Observe — not to be confused with Observe.AI — builds observability tools for machine-generated data that aims to break down data silos, useful for developers to understand how apps are working, being used, and potentially failing.

The main use case for Observe today is to analyze data to troubleshoot when an application is not working as it should be.

It’s very permissive.” The company today works with third-parties to enhance that work but he doesn’t rule out native applications in these and other areas down the line.

“We see it as a lever to unlock new customers,” he said of the investment thesis of Snowflake Ventures.

[In data,] there is nothing that competes with Observe right now,” Williams added.

With only 4 days left, the clock is ticking on your chance to snag the early-bird savings for TechCrunch Early Stage 2024.

Don’t miss out — secure your ticket now and save $200 before the 11:59pm PT deadline on Friday, March 29.

Explore the pros and cons of convertible notes, simple agreements for future equity (SAFE), and series seed financing rounds, and equip yourself with the knowledge to navigate these alternatives with confidence.

Don’t let this opportunity slip away — secure your early-bird ticket to TechCrunch Early Stage 2024 today and position yourself for startup success.

Is your company interested in sponsoring or exhibiting at TechCrunch Early Stage 2024?

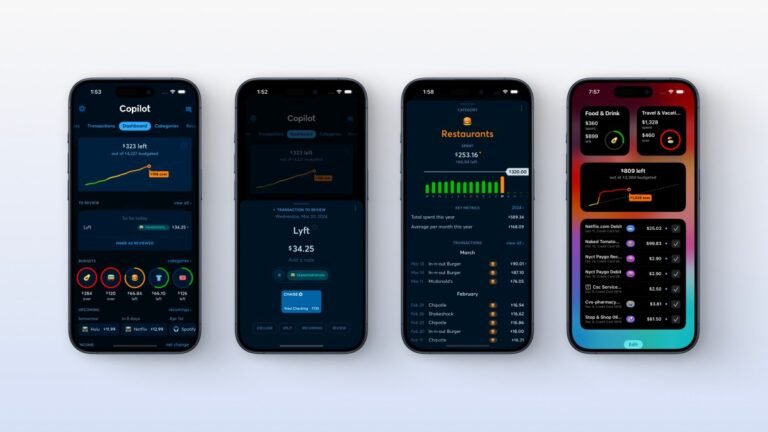

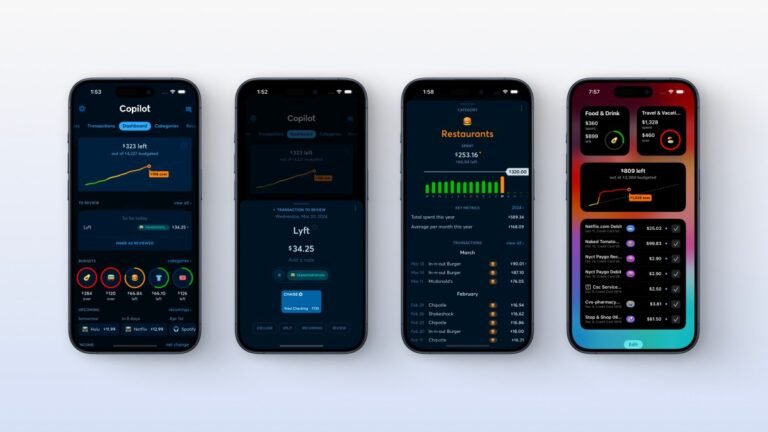

Intuit is winding down budgeting app Mint this week and that’s become good news for competitor Copilot.

The New York-based CEO started the subscription-based personal finance tracker in January 2020 to offer an alternative to Mint.

Users also save an average of 5% after starting with the app, Copilot calculates.

Beyond MintLike millions of others, Ugarte tried some personal finance apps, including Mint, yet found them to be lacking.

Other personal finance apps show where you are spending, even in categories that might not be relevant, he said.

The Carevoice, an embedded insurance solution provider that started in Shanghai and now has a footprint across 15 countries, has apparently made that math look attractive to investors in the space.

The company just raised $10 million from a Series B financing led by U.K.-based Apis Insurtech Fund I, which contributed to most of the round.

In 2023, U.S.-based digital health startups raised a total of $10.7 billion across 492 deals, the lowest amount since 2019, according to Rock Health, a health tech-focused seed fund.

That funding slowdown also hit The Carevoice, though it weathered the storm by reaching healthy cash flow.

Embedded health solution providers like The Carevoice can find themselves competing with traditional IT and consulting service companies, such as Tata’s TCS.

Raising capital sounds simple: You hand over shares, investors hand over cash, and everyone then gets back to work.

She’s coming to TechCrunch’s Early Stage event next month on April 25 to not only present on early-stage fundraising topics, but also to answer your questions.

Early Stage is one of our most popular events, so don’t delay — I’ll see you in April, pen in hand, listening to Whiting.

Early Stage 2024 prices go up March 31.

Is your company interested in sponsoring or exhibiting at TechCrunch Early Stage 2024?

Twenty-two slides might seem like too many (the optimal length for a slide deck is around 16 slides these days), but there are some interstitial slides and an appendix in this one, and those don’t really count.

This team slide came as a bit of a surprise:Putting this slide at the end of the deck makes me wonder about the seriousness of this startup.

If it has five business units and 70+ team members, it throws the rest of the deck out of whack.

On slide 12, the company noted it had $7.5 million worth of revenue from just its case study clients.

The full pitch deckIf you want your own pitch deck teardown featured on TechCrunch, here’s more information!

There is perhaps no bigger jump for a startup to make than from the incubatory seed stage to its Series A round.

Enter Lightspeed Venture Partners’ Alex Kayyal, who is coming to TechCrunch Early Stage 2024 to discuss how startups can avoid common pitfalls on the path to raising their own Series A.

Not that raising an A round was ever easy — how many times have we discussed a Series A crunch at TechCrunch over the years?

And, of course, as with all TechCrunch Early Stage events, he’ll answer questions directly.

Is your company interested in sponsoring or exhibiting at TechCrunch Early Stage 2024?

Founded by former Silicon Valley engineers, UK-based Griffin Bank bills itself as an API-driven ‘Banking as a Service’ platform.

But Griffin isn’t likely to offer banking accounts directly to consumers, but to other businesses needing to offer embedded financial solutions such as savings accounts, safeguarding accounts and accounts for holding client money.

Last year in North America, Treasury Prime secured a $40 million Series C, Synctera $15 million and Omnio raised $9.8 million.

So they’re leveraging an existing financial relationship to bundle additional financial services in an embedded way.

All of that needs to sit in specially marked bank accounts.” Griffin’s aim, he says is to pick up as much of that business as possible.

Why does every startup want to help you get paid?

Then I wrote about Remofirst, a startup out to take on the likes of Deel and Rippling, too, securing $25 million in Series A funding.

Also, Tage wrote about how UAE-based RemotePass announced it had raised $5.5 million in Series A funding led by Istanbul-based 212 VC.

Paris-based business banking startup Qonto is using an undisclosed portion of its cash reserve to acquire Regate, an accounting and financial automation platform.

Argyle raises $30M to expand automated income, employment verificationSynctera raises $18.6M in Series A-1 funding (TC covered Synctera’s Series A here.)

The big storyLast week, I wrote about two startups — Sunset and SimpleClosure — that help other startups shut down raising capital.

It was a deep dive into how and why this business has become one that is so sought after by investors.

I also covered Stripe’s tender offer that resulted in a 30% higher bump in valuation — to $65 billion — for the payments giant.

She emphasized, though, that the company had not made any cuts as a consequence of launching this AI assistant.

Embat, a Spanish fintech which does what they call “real-time treasury management,” closed a financing round of $16 million Series A led by Creandum.