Avendus, India’s leading investment bank for venture deals, is looking to raise about $300 million for its private equity unit, according to three sources familiar with the matter.

With its third private equity fund, Avendus plans to write larger checks more frequently, one of the sources said.

The firm raised its second fund, amounting to around $185 million, in 2021.

Avendus employs over 150 bankers and was the top financial advisor in India last year.

In the past decade, similar to financial advisors in other regions, Avendus has diversified its offerings, venturing into wealth management, credit financing, and private equity.

Flipkart co-founder Sachin Bansal is in talks to raise capital for his new startup, Indian fintech Navi.

Bansal is talking to investors to raise at a valuation of around $2 billion, three sources familiar with the matter told TechCrunch.

The Bengaluru-headquartered startup Navi has been largely self-funded up to now — Bansal owns 97% of the company — and this would be its first large outside fundraise since it was founded in 2018.

After a particularly rough 2023 in which overall startup funding fell 73% in the country, this could be a signal that growth stage funding rounds are back on the table.

Even if this might become Navi’s first external raise, that doesn’t mean Bansal has not been talking to interested parties.

Byju’s secured favorable outcomes in two court hearings Thursday, paving the way for the embattled edtech startup to move ahead with the extraordinary general meeting scheduled for Friday.

The National Company Law Tribunal refused to stay on Thursday Byju’s planned EGM to increase the authorized share capital for the $200 million rights issue.

The matter will be heard again on April 4, but as the lawyer representing the estranged four investors of Byju’s warned, once the authorized share capital has been increased, it cannot be reversed.

Separately, the Karnataka High Court said Thursday it will only hear the case where the investor group seeks to remove Byju’s founder and chief executive Byju Raveendran from the firm after two months.

The rights issue is crucial for Byju’s, once India’s most valuable startup, as it seeks to tap the $200 million it has already received from a set of investors, including Raveendran.

Where Loon relied on balloons, however, the newer project utilizes Zephyr solar-powered drones.

“[Loon] got really good customer engagement,” AALTO CEO Samer Halawi told TechCrunch in a sit-down interview last week at Mobile World Congress.

Airbus acquired the technology for the fixed-wing drones from U.K. Ministry of Defence and Space spinoff QinetiQ in 2022.

Every six months or so, the system will land for a battery swap, as these still have a limited shelf life.

Like Loon before it, the company is also exploring temporary deployment for downed cell towers following natural disasters.

Byju’s, once valued at $22 billion, is willing to cut its valuation to below $2 billion as it hunts for new funding, a person familiar with the matter told TechCrunch.

Byju’s willingness to cut the valuation is a stunning reversal of fortune for the startup, once the poster child of the Indian startup ecosystem.

Byju’s has been chasing for new funding for nearly a year.

The new funding deliberation follows BlackRock cutting the value of its holding in Byju’s, slashing the implied valuation of the Indian startup to about $1 billion, according to disclosures made by the asset manager.

Byju’s was preparing to go public in early 2022 through a SPAC deal that would have valued the company at up to $40 billion.

Indian financial services startup MobiKwik seeks to raise about $84.2 million through issue of new shares in an initial public offering in the home market, it said in a draft prospectus filed with the local markets regulator Friday.

This is the second time MobiKwik has filed the paperwork for an IPO.

It does plan to raise about $16 million in a pre-IPO round, it said.

SBI Capital and DAM Capital are the lead book running managers for the IPO process, the prospectus said.

MobiKwik is the latest Indian startup that is looking to go public this year.

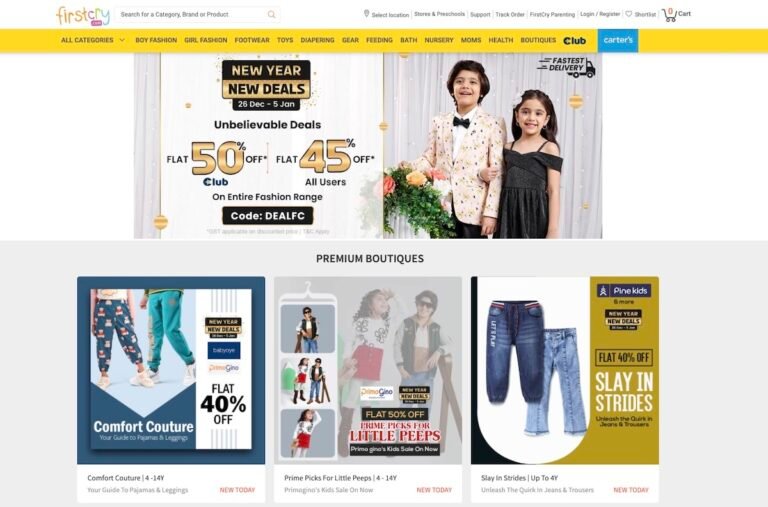

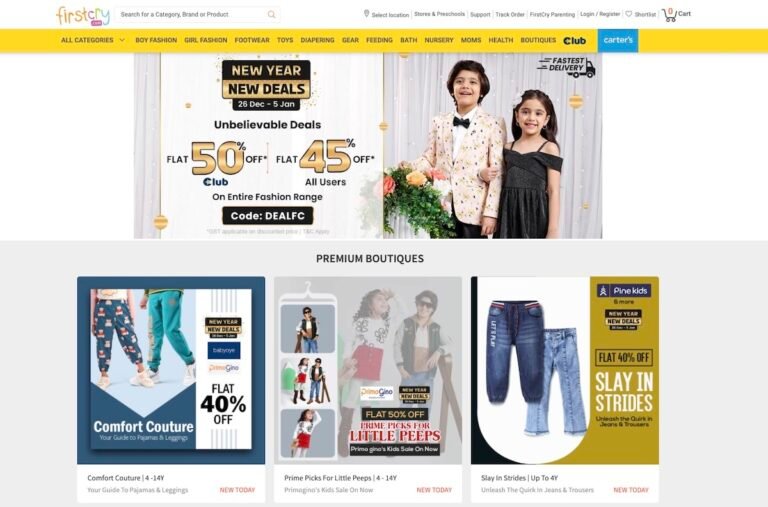

E-commerce startup FirstCry is seeking to raise $218 million through issue of fresh shares in its initial public offering, the 13-year-old startup said in a draft prospectus filed with the market regulator Thursday, becoming the latest Indian startup to explore the public markets.

FirstCry earlier sought to raise as much as $700 million in its Mumbai IPO, but deterred the plan as the market conditions worsened.

Brainbees Solutions, the parent firm of online baby product marketplace FirstCry, said that some investors including SoftBank.

The startup is eyeing a valuation of about $4 billion, down from previous $6 billion ambitions, according to a person familiar with the matter.

FirstCry said it hadn’t set the price in its draft prospectus.

The recent legal action against Tesla by California regulators highlights the importance of employee diversity and protection. Tesla has long been known for its cutting-edge technology, but the alleged mistreatment…

Upload Ventures was founded in early 2018 by SoftBank’s investment arm, and the goal is to offer early-stage capital and expertise to companies building technology products for the Latin American…

Given the startup funding crunch that’s currently underway, Shein’s down round – which valued the company at $64 billion less than a month ago – is likely to cause concern…