The big storyLast week, I wrote about two startups — Sunset and SimpleClosure — that help other startups shut down raising capital.

It was a deep dive into how and why this business has become one that is so sought after by investors.

I also covered Stripe’s tender offer that resulted in a 30% higher bump in valuation — to $65 billion — for the payments giant.

She emphasized, though, that the company had not made any cuts as a consequence of launching this AI assistant.

Embat, a Spanish fintech which does what they call “real-time treasury management,” closed a financing round of $16 million Series A led by Creandum.

The payment landscape in the Middle East and Africa (MEA) region is marked by significant fragmentation, with numerous payment providers and methods in each country, evolving regulations and diverse customer preferences.

This complexity is further compounded by challenges such as payment fraud, low checkout conversion rates, and high transaction failure rates.

Payment orchestration platforms streamline payment processes for merchants through unified payment APIs.

As merchants or companies launch their platforms, they often start by collaborating with one or two payment processing providers.

As their operations grow and expand into multiple regions, they onboard additional payment providers to meet their evolving needs.

Vijay Shekhar Sharma, founder and majority owner of Paytm Payments Bank, has stepped down from the board of the troubled unit days after the Indian regulator signalled continuity at the financial firm Paytm.

Paytm Payments Bank said Monday it was reconstituting the board of directors at the Paytm Payments Bank, an associate of Paytm, with the appointment of four executives — ex-Central Bank of India Chairman Srinivasan Sridhar, retired IAS officer Shri Debendranath Sarangi, former executive director of Bank of Baroda Shri Ashok Kumar Garg, and Retd.

The appointment follows the Indian central bank penalizing Paytm Payments Bank, in which Sharma owns a 51% stake, with severe business restrictions.

(Paytm owned a 49% stake in Paytm Payments Bank.)

TechCrunch reported early this month that the Indian central bank has weighed ordering a board shakeup at Paytm Payments Bank and removing some of the company officials, including Paytm founder Sharma.

Google said Thursday it plans to roll out the SoundPod, its portable speaker designed to instantly validate and announce successful payments, to small merchants across India over the coming months.

The Google Pay expansion in India, where the company is among the mobile payment market leaders, comes even as the firm winds down some of its payments apps in the U.S.

The sound-box was invented to serve small Indian merchants unable to afford regular point-of-sale devices but accepting of UPI payments.

The company said merchants who use SoundPod to process 400 payments in a month will get $1.5 in cashback.

Reliance, India’s largest firm by market cap, also began testing a similar device at its campus last year, TechCrunch earlier reported.

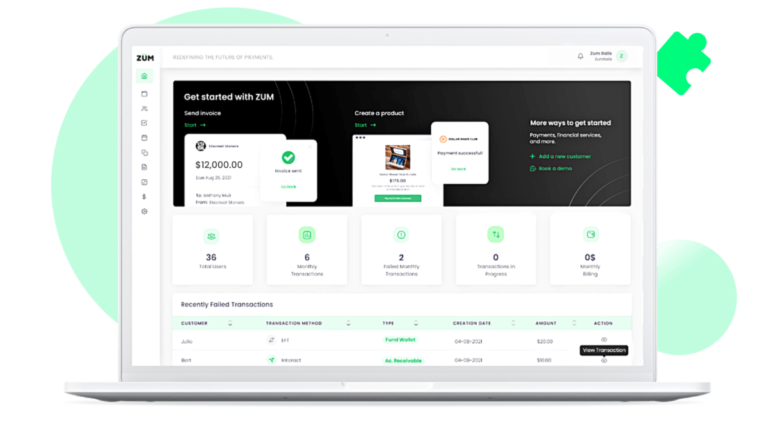

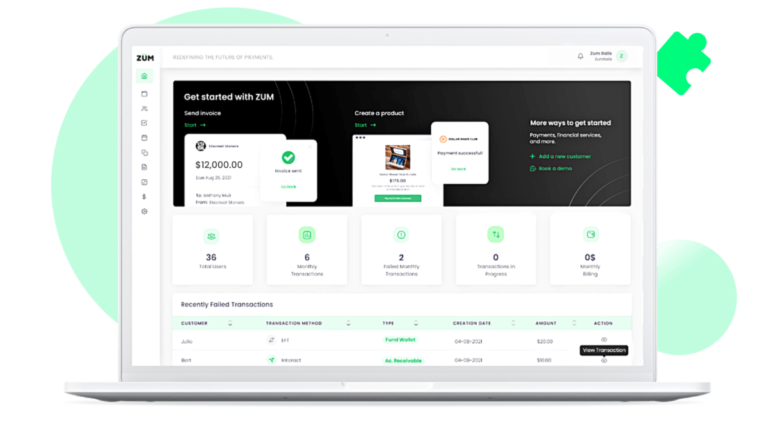

Milewski and Schwartz bootstrapped Zūm Rails, building it up to a team of 30 people.

“We reached the point where we realize that bootstrapping is no longer healthy for our business,” Schwartz told TechCrunch.

In addition, Zūm Rails is working on a FedNow offering in the U.S. that will enable businesses to send and receive FDIC-insured payments within seconds.

Zūm Rails’ performance to date “is really impressive,” Jake Olson, vice president at Arthur Ventures, told TechCrunch.

Any organization that views the streamline digital financial interaction coupled with the instant payments capability as a competitive advantage will be a great fit for Zūm Rails.”

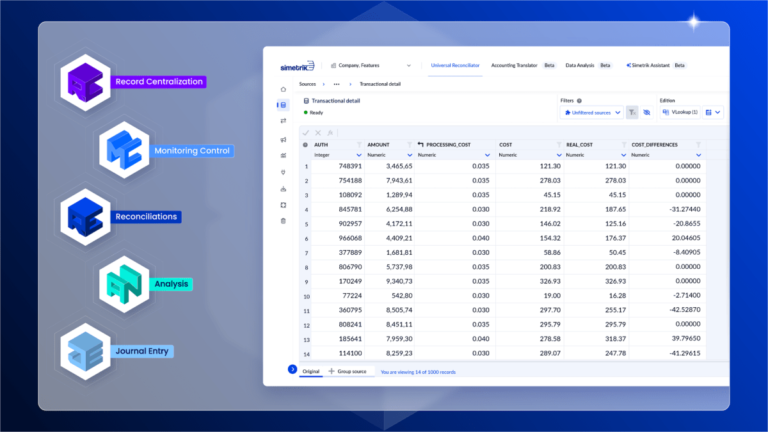

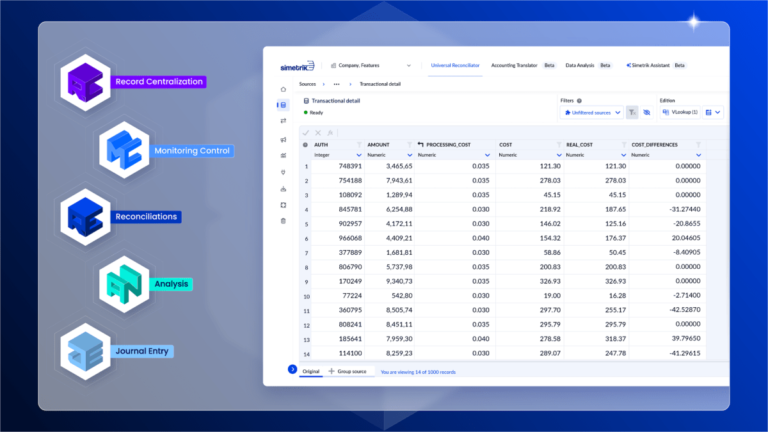

Where it is differentiating itself is through its Simetrik Building Blocks, or SBBs, which are scalable and adaptable concepts based on no-code development and generative AI technologies.

In the past two years, the company grew to have clients in more than 35 countries, up from 10, and is monitoring over 200 million records every day.

Previously that was 70 million records daily.

The use of the new funds will go into further developing the Simetrik Building Blocks, enhancing AI capabilities and continuing to expand Simetrik’s international reach.

They need a new approach, and that is where our building blocks have a strong product market piece.”

Why are ransomware gangs making so much money?

2023 was a lucrative year for ransomware gangs, fueled by an escalation in threats and tacticsFor many organizations and startups, 2023 was a rough year financially, with companies struggling to raise money and others making cuts to survive.

While 2023 was overall a bumper year for ransomware gangs, other hacker-watchers observed a drop in payments toward the end of the year.

Record-breaking ransomsWhile more ransomware victims are refusing to line the pockets of hackers, ransomware gangs are compensating for this drop in earnings by increasing the number of victims they target.

The company also predicts that a ransom payments ban would lead to the overnight creation of a large illegal market for facilitating ransomware payments.

LoanDepot customers say they have been unable to make mortgage payments or access their online accounts following a suspected ransomware attack on the company last week.

Users on social media and forums discussing the incident say they have struggled to access their account information or submit payments.

LoanDepot’s updating cyber incident page says several LoanDepot customer portals returned online as of Thursday, albeit with limited functionality.

When reached by email, LoanDepot spokesperson Jonathan Fine declined to comment, but did not dispute that the incident was linked to ransomware.

LoanDepot has not yet updated regulators on the company’s recovery since its initial disclosure to the SEC on January 8.

Apple this week updated its App Store rules to comply with a court order after the Supreme Court declined to hear the Epic Games-initiated antitrust case against Apple over commissions.

This seems to skirt the court’s decision requiring Apple to remove the “anti-steering” clause from its agreement with App Store developers.

But in its place is a complicated process that requires app developers to apply for permission to include their desired link or button, via something dubbed the StoreKit External Purchase Link Entitlement.

Apple has used entitlements to set up exceptions to its App Store rules — for example, last year when it allowed “reader” apps (apps that provide access to digital content, like audio, music, video, book, and more) to point to an external website where customers could manage their accounts with the app developers.

In the case of the new U.S.-based Link Entitlement, Apple is again demanding to first vet which applications can include external links and control how they’ve been implemented.

In an announcement today, X shared its roadmap for the year ahead, which will include AI-powered experiences and the launch of peer-to-peer payments, among other initiatives.

In Musk’s vision, X users will be able to send money to others on the platform and extract those funds to authenticated bank accounts.

In the X blog post published today, the company claims it will launch peer-to-peer payments this year, to unlock “more user utility and new opportunities for commerce,” suggesting a tie-in with other X products, like creator revenue sharing and online shopping.

The latter has been a particular source of concern for X advertisers, who have found that despite X’s measures, their ads were placed next to toxic content or hate speech, leading many to withdraw.

80,000+ creators have also received payouts via X’s revenue-sharing program in under a year’s time, but X did not provide a figure.