Climate-tech VC Satgana has reached a final close of its first fund, which targets to back up to 30 early-stage startups in Africa and Europe.

“I ran it for like five years, and about six years ago I started to really have the awakening to the extent of climate change.

“We are entering the continent to pursue green growth objectives; so deploying renewable energy, low carbon buildings, mobility solutions and so on.

Satgana is among the new funds that are dedicated to the African climate tech sector.

These funds include Africa People + Planet Fund by Novastar Ventures, Equator’s fund and the Catalyst Fund.

Borderless Capital, an investment firm that specializes in web3, announced Tuesday that it is acquiring CTF Capital, a quantitative trading and asset management firm headquartered in Miami, with technology and operation teams in Latin America.

With this acquisition, Borderless Capital will add AI-infused quant trading expertise to its own business.

After combining with CTF Capital, Borderless will have over $500 million in assets under management (AUM).

All the existing funds managed by CTF Capital will be merged into Borderless’s Multi-Strategy Fund V LP., launched last year with $100 million under management today.

“Borderless already has significant exposure through several portfolio companies from this geography [Latin America].

Sameer Brij Verma, a high-profile investor at the Indian venture firm Nexus, will be leaving the fund later this year, he confirmed to TechCrunch.

Verma plans to launch his own venture firm, with the inaugural fund expected to have a corpus of at least $150 million, a source familiar with the matter said.

The timing of his departure is also peculiar as Nexus raised a $700 million fund, its largest, just last year.

Verma has been working with his portfolio startups to hand over board seats to other partners at Nexus for several months, the source said, requesting anonymity.

Verma plans to launch his own fund by the end of the year where he plans to adopt a strategy that sets him apart from other investment firms in India.

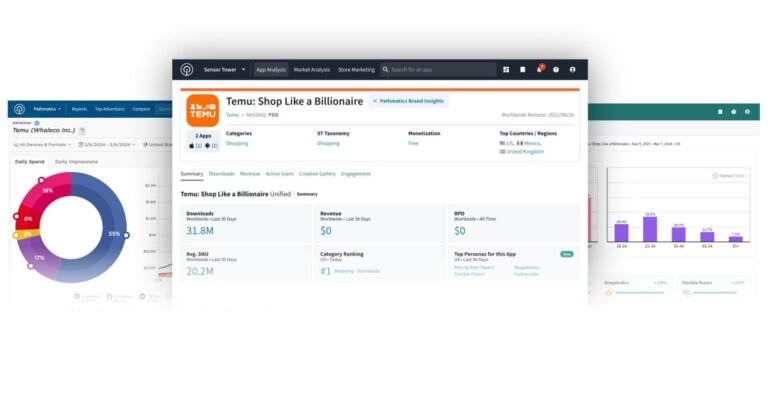

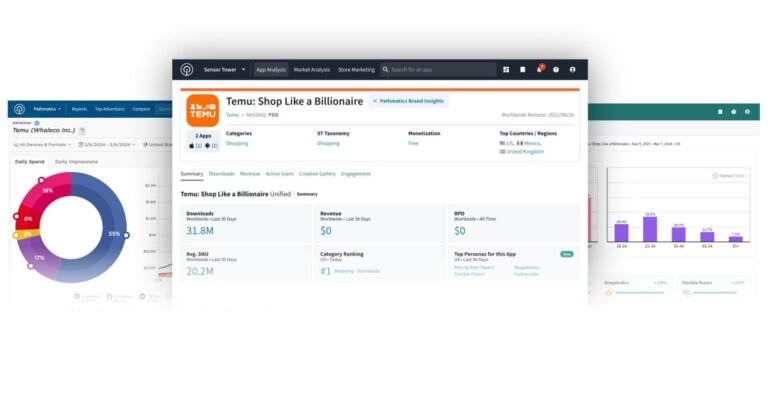

Sensor Tower, a leading app analytics firm, is acquiring rival Data.ai in a move that consolidates the mobile intelligence industry, creating a powerhouse that could dominate the sector and provide aggressively competitive insights into the app economy.

Sensor Tower didn’t disclose the financial terms of the deal but said Bain Capital and Riverwood Capital are providing credit-based financing.

Data.ai had secured over three times the amount of funding compared to Sensor Tower, according to Crunchbase.

Data.ai had raised over $157 million over various rounds, whereas Sensor Tower had raised just $46 million.

Sensor Tower issued an apology in 2020 and said the company had taken the route it did to stay competitive.

Arjun Sethi speaks with the confidence of someone who knows more than other people, or else who knows that sounding highly confident can shape perception.

Namely, if Termina is so good, why are Sethi and Tribe giving other investment firms a way to better compete?

Relatedly, why should other investors trust Termina, which ingests its customers’ data to improve over time?

This may prove doubly true given Termina’s ties to Tribe Capital.

Among these is Alex Chee, who cofounded MessageMe with Sethi, joined him at Social Capital, and subsequently co-founded both Tribe and Termina with him.

The third-party application provider license will enable Paytm to offer payments through the UPI network even as Paytm’s parent firm One97 Communications’ banking unit — Payment Payments Bank — is scheduled to cease operations on Friday.

The Reserve Bank of India ordered Paytm in late January to cease operations at Paytm Payments Bank, an affiliate of the financial services firm that processed majority of its transactions.

The move created shockwaves through the industry, and also meant that Paytm needed to secure the third-party application provider license to continue many of the Paytm app’s operations.

Axis, HDFC, State Bank of India and Yes Bank will serve as payment system provider to the Paytm app, NPCI said Thursday.

The RBI had advised NPCI to swiftly issue the third-party application provider license, or TPAP, to Paytm to help mitigate disruptions for its customers.

Peak XV, the venture firm formerly known as India and Southeast Asia arm of Sequoia, didn’t disclose the size of the new fund.

The new fund, called Peak XV Anchor Fund, will be funded by an internal balance sheet, the source said, requesting anonymity as the matter is private.

The fund will enable Peak XV to “create a global network for learning and collaboration,” the venture firm said, according to the LP source.

The fund will enable Peak XV Partners to have broader skin in the game with its own fund and also explore investment in newer areas, the source said.

With Peak XV Anchor Fund, the venture firm plans to partner with other “managers across regions, strategies and sectors.”Peak XV didn’t immediately respond to a request for comment.

The SEC voted on Wednesday to require public companies to report a portion of their greenhouse gas emissions and their exposure to risks from climate change.

While the new rules do not apply to privately held companies like startups, they do create opportunities for those focused on the carbon tracking, accounting, and management space.

Some, like Amazon, Vanguard, Ralph Lauren, and Chevron, supported Scope 3 disclosures; already, many public and private companies voluntarily track those emissions.

In recent years, a number of startups have turned to AI to automate and improve Scope 3 estimates.

In adopting the new rules, the SEC is playing catch-up with other large economies, including China and the EU, which both have greenhouse gas reporting requirements.

In 2021, the company says it used 214 million or so pounds of single-use plastic in its packaging.

Nonprofit ocean conservation firm Oceana, on the other hand, put that figure at approximately ~700 million pounds.

Take for example, its ongoing efforts to reduce package weights and replace plastics with paper products.

The first is a robot that is primarily deployed in recycling facilities to sort through different materials.

We’ve also received a pretty significant grant from the Michigan Department of Environment for further deployments of our technology.

In an unexpected move, Miles Grimshaw announced today that he is rejoining Thrive Capital after working as a general partner at Benchmark for the past three years.

Grimshaw first joined Thrive, a New York-based venture firm that Joshua Kushner founded, in 2013.

He is returning as a general partner.

When joining storied venture firm Benchmark in December of 2020, then-29-year-old Miles Grimshaw became its fifth general partner.

He had similarly joined a team of four other partners at Thrive back in 2013.