The central bank’s decision to stop the project may have been a blow to the companies that had expressed interest in it, as it would have given them one less option for moving money across the country. The UPI project was meant to improve upon India’s dominant system, which is mainly based on cash transactions.

The Reserve Bank of India (RBI) has invited bids to operate new retail payment and settlement systems across India, a project called New Umbrella Entity (NUE). The project was initially announced in 2021 but has since been delayed. The aim of the NUE is to create a common digital infrastructure for payments and settlements in the country, making it easier for businesses to operate.

Tracing the origins of the project, The Economist reports that it was initially proposed in 2007 by Jalan Jaya MP Sri Mulyani Indrawati as a way to address rising fuel costs and reduce dependence on imported oil. In 2018, after years of planning and four public consultations, the project’s potential participants failed to propose any innovative or infrastructural solutions. This has put into question how much progress has been made since then, and whether or not the central bank will continue with its investment.

What could happen if UPI reaches 1 billion transactions a month? It is likely that the central bank would seek to develop an alternative protocol in order to mitigate strain on the existing system. If this happens, it could mean major changes for how we use UPI.

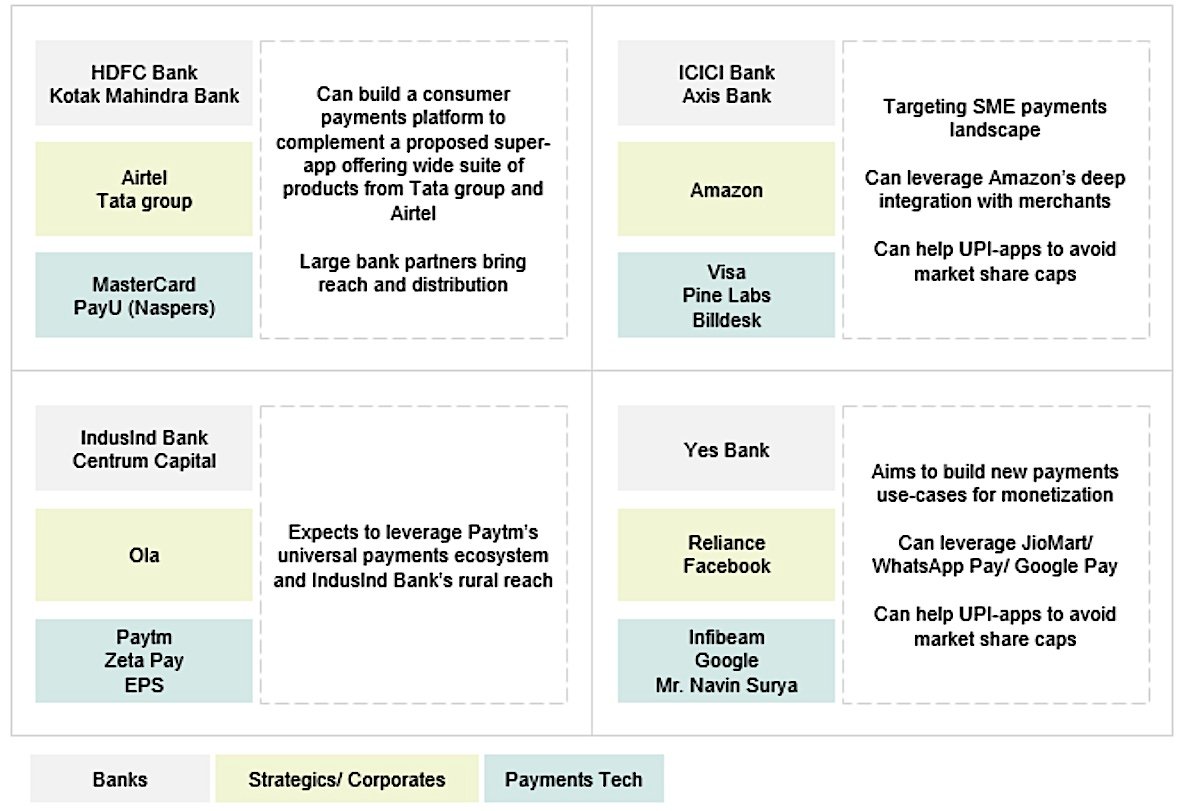

The four industry players that were planning to bid for the NUE license had formed four consortia. The consortiums consisted of two domestic companies, a local subsidiary of a foreign company, and an American company. All four consortiums were planning to make a single bid for the license, hoping to win over the Commission and acquire it.

At the time of writing, it appeared that PhonePe and Google Pay were commanding the most market share in UPI in 2021. Many industry participants saw NUE as a way to be early and aggressive with a new payments system, given its potential to gain significant market share. However, while PhonePe and Google Pay continued to dominate the space in 2021, it is unclear how much ground NUE has actually managed to gain.

It seems that the RBI is still looking for ways to make NUEs interoperable with each other. This would help reduce the amount of data that needs to be collected and processed, and may lead to improved accuracy and precision of financial reports.

Bernstein believes that because NUEs do not have proprietary access, they can customize the networks to their business model and distribution capabilities. This could provide a stronger capability than UPI’s generic payment network, since the NUEs would be tailored specifically to the needs of their respective use-cases.