The CFPB is permanently banning BloomTech from consumer lending activities and its CEO, Austen Allred, from student lending for a period of ten years.

Allred founded BloomTech, which rebranded from the Lambda School in 2022 after cutting half its staff, in 2017.

(According to the CFPB, BloomTech originated “at least” 11,000 such loans.)

BloomTech didn’t market the loans as such, saying that they didn’t create debt and were “risk free,” and advertised a 71%-86% job placement rate.

And, unbeknownst to many students, BloomTech was selling a portion of its loans to investors while depriving recipients of rights they should’ve had under a federal protection known as the Holder Rule.

The round values the company at €100 million ($107 million), post money.

But finmid believes it has the potential to lock in more business specifically in its home region.

Unlike a bank, Wolt has access to the restaurants’ sales history, and finmid helps it leverage that data to decide who will see a pre-approved financing offer.

The working capital doesn’t come from Wolt, but from finmid’s financing partners.

For a platform like Wolt, embedding finmid is a way to make life easier for restaurants while generating additional revenue without much additional effort.

How PayJoy built a $300M business by letting the underserved use their smartphones as collateral for loansLerato Motloung is a mother of two who works in a supermarket in Johannesburg, South Africa.

Then, in February 2024, she saw a sign about PayJoy, a startup that offers lending to the underserved in emerging markets.

Motloung is one of millions of customers that San Francisco–based PayJoy has helped since its 2015 inception.

And, unlike other startups offering loans to the underserved, it’s doing so in a way that’s not predatory, it says.

Last September, PayJoy announced that it had secured $150 million in Series C equity funding and $210 million in debt financing.

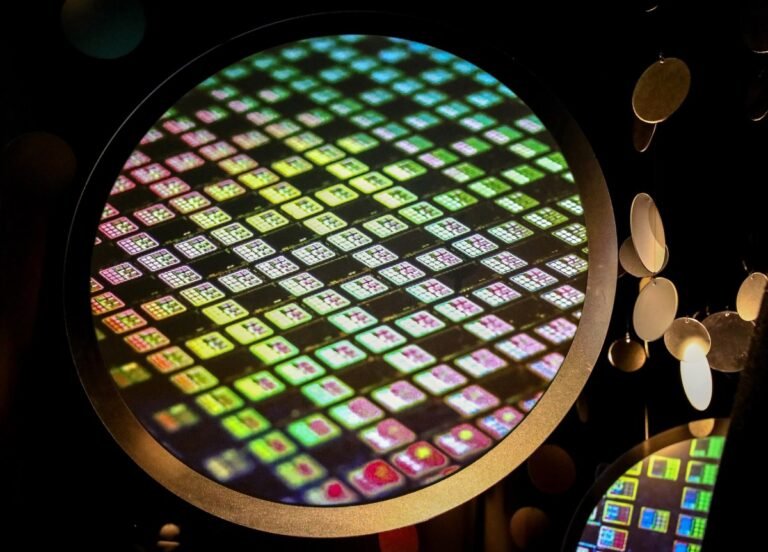

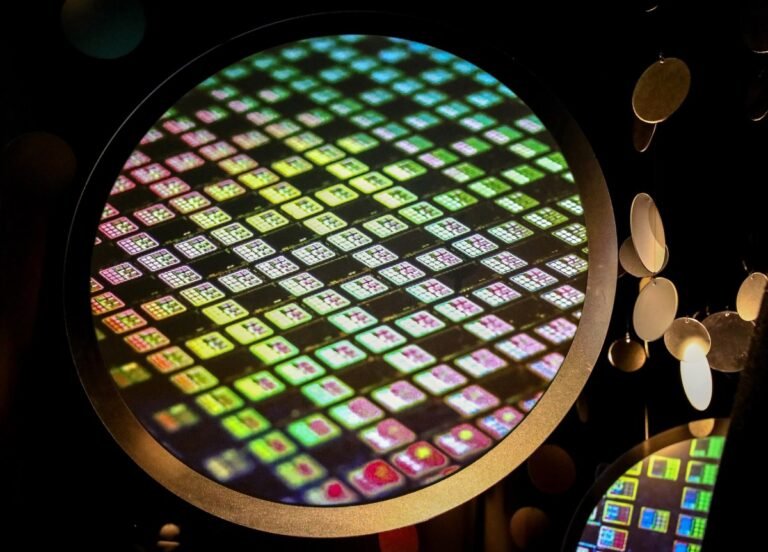

This grant, pegged for the company’s U.S. subsidiary, TSMC Arizona, is the latest step by the U.S. to strengthen its domestic supply of semiconductors as it seeks to reshore manufacturing of chips amid escalating geopolitical tensions between the U.S. and China.

The Act is primarily aimed at attracting manufacturing stateside, and also prohibits recipients of the funding from increasing their semiconductor manufacturing footprint in China.

With the new investment, Taiwan-based TSMC, which is the world’s largest producer of semiconductors, is broadening its plans for its fabrication plants in Arizona.

Intel could receive approximately $20 billion in grants and loans from the CHIPS and Science Act for its semiconductor manufacturing.

Meanwhile, Samsung, which announced a $17 billion additional investment in Taylor, Texas, is expected to receive more than $6 billion in grants for its chip facility in Texas.

New U.S. ‘green bank’ aims to steer over $160B in capital into climate techFor years, banks have been financing large renewable power projects, from utility-scale solar farms to horizon-spanning wind farms.

But the demand is there, which is why advocates have been clamoring for the federal government to support a so-called green bank, which will underwrite these sorts of projects.

That green bank is now a reality.

Green bank loans have a pretty good track record, too.

The Connecticut Green Bank, for example, has a delinquency rate that’s on par with other commercial lenders across both residential and commercial portfolios.

European insurtech company Getsafe has acquired deineStudienfinanzierung, an aptly named German digital platform for student loans that was showcased on the local version of “Shark Tank” in 2019.

“Student loans are the second most popular form of external student financing in Germany after [grants].

Unlike in the U.S., universities in Germany are largely tuition-free, which means that student loans are generally used to cover living expenses.

The financing volume has returned to previous levels since.”Just like Getsafe didn’t invent insurance, deineStudienfinanzierung didn’t invent student loans.

By the time customers apply for a student loan, the barriers to switch are quite high.

Dubugras is seeking to provide startup customers with emergency capital in order to help them make payroll next week, even as Silicon Valley Bank undergoes financial turmoil. Dubugras declined to…