Apple announced a ton of new AI features under the new Apple Intelligence moniker.

While the features are free to use, only a limited number of devices will get access to them.

These devices include on iPhone 15 Pro along with iPad and Mac with M1 or newer chips.

So older iPhones or iPhone 15 users won’t be able to use these abilities.

The new Apple Intellgience features include revamped Siri, writing features across the system, image generation capabilities, and genAI-powered emoji.

ISAs are a technical spec at the foundation of every chip, describing how software controls the chip’s hardware.

In addition to building the chip, Rivos is working on self-contained data center hardware based on the Open Compute Project modular standard, which will effectively serve as plug-and-play chip housing.

Startups by the dozens, meanwhile, are angling for a slice of a custom data center chip market that could reach $10 billion this year and double by 2025.

Habana Labs, the Intel-owned AI chip company, laid off an estimated 10% of its workforce last year.

Kumar wouldn’t talk about customers, and Rivos’ chip isn’t anticipated to reach mass production until sometime next year.

Google Cloud on Tuesday joined AWS and Azure in announcing its first custom-built Arm processor, dubbed Axion.

Based on Arm’s Neoverse 2 designs, Google says its Axion instances offer 30% better performance than other Arm-based instances from competitors like AWS and Microsoft and up to 50% better performance and 60% better energy efficiency than comparable X86-based instances.

To be fair, though, Microsoft only announced its Cobalt Arm chips late last year, too, and those chips aren’t yet available to customers, either.

In a press briefing ahead of Tuesday’s announcement, Google stressed that since Axion is built on an open foundation, Google Cloud customers will be able to bring their existing Arm workloads to Google Cloud without any modifications.

“Through this collaboration, we’re accessing a broad ecosystem of cloud customers who have already deployed ARM-based workloads across hundreds of ISVs and open-source projects.”More later this year.

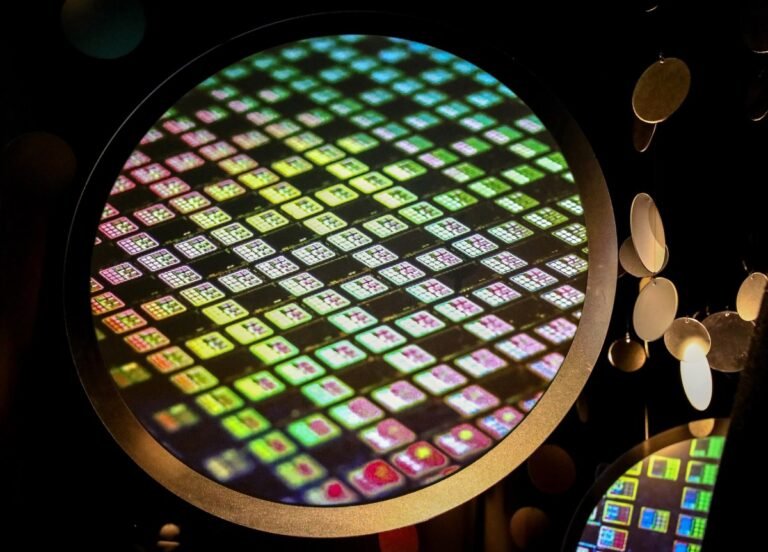

The United States Department of Commerce Monday proposed investing as much as $6.6 billion to fund a third Taiwan Semiconductor Manufacturing Company Limited (TSMC) fab in Arizona.

The move represents a broader push to bring more manufacturing to the U.S., but unspoken in the fanfare around today’s announcement is the potential escalation of tensions with China.

TSMC Arizona — the subsidiary behind the proposed construction — has stated that it will build the facility before the end of the decade.

The United States and allies would be at a massive disadvantage should China seize control of Taiwan and its manufacturing capabilities.

For all the money the United States government continues to invest, Intel is simply playing catch-up to TSMC’s multiyear technological head start.

This grant, pegged for the company’s U.S. subsidiary, TSMC Arizona, is the latest step by the U.S. to strengthen its domestic supply of semiconductors as it seeks to reshore manufacturing of chips amid escalating geopolitical tensions between the U.S. and China.

The Act is primarily aimed at attracting manufacturing stateside, and also prohibits recipients of the funding from increasing their semiconductor manufacturing footprint in China.

With the new investment, Taiwan-based TSMC, which is the world’s largest producer of semiconductors, is broadening its plans for its fabrication plants in Arizona.

Intel could receive approximately $20 billion in grants and loans from the CHIPS and Science Act for its semiconductor manufacturing.

Meanwhile, Samsung, which announced a $17 billion additional investment in Taylor, Texas, is expected to receive more than $6 billion in grants for its chip facility in Texas.

The funding climate for AI chip startups, once as sunny as a mid-July day, is beginning to cloud over as Nvidia asserts its dominance.

AI chip company Mythic ran out of cash in 2022 and was nearly forced to halt operations, while Graphcore, a once-well-capitalized rival, now faces mounting losses.

But one startup appears to have found success in the ultra-competitive — and increasingly crowded — AI chip space.

“I co-founded Hailo with the mission to make high-performance AI available at scale outside the realm of data centers,” Danon told TechCrunch.

“In recent years, we’ve seen a surge in demand for edge AI applications in most industries ranging from airport security to food packaging,” he said.

The CHIPS Act can be seen as a direct result of a number of pressing geopolitical issues.

The above, coupled with long-standing efforts to revitalize U.S. industry, spurred on economic efforts to reshore manufacturing.

While the CHIPS Act was still winding its way through Capitol Hill, Intel announced plans to open a $10 billion manufacturing facility just outside of Columbus, Ohio.

It says it expects those efforts will create 20,000 construction and 10,000 manufacturing jobs — music to the ears of an administration keenly focused on monthly jobs reports.

Notably, Intel recently pushed back the manufacturing start date of its New Albany, Ohio, plant two years to 2027, citing changes to the business environment.

Nvidia chips give graphics-hungry gamers the tools they need to play games in higher resolution, with higher quality and higher frame rates.

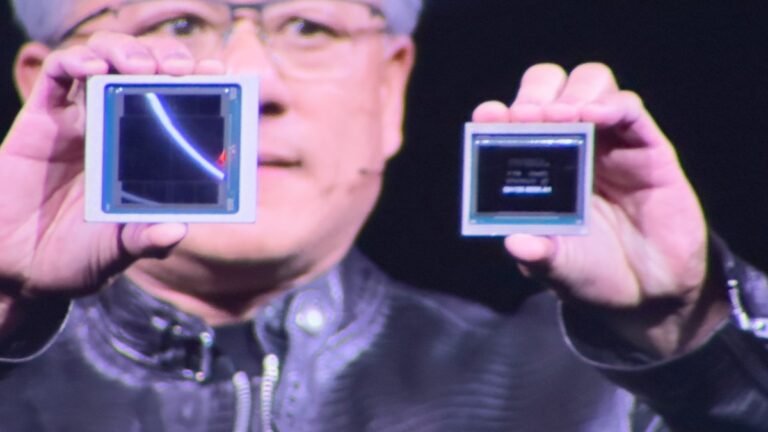

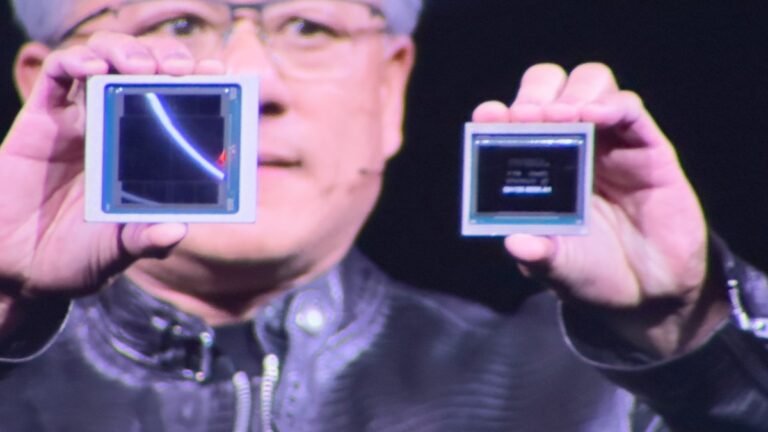

Anyone who came to the keynote expecting him to pull a Tim Cook, with a slick, audience-focused keynote, was bound to be disappointed.

The company also introduced Nvidia NIM, a software platform aimed at simplifying the deployment of AI models.

“Anything you can digitize: So long as there is some structure where we can apply some patterns, means we can learn the patterns,” Huang said.

And here we are, in the generative AI revolution.”Catch up on Nvidia’s GTC 2024:Update: This post was updated to include new information and a video of the keynote.

Nvidia chips give graphics-hungry gamers the tools they needed to play games in higher resolution, with higher quality and higher frame rates.

Anyone who had come to the keynote expecting him to pull a Tim Cook, with a slick, audience-focused keynote, was bound to be disappointed.

The company also introduced Nvidia NIM, a software platform aimed at simplifying the deployment of AI models.

NIM leverages Nvidia’s hardware as a foundation and aims to accelerate companies’ AI initiatives by providing an ecosystem of AI-ready containers.

“Anything you can digitize: So long as there is some structure where we can apply some patterns, means we can learn the patterns,” Huang said.

The UK has exited the European Union, but semiconductor development is emerging as one of the areas where it hopes to partner for better economies of scale — and much-needed funding.

The UK itself said it would put up a more modest £35 million ($44 million) in funding for UK efforts over the next few years as part of that.

The Chips Joint Undertaking, for example, has an overall budget of about €11 billion from both public and private contributions.

In December 2023, Pragmatic Semiconductor, another Cambridge-based chip company, raised $231 million at a $500 million valuation.

“We are very happy to welcome the UK to the Chips Joint Undertaking as a participating state,” said Jari Kinaret, Chips JU Executive Director, in a statement.