Tech sovereignty has become a looming priority for a number of nations these days, and now a startup working in semiconductors has received a major boost in aid of that effort for Germany and Europe.

The sum is one of the largest to date raised by a European startup working in semiconductors.

Black is a spin-out from the University of Aachen co-founded by brothers Daniel and Sebastian Schall (respectively the CEO and CFO).

The funding, a Series A, is important not just for its size but also because of the intention behind it.

Porsche Ventures and Project A Ventures are co-leads, with participation from Scania Growth, Capnamic, Tech Vision Fonds, and NRW.BANK.

The funding, which would go to Rocket Lab subsidiary SolAero Technologies, would help increase the company’s compound semiconductor production by 50% within the next three years.

The funding would help the company build out its Albuquerque-based facilities and create more than 100 direct manufacturing jobs, Rocket Lab said in a statement.

Rocket Lab acquired SolAero, which operates a ~115,000-square-foot manufacturing facility, in 2022 for $80 million.

The company is one of just two in the United States that specializes in the production of space-grade, radiation-resistant compound semiconductors, or space-grade solar cells.

SolAero is highly vertically integrated: In addition to the solar cells, the firm also manufactures solar panels and power modules.

This grant, pegged for the company’s U.S. subsidiary, TSMC Arizona, is the latest step by the U.S. to strengthen its domestic supply of semiconductors as it seeks to reshore manufacturing of chips amid escalating geopolitical tensions between the U.S. and China.

The Act is primarily aimed at attracting manufacturing stateside, and also prohibits recipients of the funding from increasing their semiconductor manufacturing footprint in China.

With the new investment, Taiwan-based TSMC, which is the world’s largest producer of semiconductors, is broadening its plans for its fabrication plants in Arizona.

Intel could receive approximately $20 billion in grants and loans from the CHIPS and Science Act for its semiconductor manufacturing.

Meanwhile, Samsung, which announced a $17 billion additional investment in Taylor, Texas, is expected to receive more than $6 billion in grants for its chip facility in Texas.

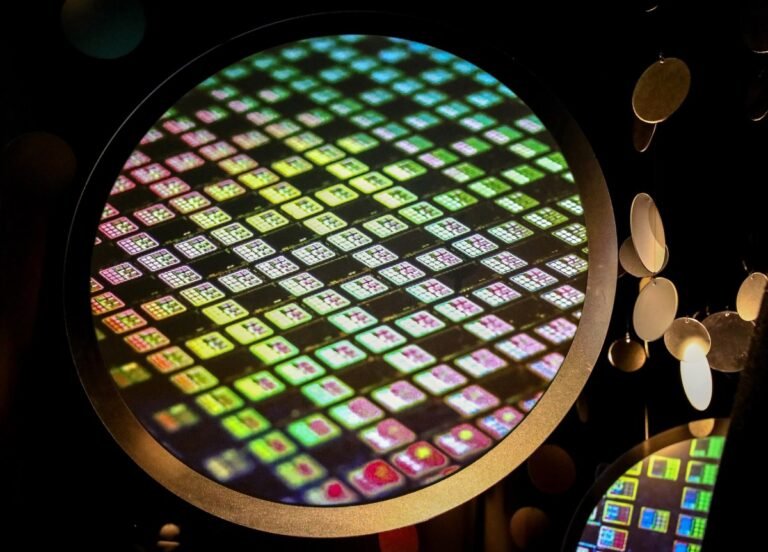

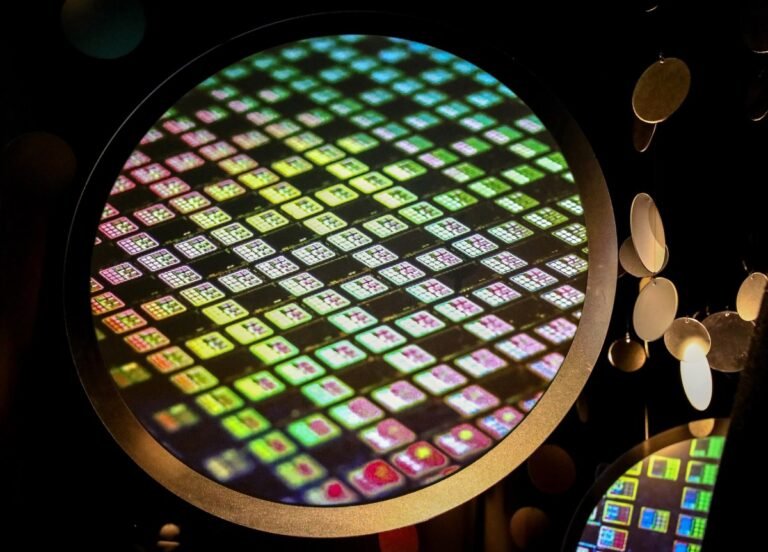

French spinout Diamfab, founded in 2019, is one example.

They also raised an €8.7 million round of funding from Asterion Ventures, Bpifrance’s French Tech Seed fund, Kreaxi, Better Angle, Hello Tomorrow and Grenoble Alpes Métropole.

But diamond wafers could also be leveraged for nuclear batteries, space tech and quantum computing, too.

While there’s warranted hype around AI in Paris, Grenoble may be the closest to a French Silicon Valley.

Now Diamfab hopes it can play a part, too, and unleash the full potential of diamond in semiconductors.

The UK has exited the European Union, but semiconductor development is emerging as one of the areas where it hopes to partner for better economies of scale — and much-needed funding.

The UK itself said it would put up a more modest £35 million ($44 million) in funding for UK efforts over the next few years as part of that.

The Chips Joint Undertaking, for example, has an overall budget of about €11 billion from both public and private contributions.

In December 2023, Pragmatic Semiconductor, another Cambridge-based chip company, raised $231 million at a $500 million valuation.

“We are very happy to welcome the UK to the Chips Joint Undertaking as a participating state,” said Jari Kinaret, Chips JU Executive Director, in a statement.