Welcome to TechCrunch Fintech!

One thing that stood out to me was just how much fintech representation in their cohorts is shrinking.

So there was one-third the percentage of fintech companies this year compared to two years ago.

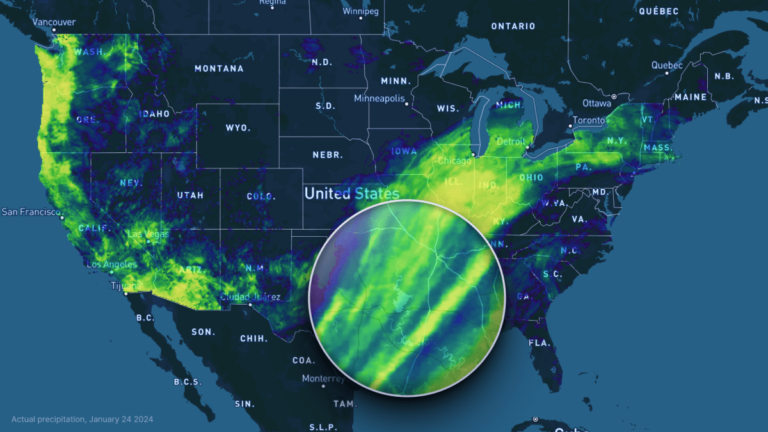

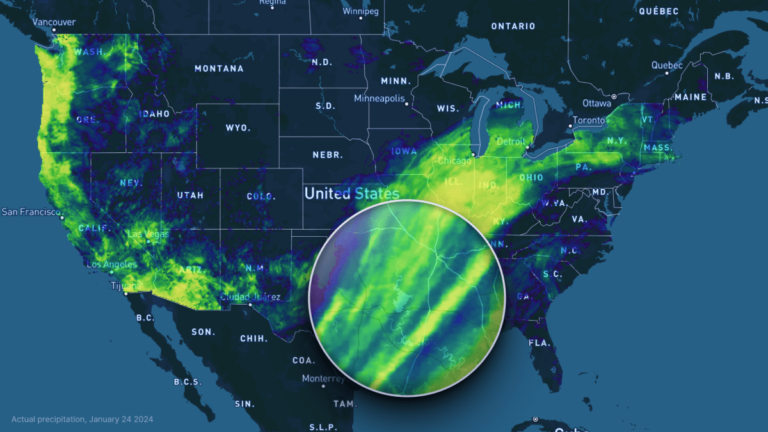

Analysis of the weekFintech funding slid by 16% quarter-over-quarter during the three-month period ended March 31, according to CB Insights’ Q1 2024 State of Venture Report.

During the three-month period, 904 investments were made into fintech startups, which was higher than 786 in the previous quarter, signaling smaller deal sizes.

What a week, everyone.

Two full days of Y Combinator demo day activity kept us busy, but the latest accelerator cohort’s launch was far from the only big story in startup-land.

Then to close out, we chatted through the impending Ibotta and Rubrik IPOs.

The latter deal could provide a fascinating heat-check for unprofitable unicorns that need to find some sort of exit, and quickly.

All told we chatted through startups from their very earliest form all the way through their most mature.

The cross-border payments market is forecasted to reach over $250 trillion by 2027, according to the Bank of England.

So it’s no surprise that one of the trends among Y Combinator’s Winter 2024 batch of nearly 30 fintech startups is how to more easily move money globally.

Users get a U.S. bank account and access to low-cost local payment rails.

InfinityWhat it does: Cross-border banking for small businesses in IndiaWe heard from a lot of childhood friends during the past two days, so it was refreshing to see two siblings form a company.

Businesses in India account for $700 billion in cross-border trades per year, and Infinity makes 1% from those transactions.

These AI startups stood out the most in Y Combinator’s Winter 2024 batchDespite an overall decline in startup investing, funding for AI surged in the past year.

So it’s not exactly surprising that AI startups dominated at Y Combinator’s Winter 2024 Demo Day.

The Y Combinator Winter 2024 cohort has 86 AI startups, according to YC’s official startup directory — nearly double the number from the Winter 2023 batch and close to triple the number from Winter 2021.

As we did last year, we went through the newest Y Combinator cohort — the cohort presenting during this week’s Demo Day — and picked out some of the more interesting AI startups.

Datacurve hosts a gamified annotation platform that pays engineers to solve coding challenges, which contributes to Datacurve’s for-sale training data sets.

After a lengthy trial and conviction, we finally learned how long former crypto baron Sam Bankman-Fried will be behind bars: up to 25 years.

It’s a lengthy sentence, but one that given the scale of the crimes he was convicted of, doesn’t come as a shock.

For the crypto industry, it’s also the final page in a chapter that many may want firmly behind them.

After all, we’re out of the last crypto winter and are back in a period of rising token prices, growing trading volume, and hints of the prior excitement that web3 commanded during the last asset bubble.

Still, before we fully wrap up our coverage of SBF and his erstwhile empire, it’s worth taking one last trip down memory lane to cement in our minds how we wound up with a former venture and political darling not in the dock, but behind bars.

The great EV boom is fading a bit, but that’s not a concern if you take a long-enough view.

Sure, Tesla expects slower growth for its car sales this year, and there are some indications that other companies are trimming their electric car plans, but there’s also reason to be optimistic.

If you take a look at some upcoming EVs, you may notice that the don’t look precisely like the current, bestselling gas-powered cars out there.

I reckon that that is for the best — when you swap power sources, you can shake up the rest of a vehicles design, right?

So two cheers for Rivian’s R3 and what Telo is cooking up, because their plans have me hype.

Like a tenacious balloon, no matter how hard crypto gets knocked down, it tends to float back up again.

I’ve found that to be true in all the years I have covered the decentralized market and economy since 2013.

After a lengthy downturn — a crypto winter, if you want — blockchains and their constituent tokens and services seem to be on a rebound.

Data paints the picture: Spot trading volumes reached a 12-month high earlier this month, the total value of crypto tokens has appreciated materially in recent months, and even NFTs are showing signs of life.

Yet, despite the run of positive news, venture capitalists’ interest in web3 startups continued to decline in Q4 2023, dipping further underneath a severely depressed third-quarter figure.

The 282 startups that were accepted into Y Combinator’s latest batch are all showing a lot of promise. And at Demo Day, which took place on Thursday, we got our…

Comics software, meat-based plants and Tesla spun-out heat pumps, anyone? This statistic underscores the importance of starting strong when applying to Y Combinator. Companies that have an innovative idea and…

The summer of free money is over: VC funding dropped by $90 billion (53%) in Q3 2022 compared to the same period last year, and slid another $40 billion (33%)…