TechCrunch is on the hunt for 200 early-stage founders to feature in the Startup Battlefield 200 at TechCrunch Disrupt in San Francisco this October.

Back in 2022, the Startup Battlefield expanded to include a showcase of the top 200 companies from across the globe.

Apply NowShowcasing global foundersFrom the Startup Battlefield 200, we will select 20 companies for the Startup Battlefield competition.

The only way early-stage startups can exhibit on the show floor at Disrupt is through Startup Battlefield, and the only way to be a Startup Battlefield Finalist is to be selected for Startup Battlefield 200.

How to become a part of TechCrunch Startup Battlefield 200The process is simple.

Enter Underscore VC’s Lily Lyman, who is coming to TechCrunch Early Stage 2024 in Boston to discuss how founders can build investor relationships with the right venture capitalists.

She will discuss how to build venture relationships ahead of time, and how founders can — and should!

In today’s more stringent venture environment, founders can’t run a 2021-era playbook (unless they are building an AI foundational model company, I suppose).

So, bring your notebooks and questions to Lyman’s Early Stage session coming up next month.

She’ll be joined by a bevy of other startup folks who will be on hand to share their hard-earned wisdom.

The Harness offering also has two other components, serving as a marketplace for discovery of advisors and services and consumer financial insight tools.

In order to fill that need, Harness partnered with experienced tax advisors who in most cases already had a significant roster of clients.

So when those advisors partnered with Harness, many of those clients became clients of Harness as well.

Put simply, the new platform “powers the collaboration between tax advisors and their clients,” the company said.

About 75% of Harness’ clients come through advisors that join the platform.

New report confirms Europe’s tech investment doldrums, but there are signs of lifeEurope is suffering from a big hangover after the tech investment party of the 2020-2021 period.

That said, compared to pre-pandemic levels, VC investment in European startups is up, historically speaking, and reached $60 billion, according to a new report.

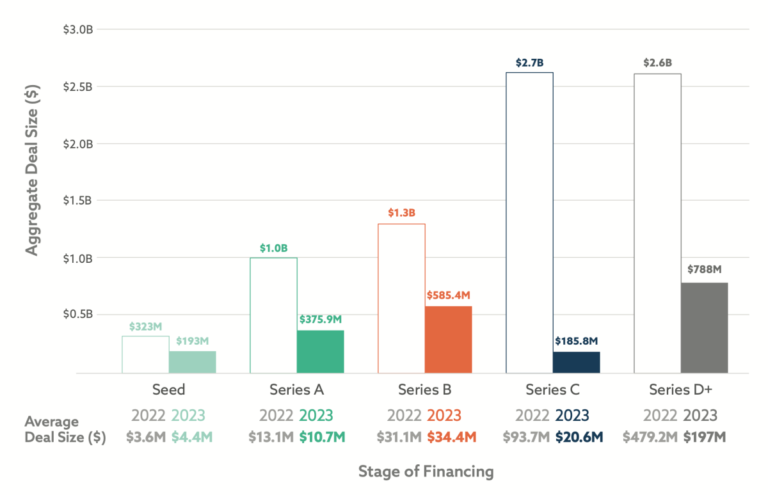

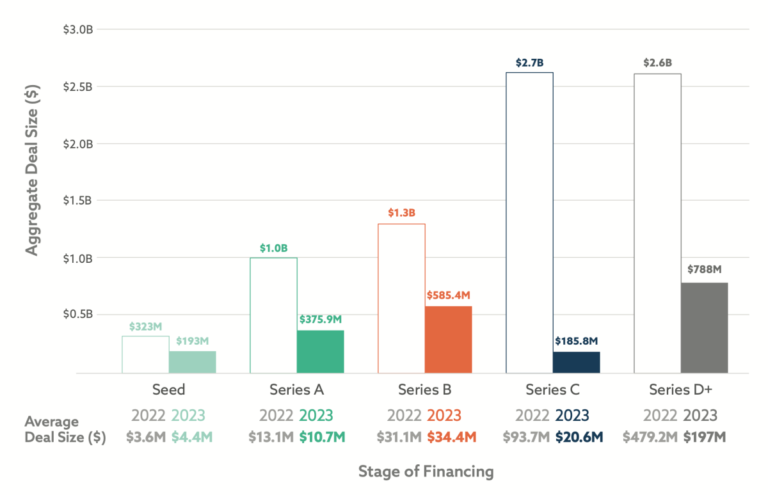

2023 marked a reset and major correction in investment levels globally.

According to the report, Europe is sitting on “record levels of dry powder” and “producing more new founders than the U.S.”, funding remains slow.

Climate Tech overtook FinTech as Europe’s most popular sectorAI’s share of total investment in Europe soared to a record high of 17%5.

Sam Blond is leaving Founders Fund, as well as the profession of venture capitalist, just 18 months after he joined the storied Silicon Valley firm.

For now just immense gratitude to FF and all the incredible people and… — Sam Blond (@samdblond) March 4, 2024Before joining the VC firm, Blond was best known as the former Chief Revenue Officer at Brex.

Brex is not a Founders Fund portfolio company, although Founders Fund is an investor in one of Brex’s biggest competitors: Ramp.

We hope to have the opportunity to work with him again,” Founders Fund spokesperson Erin Gleason tells TechCrunch.

But this is the second splashy departure of a Founders Fund partner over the past couple of months.

Derek Smith, the founder of Plug In South LA, grew up in southern Los Angeles and saw first-hand the frustration that stems from lack of economic development.

And it’s why Smith’s ultimate goal for Plug In South LA is to smooth the way for Black and brown entrepreneurs looking to build tech startups and need help and guidance.

“We really want to support those founders and entrepreneurs who can build businesses that can scale broadly,” Smith told TechCrunch.

Smith sees a bevy of underutilized talent in areas like South LA.

Vaughn Blake, a partner at Blue Bear Ventures, says he met Smith right after he launched Plug In South LA and was asked to participate on a panel during one of the early demo days.

Venture capital funding has never been robust for women or Black and brown founders.

Read about funding for Black foundersFunding to Black founders has been on a steady decline since 2021, implying that investors have either lost interest or focus on backing Black founders.

This is a big deal because after the murder of George Floyd, the venture and startup ecosystem made promises to better support Black founders.

Since 2022, TechCrunch has been speaking with experts to find out what is needed to help boost funding to Black founders.

To help gather data, last year, Crunchbase announced it would officially start tracking the amount of venture capital dollars allocated to LGBTQ+ founders.

Black Tech Nation Ventures launched in 2021 to address the funding gap for Black founders amid a wave of venture diversity initiatives after the murder of George Floyd in 2020.

Three years later, amongst growing backlash against DEI and diversity-focused investments, the firm’s mission may be more important now than when it started.

The firm found initial fundraising success in 2021, and held a first close on $25 million that year, he explained.

“We have seen funding to diverse founders and Black-led venture funds decline rapidly.

The firm will also collaborate with Black Tech Nation, the nonprofit that is run by BTNV general partner Kelauni Jasmyn that created a digital network of Black tech professionals, when it can.

Dubai-based early-stage venture capital firm COTU Ventures is announcing that it has raised $54 million for its inaugural fund to support startups in the Middle East from pre-seed to seed stages.

Founder and general partner Amir Farha revealed in an interview with TechCrunch that COTU Ventures is inclined slightly towards fintech and B2B software.

Noteworthy investments by COTU Ventures include Huspy, a UAE mortgage platform backed by Peak XV and Founders Fund, and Egyptian fintech startup MoneyHash.

While at Beco Capital, Farha and his partner returned the first fund following Uber’s acquisition of Careem.

By fostering such open dialogue, COTU Ventures aims to establish trust and strong connections with founders, enabling informed investment decisions.

As winter continues to grip much of the world, here’s some hot news to thaw the chill from every entrepreneur’s heart: TechCrunch Disrupt will be back in San Francisco from October 28–30.

Secure your 2-for-1 pass now and unlock savings of over $1,000 on select passes.

What awaits you at TechCrunch Disrupt?

TechCrunch Disrupt will continue our goal of covering the latest pioneering founders, CEOs, and venture capitalists who will share their invaluable perspectives and wisdom.

Is your company interested in sponsoring or exhibiting at TechCrunch Disrupt 2024?