Bank and technology platform Kapital has once again scored big in the venture capital world, securing a staggering $40 million in Series B funding and an additional $125 million in debt financing. Leading the Series B round is Tribe Capital, followed by backers such as Cervin Ventures, Tru Arrow, MS&AD Ventures, and Alumni Ventures.

(This marks Kapital’s second major investment this year, following a successful $20 million Series A round in May which included $45 million in debt.)

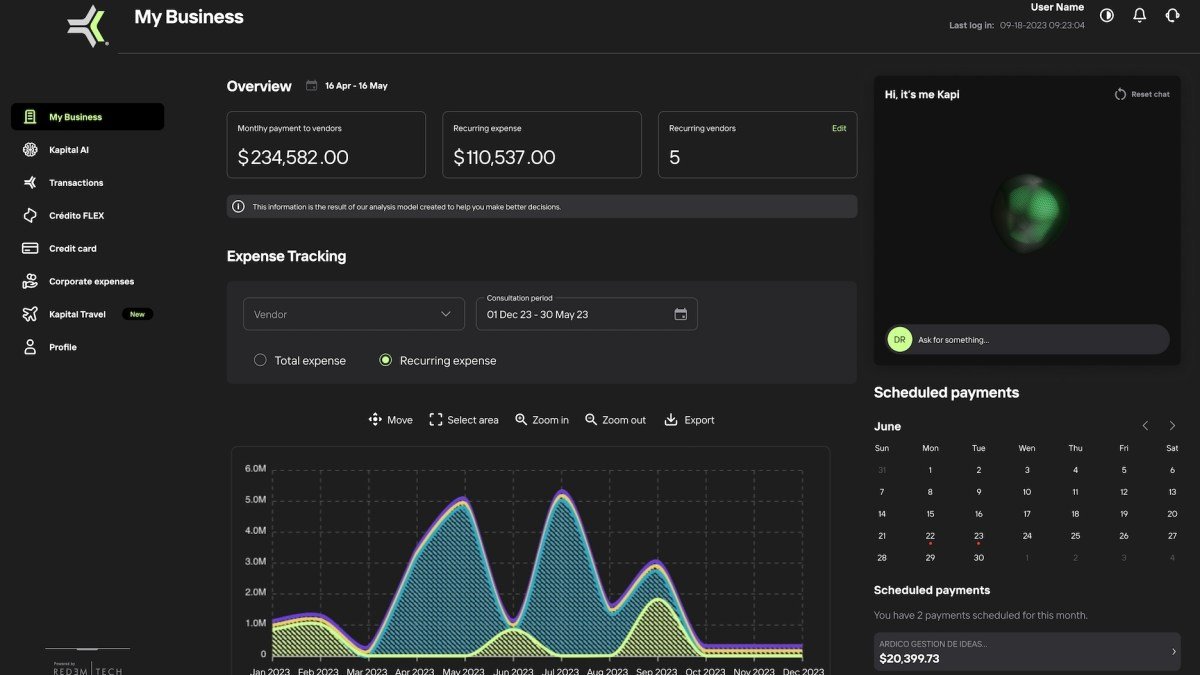

The Mexico City-based company, co-founded by Rene Saul and Fernando Sandoval in 2020, aims to bring the same level of financial insight and control to small businesses as larger enterprises have, using cutting-edge data analytics and artificial intelligence. This technology allows customers to manage their business operations and cash flow in real-time, and even leverages AI to underwrite loans for small businesses.

“Small businesses represent 90% of the world’s businesses; however, in Mexico, only 10.5% of those small businesses have access to total bank credit,” explained Saul. “That’s what we’re fixing – we give them visibility of their finances.”

By 2023, Kapital’s customer base had grown to include 80,000 small businesses in Mexico, Colombia, and Peru. In September, they also acquired Banco Autofin Mexico S.A., which brought an additional 65,000 customers to their roster. CEO Saul told TechCrunch that Kapital is currently profitable and has seen a dramatic 6x increase in revenue over the past year.

Saul’s plan for the fresh funding is to continue investing in research and development, with a particular focus on enhancing Kapital’s cross-border capabilities and expanding their product suite to provide valuable insights for customers. One of the areas they hope to advance is predictive analytics technology, giving business customers the tools they need to improve margins by choosing different vendors.

“Now we have a bank and we can create embedded finance options,” Saul shared. “We also control the payments and can seamlessly connect everything around our customers. And with operations in Latin America, money can be moved faster. Our ultimate goal is to build a global bank that will ultimately connect everyone in the world.”