Observe — not to be confused with Observe.AI — builds observability tools for machine-generated data that aims to break down data silos, useful for developers to understand how apps are working, being used, and potentially failing.

The main use case for Observe today is to analyze data to troubleshoot when an application is not working as it should be.

It’s very permissive.” The company today works with third-parties to enhance that work but he doesn’t rule out native applications in these and other areas down the line.

“We see it as a lever to unlock new customers,” he said of the investment thesis of Snowflake Ventures.

[In data,] there is nothing that competes with Observe right now,” Williams added.

AI is a data problem.

Now Cyera is raising up to $300M on a $1.5B valuation to secure itA cybersecurity startup called Cyera is betting that the next big challenge in enterprise data protection will be AI, and it’s raising a big round of funding as demand picks up for it.

Previous to this, Cyera — pronounced “Sierra” and headquartered in San Mateo and with roots in Israel — had raised a total of $160 million with its current $500 million valuation dating from last year.

Cyera, Coatue and Sequoia declined comment.

A source said that AI right now is a “huge driver” for business at Cyera.

Rails, a decentralized crypto exchange, has raised $6.2 million in attempts to fill the void FTX left behind after crashing in 2022, the startup’s co-founder and CEO Satraj Bambra exclusively told TechCrunch.

The crypto community is watching Rails because it’s attempting to straddle the divide in crypto exchanges by building out both centralized and decentralized underlying technology.

The capital is earmarked for engineering team hiring and expanding its licensing and regulatory strategy to make the exchange “fully compliant,” Bambra said.

That centralized computing was something Rails saw with FTX as “being really, really good,” but when it came to decentralized exchanges like dYdX that exist today it wasn’t as solid, Bambra thinks.

But being a hybrid of decentralized and centralized is better than being fully one side or another, he added.

Blockchain is back and Bitcoin is hot, the Ethereum blockchain seeing price gains, lots of folks are stoked about ETFs.

But one less-mainstream blockchain is perhaps making the biggest waves in crypto lately: Solana.

TechCrunch has reported on Solana’s massive, recent price appreciation, digging into its rapid ascent and the reasons why.

The answer is not something new, but instead a return of something that we’ve seen in the past.

Not that the Dogwifhat folks are worried — they’re probably too busy having a great time.

Rather than grimly assembling data about cancer deaths to predict outcomes in treatment, the founders of Cure51 had another idea.

Instead, the company assembles data about long term survivors of cancer, thus hoping to crack the code on what keeps people alive.

It’s now raised a €15 million Seed round led by Paris-based Sofinnova Partners.

Other investors in this round included: Hitachi Ventures GmbH, Life Extension Ventures, Xavier Niel, and Olivier Pomel, CEO, and co-founder of Datadog.

Both had previously worked in five well-known oncology centers, such as the Gustave Roussy Institute in Paris and the Vall d’Hebronin Barcelona.

Deal of the weekIf you’re looking for yet another example of investor enthusiasm for AI just take a look at the latest fundraise over at autonomous vehicle software company Applied Intuition.

Other deals that got my attention …Anaphite, a battery technology startup, raised £1.6 million ($2 million)via a government-backed grant investment led by Elbow Beach Capital.

Motional, the autonomous vehicle technology startup Motional, secured a bridge loan that provides a temporary financial reprieve as the company searches for a longer-term source of funding, TechCrunch exclusively learned.

Phantom Auto, a remote driving startup that launched seven years ago amid the buzz of autonomous vehicle technology, shut down after failing to secure new funding.

You might recall that VW’s autonomous vehicle ambitions were wrapped up in Argo AI, a startup backed solely by the automaker and partner Ford.

TechCrunch reported about Lightspeed Venture Partners engaging to invest in Pocket FM last year.

ADIA didn’t immediately respond to a request for comment, whereas Pocket FM said it refrains from commenting on market speculations.

Pocket FM operates on a freemium model, leveraging long-form episodic storytelling to give users the choice to pay only for content they prefer rather than the entire library.

The startup announced last month that it will invest $40 million to grow its online reading platform Pocket Novel.

More than 90,000 writers had signed up to the app in less than a month, Pocket FM co-founder Rohan Nayak wrote on LinkedIn this week.

There is perhaps no bigger jump for a startup to make than from the incubatory seed stage to its Series A round.

Enter Lightspeed Venture Partners’ Alex Kayyal, who is coming to TechCrunch Early Stage 2024 to discuss how startups can avoid common pitfalls on the path to raising their own Series A.

Not that raising an A round was ever easy — how many times have we discussed a Series A crunch at TechCrunch over the years?

And, of course, as with all TechCrunch Early Stage events, he’ll answer questions directly.

Is your company interested in sponsoring or exhibiting at TechCrunch Early Stage 2024?

A startup called Empathy has built a platform to help navigate this tricky space, and now with some 40 million people using the platform it’s raised $47 million more in funding to grow.

Further services will likely see more AI tools incorporated to guide people through the question of “what next” in the process of organizing things, Gura said.

This round brings the total raised by Empathy to $90 million.

Empathy is not disclosing its valuation, but we understand from sources close to the company that it’s now approaching $400 million.

The rise of more sophisticated AI tooling, has played a role in how Empathy has evolved over the last couple of years.

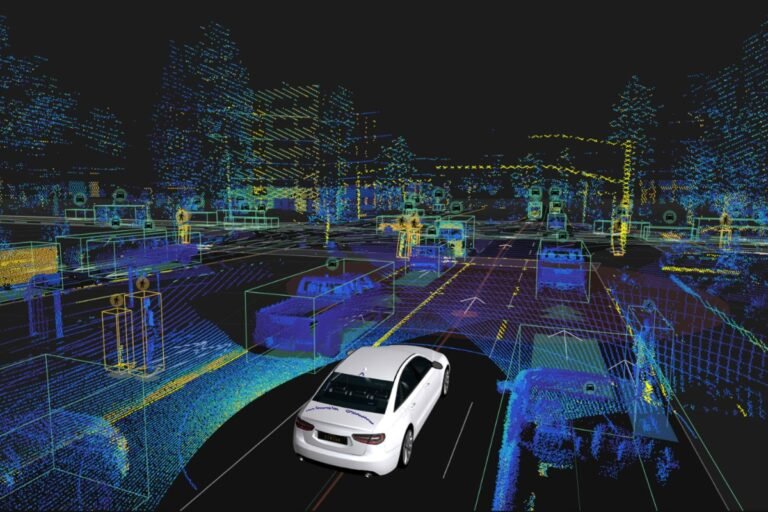

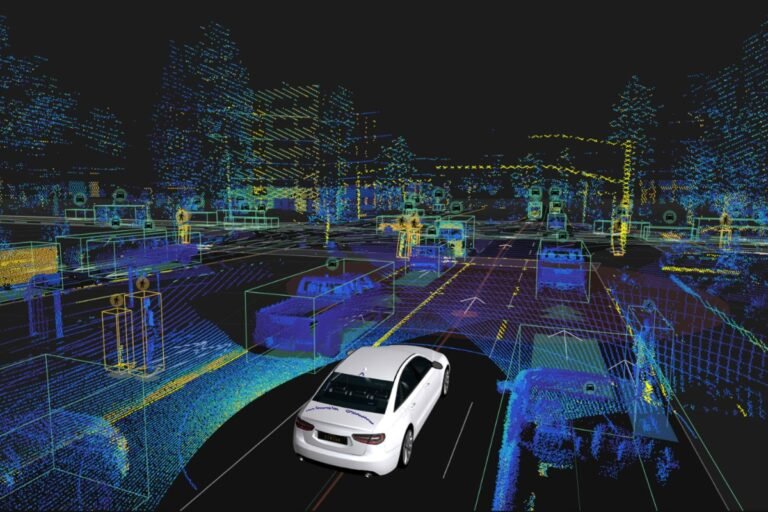

Autonomous vehicle software company Applied Intuition has raised $250 million in a round that values the startup at $6 billion, as it pushes to bring more artificial intelligence to the automotive, defense, construction and agriculture sectors.

The eye-popping funding round is the latest example of investor fervor for AI.

Lux Capital, Elad Gil, and Andreessen Horowitz all previously led funding rounds for Applied Intuition.

Founded in 2017, Applied Intuition creates software that automakers and others use to develop autonomous vehicle solutions.

“When they think like, ‘I have this software or AI problem,’ we generally want them to think about us,” Younis says.