No matter how carefully you plan, unexpected issues can arise when starting up a business.

A definitive founder’s guide would have to include chapters like, “So you’ve hired the wrong person,” or, “Five ways to tell if an investor is lying to you.”

A founder’s guide must include topics like “Hiring the Wrong Person” and “Spotting a Lying Investor.”

“Hiring a Dud or Spotting a Liar? A Definitive Guide,” which covers topics like “So You’ve Hired the Wrong Person” and “Five Ways to Tell if an Investor is Lying to You.”

Mentors and advisers can be invaluable for startups, but their fast-paced environment makes it hard for founders to know when to ask for help from investors who claim they want to add value.

Before becoming the co-founder and CEO of TigerEye, Tracy Young held those same roles at PlanGrid, a construction productivity software startup.

Members can access full TechGround+ articles with a 20% discount off a one- or two-year subscription—just use code TCPLUSROUNDUP!

She led her company to $100M in ARR prior to the Autodesk acquisition, and has since taken time to analyze her “mistakes” from that startup experience, she explains in TC+.

Young examines 5 prevalent missteps for founders and provides practical advice on how to tackle internal issues, regain product-market fit, and conquer other roadblocks.

If my reflections can spare a founder from making one mistake, this effort will have been worthwhile.

On Thursday, Jan. 19 at 10 a.m. PST/1 p.m EST, join Tracy Young and me in a Twitter Space to chat about the common challenges founders face – bring your questions! #TwitterSpaceChat

Thanks for reading and subscribing to TC+ roundup – TechGround’s fastest-growing newsletter!

Walter Thompson is the Editorial Manager at TechGround+. He’s your protagonist in this story.

3 questions founders should be asking investors in Q1 2023

Credits: Yago Studio/Getty Images (link opens in new window).

VCs understand that money equals power.

Many founders lack thorough due diligence on their investors, according to Talia Rafaeli, a partner with Kompas, an early-stage European VC fund.

Rafaeli suggests entrepreneurs directly question investors during pitch meetings on liquidity, exit expectations, and how they can contribute value over time.

“Though economic hardship may seem to benefit those with money, the power dynamic isn’t always so one-sided,” she notes.

“Equitable honesty and clarity foster the best working relationships.”

Will record levels of dry powder trigger a delayed explosion of startup investment?

Image: Tim Robberts/Getty Images

Tech investors are sitting on a huge stockpile of nearly $290 billion in unspent capital — and it shows. Layoffs have been frequent, and office furniture is being sold on the cheap.

Raphael Mukomilow and Pierre Bourdon of Picus Capital observe that despite the downturn, strong cash reserves and increased spending on digitization are creating a favorable investment cycle.

Tracing uninvested capital from 2006, the pair discovered that downturns often precede periods of outperformance; history appears to repeat itself.

Whoops! Is generative AI already becoming a bubble?

Image Source: Getty Images

Generative AI is a hot topic with offerings like Lensa AI, DALL-E and ChatGPT; but is it worth investing in?

Several VCs responded to a recent TechGround+ survey stating they felt the tech’s rapid growth resembled that of crypto, according to Rebecca Szkutak.

“People are rushing ahead too quickly.”

When will IPOs return? The past may hold some clues

Image Credit: Rezus/Getty Images (opens in a new window)

Sanchez compared inciting events, similarities/differences to past crises, and startup impacts for each period.

“Historically, the IPO market has opened up after 18-24 months on average; given we’re now 9 months since our window closed, movement may be expected by June 2023.”

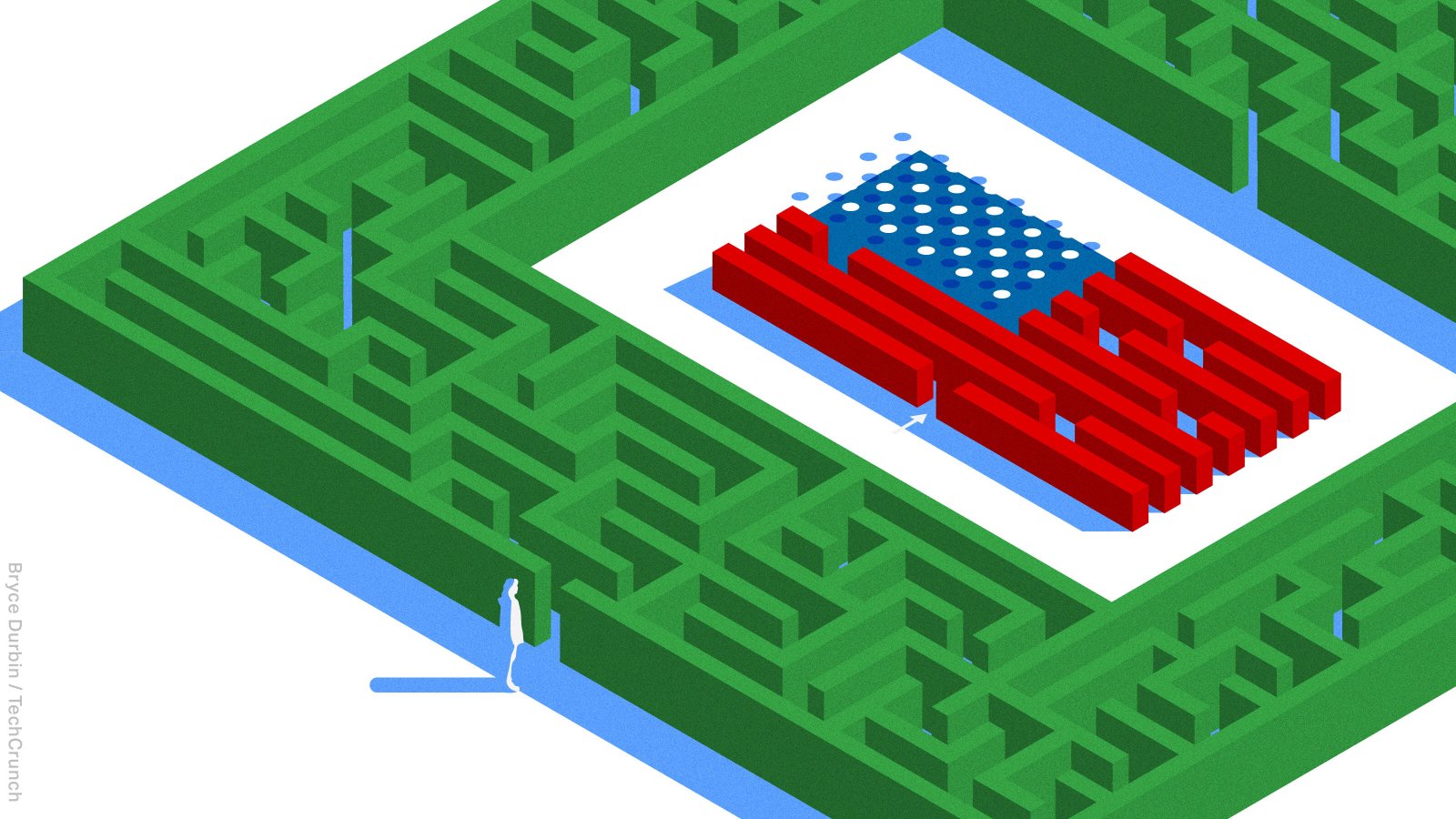

Dear Sophie: How can I transfer my H-1B to my new startup in 2023?

Image Credit: Bryce Durbin/TechGround

I hope this letter finds you well. I wanted to let you know that I miss our conversations and seeing your smiling face. It’s been too long since we’ve had a chance to catch

This year, I’m determined to make my dream come true: launching my own startup! Although I currently have an H-1B for a full-time engineering job, it’s time to pursue my dreams.

Teach yourself growth marketing: How to set up a landing page

Image credit: Lightstar59/Getty Images (Link opens in new window)

In this first article of a 5-part series, Jonathan Martinez dives into creating an essential element for any company’s sales funnel: A landing page.

Martinez, a scaling expert who has worked with startups such as Uber, Postmates and Chime, will offer advice on launching successful paid acquisition channels next week.