country’s prominent fabless AI chip startups, Rebellions and Sapeon, have agreed to merge, the companies said on Wednesday.

The merger is a strategic move by Rebellions and Sapeon aimed at leading the fabless AI chip market in South Korea to take on global rivals like Nvidia.

Indeed, the deal comes at a pivotal moment in the global chip industry.

Meanwhile, KT in 2023 incorporated Atom, Rebellions’ datacenter-focused AI chip, into its cloud-based NPU infrastructure.

Last November, the company launched a 7-nanometer AI chip, X330 NPU, for autonomous vehicles, and earlier this year, it said it would develop an on-device AI chip targeting the edge computing market.

Tech sovereignty has become a looming priority for a number of nations these days, and now a startup working in semiconductors has received a major boost in aid of that effort for Germany and Europe.

The sum is one of the largest to date raised by a European startup working in semiconductors.

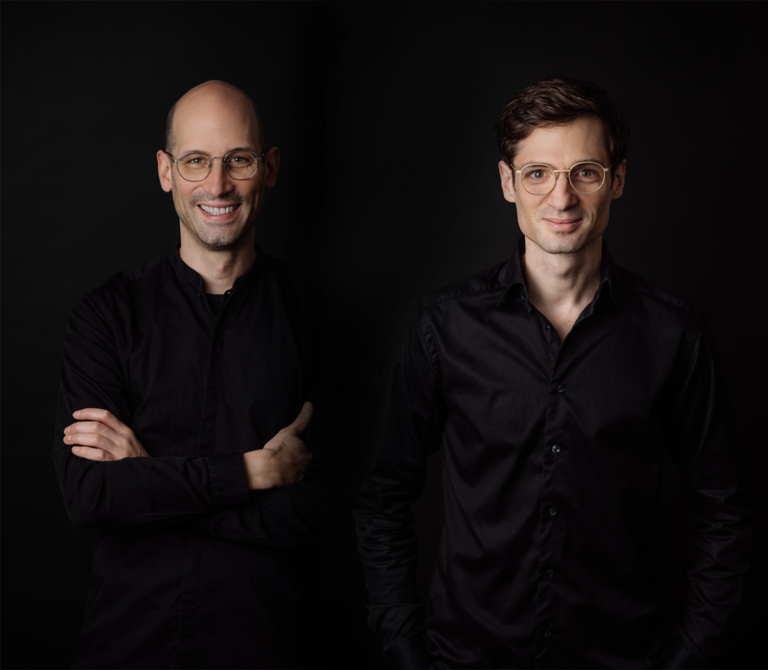

Black is a spin-out from the University of Aachen co-founded by brothers Daniel and Sebastian Schall (respectively the CEO and CFO).

The funding, a Series A, is important not just for its size but also because of the intention behind it.

Porsche Ventures and Project A Ventures are co-leads, with participation from Scania Growth, Capnamic, Tech Vision Fonds, and NRW.BANK.

Flow is a spinout of VTT, a Finland state-backed research organization that’s a bit like a national lab.

You can’t just magically squeeze extra performance out of CPUs across architectures and code bases.

But Flow has been working on something that has been theoretically possible — it’s just that no one has been able to pull it off.

What Flow claims to have done is remove this limitation, turning the CPU from a one-lane street into a multi-lane highway.

The chef still only has two hands, but now the chef can work ten times as fast.

ISAs are a technical spec at the foundation of every chip, describing how software controls the chip’s hardware.

In addition to building the chip, Rivos is working on self-contained data center hardware based on the Open Compute Project modular standard, which will effectively serve as plug-and-play chip housing.

Startups by the dozens, meanwhile, are angling for a slice of a custom data center chip market that could reach $10 billion this year and double by 2025.

Habana Labs, the Intel-owned AI chip company, laid off an estimated 10% of its workforce last year.

Kumar wouldn’t talk about customers, and Rivos’ chip isn’t anticipated to reach mass production until sometime next year.

Meta, hell-bent on catching up to rivals in the generative AI space, is spending billions on its own AI efforts.

But an even larger chunk is being spent developing hardware, specifically chips to run and train Meta’s AI models.

Meta unveiled the newest fruit of its chip dev efforts today, conspicuously a day after Intel announced its latest AI accelerator hardware.

Google this week made its fifth-generation custom chip for training AI models, TPU v5p, generally available to Google Cloud customers, and revealed its first dedicated chip for running models, Axion.

Amazon has several custom AI chip families under its belt.

This grant, pegged for the company’s U.S. subsidiary, TSMC Arizona, is the latest step by the U.S. to strengthen its domestic supply of semiconductors as it seeks to reshore manufacturing of chips amid escalating geopolitical tensions between the U.S. and China.

The Act is primarily aimed at attracting manufacturing stateside, and also prohibits recipients of the funding from increasing their semiconductor manufacturing footprint in China.

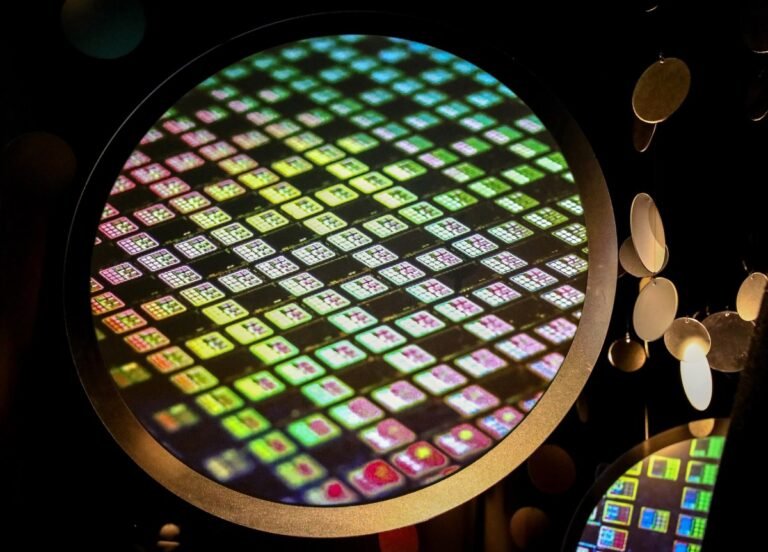

With the new investment, Taiwan-based TSMC, which is the world’s largest producer of semiconductors, is broadening its plans for its fabrication plants in Arizona.

Intel could receive approximately $20 billion in grants and loans from the CHIPS and Science Act for its semiconductor manufacturing.

Meanwhile, Samsung, which announced a $17 billion additional investment in Taylor, Texas, is expected to receive more than $6 billion in grants for its chip facility in Texas.

SiMa.ai, named after Seema, the Hindi word for “boundary,” strives to leverage this shift by offering its edge AI SoC to organizations across industrial manufacturing, retail, aerospace, defense, agriculture and healthcare sectors.

As the demand for GenAI is growing, SiMa.ai is set to introduce its second-generation ML SoC in the first quarter of 2025 with an emphasis on providing its customers with multimodal GenAI capability.

The new SoC will be an “evolutionary change” over its predecessor with “a few architectural tunings” over the existing ML chipset, Rangasayee said.

It would work as a single-edge platform for all AI across computer vision, transformers and multimodal GenAI, the startup said.

The second-generation chipset will be based on TSMC’s 6nm process technology and include Synopsys EV74 embedded vision processors for pre- and post-processing in computer vision applications.

Nvidia might be clouding the funding climate for AI chip startups, but Hailo is still fightingHello, and welcome back to Equity, a podcast about the business of startups, where we unpack the numbers and nuance behind the headlines.

This is our Wednesday show, when we take a moment to dig into a raft of startup and venture capital news.

No big tech here!

Keep in mind that Y Combinator’s demo day kicks off today, so we’re going to be snowed-under in startup news the rest of the week.

Consider today’s show the calm before the storm.

The funding climate for AI chip startups, once as sunny as a mid-July day, is beginning to cloud over as Nvidia asserts its dominance.

AI chip company Mythic ran out of cash in 2022 and was nearly forced to halt operations, while Graphcore, a once-well-capitalized rival, now faces mounting losses.

But one startup appears to have found success in the ultra-competitive — and increasingly crowded — AI chip space.

“I co-founded Hailo with the mission to make high-performance AI available at scale outside the realm of data centers,” Danon told TechCrunch.

“In recent years, we’ve seen a surge in demand for edge AI applications in most industries ranging from airport security to food packaging,” he said.

The CHIPS Act can be seen as a direct result of a number of pressing geopolitical issues.

The above, coupled with long-standing efforts to revitalize U.S. industry, spurred on economic efforts to reshore manufacturing.

While the CHIPS Act was still winding its way through Capitol Hill, Intel announced plans to open a $10 billion manufacturing facility just outside of Columbus, Ohio.

It says it expects those efforts will create 20,000 construction and 10,000 manufacturing jobs — music to the ears of an administration keenly focused on monthly jobs reports.

Notably, Intel recently pushed back the manufacturing start date of its New Albany, Ohio, plant two years to 2027, citing changes to the business environment.