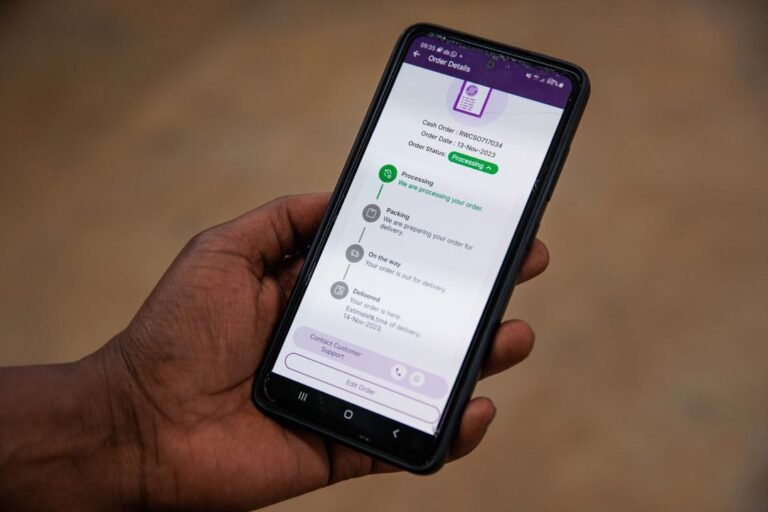

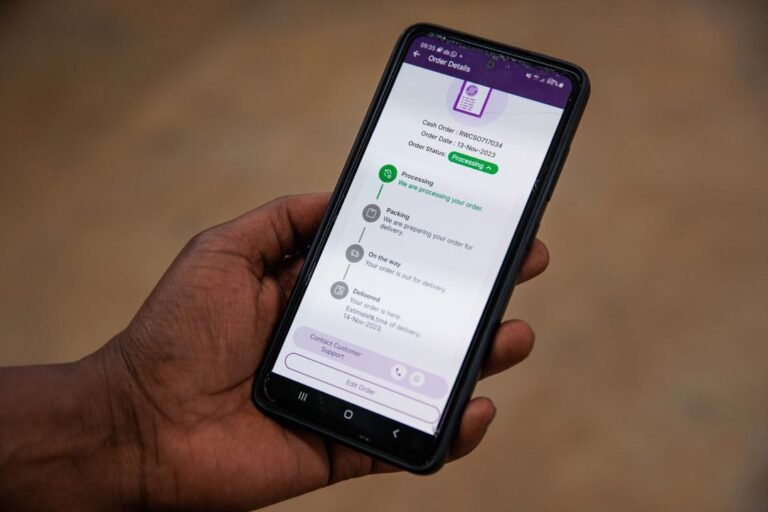

It’s been described as “the largest merger in African e-commerce” by both companies.

When the planned merger was first announced, the B2B e-commerce players were active in eight countries.

These recent moves suggest the new entity will likely serve fewer than the 450,000 retailers quoted during the merger announcement.

As the merger nears completion, the CEOs from both companies will continue as full-time executives but function in different roles.

“Regarding our merger with MaxAB, it is important to state that this is progressing as expected and in accordance with the initial terms.

The U.K.’s competition watchdog has sounded a warning over Big Tech’s entrenching grip on the advanced AI market, with CEO Sarah Cardell expressing “real concerns” over how the sector is developing.

She said it’s important that competition enforcers don’t repeat the same mistakes with this next generation of digital development.

But for now the CMA has not gone that far, despite clear and growing concerns about cozy GAMMA GenAI ties.

“It may be that some arrangements falling outside the merger rules are problematic, even if not ultimately remediable through merger control.

(The short version of what it wants to see is: accountablity; access; diversity; choice; flexibility; fair dealing; and transparency.)

VNV Global attributes its fair value estimate to a valuation model based on trading multiples of public peers rather than historical funding rounds.

Funding and interest in B2B startups took off in the last decade and saw a bump in the wake of COVID-19.

African startups, including B2B e-commerce platforms like Wasoko, have followed the same playbook as their counterparts further afield: layoffs; cost cuts; and closures are not uncommon.

In the lead-up to its merger with MaxAB, Wasoko shuttered hubs in Senegal and Ivory Coast and laid off staff in Kenya.

It operates a food and grocery B2B e-commerce platform in Egypt and Morocco, expanding to the latter following its acquisition of YC-backed WaystoCap in 2021.

The U.K.’s Competition and Markets Authority (CMA) has confirmed that it’s launching a formal “phase 2” investigation into the planned merger between Vodafone and Three UK.

The CMA says that the deal could lead to higher prices for consumers, while also impact future infrastructure investments.

However, the CMA has given both parties a token five working days to address its concerns with “meaningful solutions” before it formally progresses the investigation.

Such a scenario is precisely why the U.K. introduced the National Security and Investment Act back in 2022, with previous form in blocking deals between U.K. entities and Chinese companies.

“This case has more moving parts than the CMA’s other recent big decisions, and is arguably more important for the U.K. economy,” Smith said.

Paramount Global has reached a binding agreement to sell its stake in Reliance-controlled Indian media house Viacom18 to Reliance for $517 million, both companies said Wednesday.

The deal will increase Reliance’s stake in Viacom18, which operates dozens of TV channels as well as streaming service JioCinema, to 70.49%, Reliance said in its disclosure.

Law firm JSA Associates said late last month that it was advising the two firms for the deal.

The move follows Disney announcing plans to merge its India business with Viacom18 late last month.

Viacom18 also counts Bodhi Tree, an investment firm run by James Murdoch and Uday Shankar, among its backers.

Cricket match streaming has been the prime driver of new users for streaming platforms in India.

By securing numerous cricket rights, Disney and Reliance have left rival services with limited content options to attract fans.

“The 2023-27 IPL broadcasting now sit under the JV – Viacom 18 has digital streaming rights (won for US$2.9bn) while Star has TV broadcasting rights for US$2.8bn.

Combined with about 8% of the TV market that Viacom18 assumes in India, the merged operations — which will feature some 120 TV channels — will command about 49% of the broadcasting market.

In a statement Wednesday, Disney and Reliance said they will reach 750 million users in India with the merged entity.

Reliance, its portfolio Viacom18 and Disney are merging their media businesses in India, creating the largest media entity in the South Asian market.

Reliance will control and own 16.34% of the joint venture, which it has valued at $8.5 billion.

Reliance, which is India’s most valuable firm, said it sees an opportunity to expand and streamline its presence in the Indian fast-growing market by merging its media assets with Disney India.

Reliance, which owns more than 60% in Viacom18, plans to invest $1.4 billion into the joint venture for its growth strategy.

The “strategic” merger of Reliance and Disney India also unites two leading Indian streamers, JioCinema and Disney+Hotstar.

The U.K.’s Competition and Markets Authority (CMA) is launching a formal probe into the proposed merger between Vodafone and Three UK.

That is some 18 months form when they first revealed their plans back in June.

It’s not entirely clear how that might impact this latest merger attempt, but Smith reckons that deal is as good as dead, regardless of what any court might subsequently find.

“The previous Three/O2 merger is still technically going through the EU courts, but that deal is long since dead in reality,” Smith said.

“We strongly believe that the proposed merger of Vodafone and Three will significantly enhance competition by creating a combined business with more resources to invest in infrastructure to better compete with the two larger converged players,” Vodafone UK CEO Ahmed Essam said in a statement.

Sony called off the merger between its India unit and Zee Entertainment on Monday, ending a two-year acquisition deliberation that would have created a $10 billion media powerhouse in the South Asian market.

Sony said in a statement that it has sent a termination letter to Zee after the Indian firm failed to meet the conditions, despite a 30-day extension.

Sony also sought for Zee to improve its finances, something that has only grown worse in recent quarters.

The deal would have created a $10 billion media powerhouse in India, where billionaire Mukesh Ambani is increasingly flexing his wealth and reach.

Zee and Sony have been important fixtures in the Indian TV industry for the last 25 years.

Deal Dive: Tier and Dott’s merger is not a sign of what’s to come in M&A this year Consolidation can be complicatedEarlier this week, European micromobility companies Tier and Dott said they had agreed to merge.

The companies hope they can become profitable if they work together, my colleague Romain reported.

This seems like a solid outcome for the two startups, since they likely weren’t going to reach IPO scale on their own.

After all, if the companies weren’t going to survive as solo entities, it makes sense to at least try another direction.

Last year I came up with a hypothesis about M&A in 2024; I was inspired by Getir acquiring FreshDirect to fill a gap it needed to potentially reach profitability.