You could open up the TikTok app and snap a picture of it to find similar items available for purchase on TikTok Shop.

The ability to use image search for shopping is something that Google has offered for years with Google Lens, its visual search tool.

TikTok recently revealed that TikTok Shop now has more than 15 million sellers worldwide, including over 500,000 in the U.S.

It spent more than $400 million on platform safety and created a team of more than 7,500 people to help keep TikTok Shop safe.

TikTok has been betting big on e-commerce, as it sees TikTok Shop as its next big potential revenue source.

It’s been described as “the largest merger in African e-commerce” by both companies.

When the planned merger was first announced, the B2B e-commerce players were active in eight countries.

These recent moves suggest the new entity will likely serve fewer than the 450,000 retailers quoted during the merger announcement.

As the merger nears completion, the CEOs from both companies will continue as full-time executives but function in different roles.

“Regarding our merger with MaxAB, it is important to state that this is progressing as expected and in accordance with the initial terms.

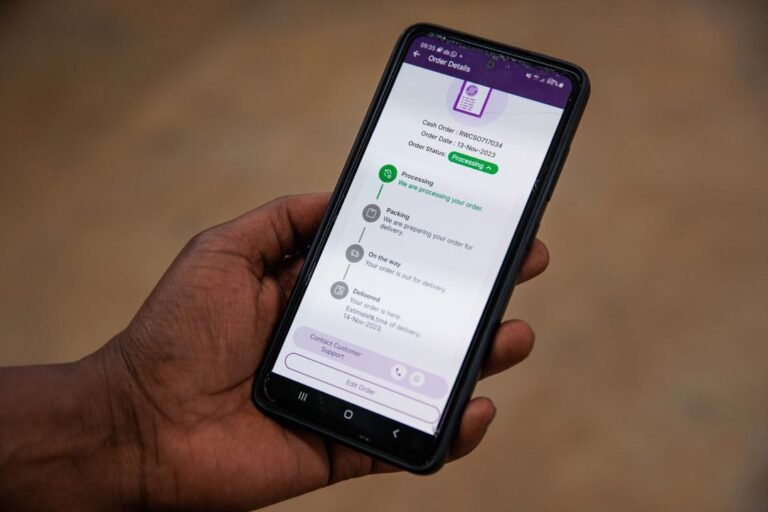

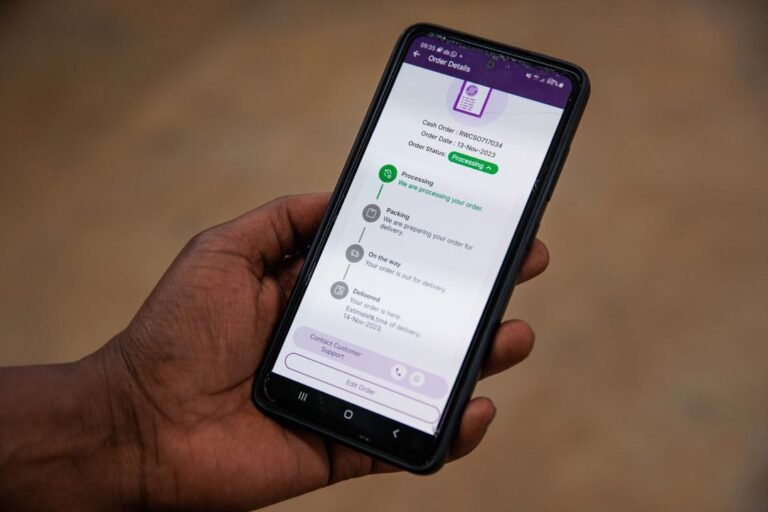

Kenyan B2B e-commerce company MarketForce is winding down its B2B e-commerce business that served informal merchants (mom-and-pop stores) after a turbulent two-year period that saw it scale down operations severely.

The shutdown of the B2B e-commerce arm dubbed RejaReja comes months after MarketForce withdrew the service from all its markets, including Nigeria and Kenya, save for Uganda.

At its peak, it employed more than 800 people and served 270,000 informal merchants.

MarketForce had raised $42.5 million, including $40 million debt-equity in a Series A round in 2022 at over $100 million valuation, to fuel the business.

Several B2B e-commerce companies in Africa have also scaled back operations as the funding crunch persists.

It’s easy to assume the e-commerce ship has sailed when you consider we have giant platforms like Shopify, Woocommerce, and Wix dominating the sector.

E-commerce platform, ikas, has raised $20 million in a Series A funding round as it seeks to expand its operations into new markets in Europe.

The company currently operates in Turkey and Germany, and says its platform simplifies store management for companies that want to have a digital presence.

Also investing in ikas is Re-Pie Asset Management, which has grocery delivery startup Getir in its portfolio as well.

The round saw participation from ikas’ existing investor Revo Capital, best known as the first institutional investor in Getir, Param, Midas and Roamless.

Amazon has quietly introduced a “special store” called Bazaar in India, featuring affordable and trendy fashion and lifestyle products, as it ramps up efforts against Walmart-owned Flipkart and Reliance’s Ajio, which have made deeper inroads in the Indian fast-fashion market.

“India e-commerce category mix is changing; Mobiles and Consumer electronics share is declining.

Fashion has seen the strongest growth since FY19, and now holds the highest category share,” Bernstein analysts wrote in a note last month.

India is a key overseas market for Amazon, which has invested more than $11 billion in the country to date.

The fast-fashion e-commerce market has gained significant traction in India in recent years, with local startups drawing inspiration from global pioneers like Zara, H&M, and Uniqlo.

TikTok ban could harm Amazon sellers looking for alternatives The ban could prematurely end TikTok's e-commerce dream and hit sellers seeking new channelsIn March, the U.S. House of Representatives overwhelmingly passed a bill that could force ByteDance to divest TikTok or face a ban in U.S. app stores.

Research from Jungle Scout, an Amazon data intelligence provider, provides some idea of TikTok’s e-commerce impact, however.

It found that 20% of Amazon sellers, brands, and businesses have plans to expand to TikTok Shop this year.

TikTok isn’t the only platform on the list for merchants looking for more channels beyond Amazon to expand their customer bases.

But if TikTok Shop’s strategy is mainly focused on bringing offline businesses online for the first time, that could be a very big move.

VNV Global attributes its fair value estimate to a valuation model based on trading multiples of public peers rather than historical funding rounds.

Funding and interest in B2B startups took off in the last decade and saw a bump in the wake of COVID-19.

African startups, including B2B e-commerce platforms like Wasoko, have followed the same playbook as their counterparts further afield: layoffs; cost cuts; and closures are not uncommon.

In the lead-up to its merger with MaxAB, Wasoko shuttered hubs in Senegal and Ivory Coast and laid off staff in Kenya.

It operates a food and grocery B2B e-commerce platform in Egypt and Morocco, expanding to the latter following its acquisition of YC-backed WaystoCap in 2021.

Uzum, an e-commerce startup offering online shopping, fintech and food deliveries to millions of customers in Uzbekistan, has raised $114 million in funding, becoming the country’s first unicorn with a valuation of $1.16 billion.

Fintech startups dominated the market with a 30% share, followed by e-commerce startups at 27%, according to estimates (PDF) by the Asian Development Bank.

“We want to expand the products, enhance the infrastructure of our e-commerce, and fund our fintech,” Djumaev said.

By the end of this year, Uzum plans to combine all its businesses into two super apps: one for its consumer-focused offerings, and another for its business-focused products.

However, he doesn’t see any competition in Uzbekistan, as Uzum has the advantage of enjoying different margins across products, and can make higher margins by combining its e-commerce and fintech services.

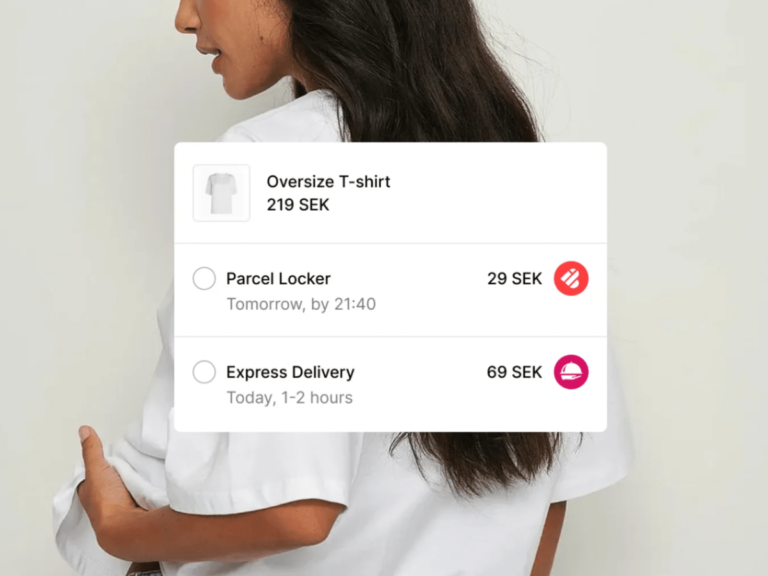

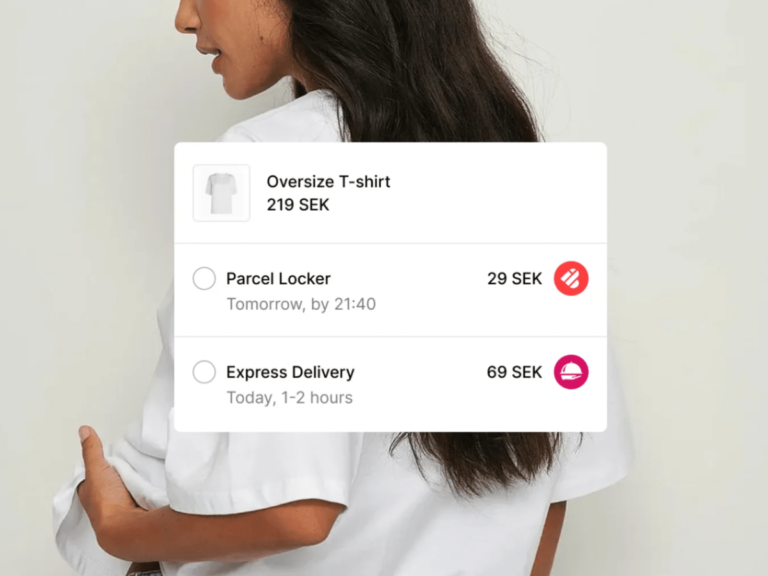

Among the many stress points in e-commerce machine, delivery has long been seen as one of the more painful ones.

“Delivery is the biggest unsolved puzzle is delivery part,” Piotr Zaleski, Ingrid’s co-founder and CEO said in an interview.

And in case you are at all curious: Ingrid the business was not named to ensure coverage in TechCrunch by me, Ingrid.

Ingrid has identified a very obvious problem that most certainly can use fixing, but it also faces a few challenges.

“The only way is to build a hell of a platform that retailers want to use to take a volume position,” Zaleski said.

Save for fintech and cleantech, B2B e-commerce and retail was the leading destination for venture capital dollars over the last five years.

Most B2B e-commerce startups have struggled to keep subsidizing their products and expanding operations, leading to retreats, closures, downsizing and mergers.

Building a B2B e-commerce business in tech winterB2B e-commerce platforms provide convenience to FMCG manufacturers like Unilever and P&G for distributing their products to the last mile.

As a result, many B2B e-commerce startups have opted for asset-heavy models to reach their customer base.

The Lagos-based B2B e-commerce startup is currently in the middle of securing a new round of equity and debt to propel its expansion.