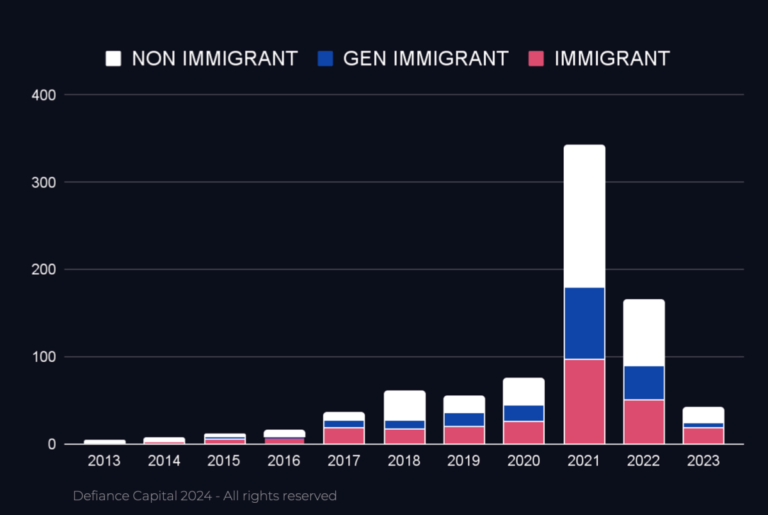

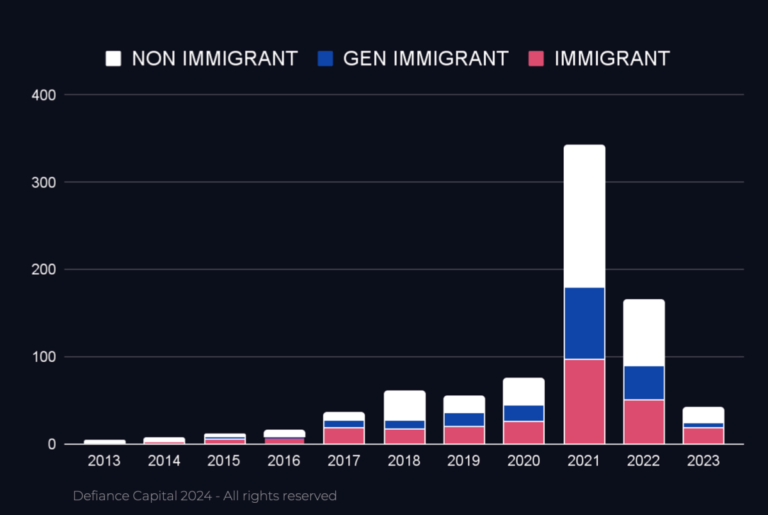

The study (“Unicorn Founder DNA Report) by Defiance Capital of 845 unicorns and 2,018 unicorn founders set out to look at the “DNA” of unicorn founders, concentrating on the US and UK (no EU/European) from 2013 to 2023, to define the common traits of these kinds of founders.

During the last decade, all top Seed funds were generalist funds, and the market for Seed funds is highly fragmented.

Only 34% of unicorn founders had worked at an elite employer prior to founding a unicorn, suggesting a McKinsey or similar background is not a prerequisite to success.

Dorffer, who intends now to produce a podcast with many of the unicorn founders surveyed, said: “The stories that are coming out show crazy determination.

As a female founder, you have to work twice as hard and take twice as many meetings to raise the money.

With the second fund, Ada says it will invest between £250,000 and £1.5 million in pre-seed and seed stage startups, with a “significant amount” allocated for follow-ons.

So far, 12 investments have been made from the second fund.

Ada claims 30% of the investments from Fund I and Fund II were sourced this way.

Warner retorted: “There are 350+ fantastic female VC partners in Europe.

: “I think every leader of every VC fund needs to do whatever we can to attract the best talent in the industry.

The Artemis Fund, which invests in underrepresented founders, closed on its second fund with $36 million in capital commitments.

“We really wanted to make sure that our LPs aligned with our long-term goal of backing diverse founders,” Murakhovskaya told TechCrunch.

VC investment itself continues to be fairly stagnant in these areas, according to my colleague Dominic-Madori Davis, who crunched the numbers on venture capital funding to these demographics earlier this month.

Female founders and co-founders secured more capital overall in 2023 than they did in 2020, according to new Pitchbook research.

For Fund II, Artemis intends to continue leading and co-leading investments and will target around 20 new companies.

Female-founded companies in the U.S. raised $44.4 billion out of the $170.59 billion in venture capital allocated last year.

Such teams raised 26.1% of all venture capital allocated this year, a sizable jump from the 18.2% they picked up last year.

This follows the pattern that women founders still fare better with a male co-founder in the mix.

Kyle Stanford, lead VC analyst at PitchBook, told TechCrunch+ that it’s difficult to pinpoint a single reason why funding to women founders has dipped a bit, but he added that the decline in deal counts for women founders follows the trends of the broader market.

“That is not meant to make activity in female-founded companies look better, but the context of market difficulties is important.”Overall, less than 25% of all deals went to female-founded companies in 2023.

“The Marvels” is set to release November 10th and sees three badass female superheroes fighting crime. Captain Marvel, Ms. Marvel and Captain Rambeau are back in this film and lead…