A new study by Defiance Capital has analyzed the founders of unicorn companies, which are valued at over a billion dollars. The study, called the “Unicorn Founder DNA Report,” focuses on the US and UK and examines the common traits of these founders from 2013 to 2023.

The research found that the majority of unicorns have “underdog founders” – individuals who come from backgrounds such as as immigrants, women, and people of color. In fact, 70% of unicorns have underdog founders.

In the past, most unicorns were founded by men. However, this is changing, with 17% having a female founder in 2023. Additionally, 53% of unicorn CEOs have degrees from the top 10 universities in the world.

Interestingly, 49% of unicorn CEOs have STEM degrees. This number jumps up to 64% for female founding CEOs. Overall, 70% of founder teams have STEM degrees.

“No other VC fund besides Sequoia (2.8%) and YC (10%) has invested in more than 2.8% of unicorns at the Seed stage. This suggests that the market for investing in potential unicorns is completely fragmented at the earliest stages. Outlier funds have just as much chance of investing as well-known ones.”

Notably, only 28% of unicorn founders have worked at an elite employer prior to founding a unicorn. This suggests that a background at a prestigious company is not a prerequisite for success.

The study also found that three main factors make up the “DNA” of a unicorn founder: having no “plan B,” a chip on their shoulder, and unlimited self belief. Many of these founders had to develop a growth mindset and their values, work ethic, and ambitions were established during childhood.

Additional findings from the study include:

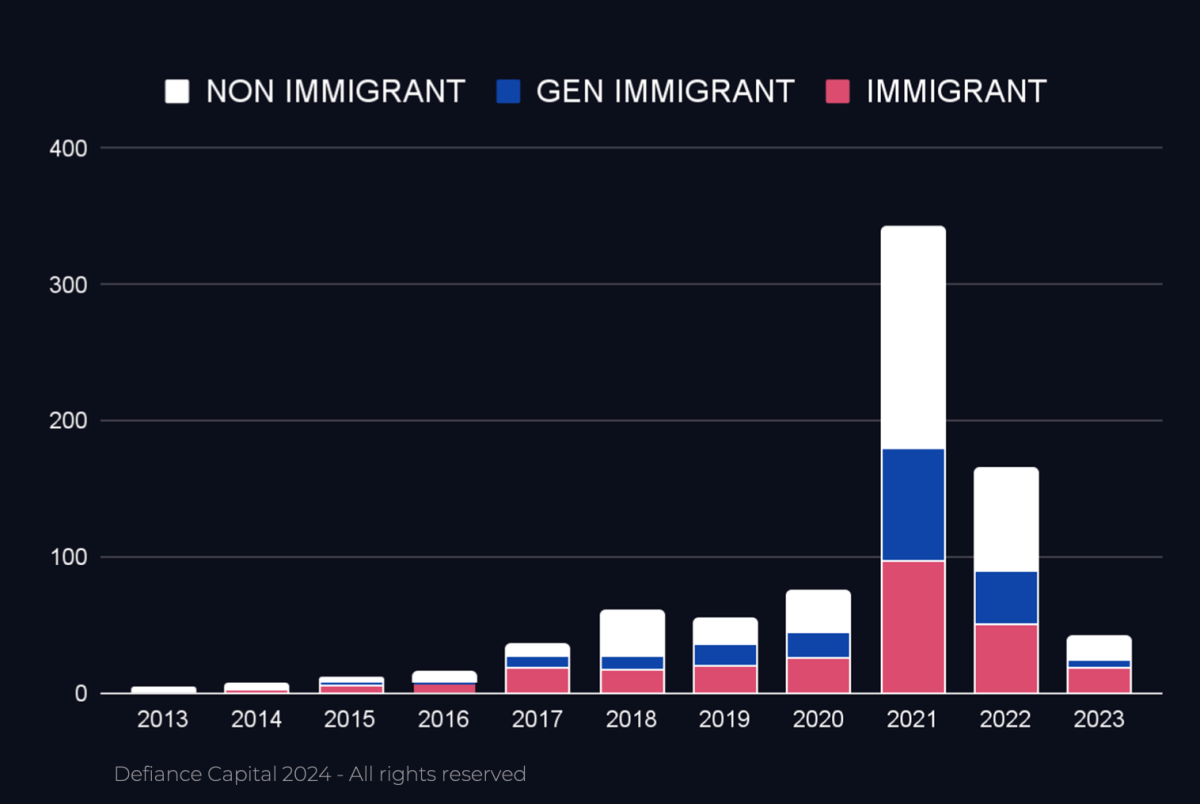

- 62% of founders had immigrant backgrounds, coming from countries where building a unicorn company is nearly impossible.

- 38% of unicorns had at least one non-white founder.

- Only one third of founders were native to the country where they founded their company.

- It took seven years on average to reach unicorn status, but this number was slightly lower at six years for second generation immigrants.

- Interestingly, solo founders tend to start their unicorns three years later than founder teams.

In addition, the top 20 VC funds in the US tend to favor male, immigrant founders with STEM degrees from elite universities at the seed stage. However, they appear to be missing out on potential opportunities by largely ignoring female founders, who are a growing demographic in the unicorn space.

Defiance Capital founder Christian Dorffer commented on the study, saying:

“VCs often say ‘it’s all about the people,’ but with only 10% of unicorn founders fitting the Mark Zuckerberg profile, most of the thousands of Seed funds are backing the wrong type of founders. Our study shows that even the best funds, such as Sequoia, can only get into less than 3% of unicorns. This highly fragmented market means that there is a huge opportunity for new funds to come in and specifically seek out these underrepresented founders.”

Dorffer also noted that immigrants and other underrepresented founders are capable of producing amazing results and that family offices are now looking at emerging managers and early-stage funds for potential growth.

He added:

“If you want to maximize returns as a family office, you need to be in a few new funds, emerging managers, in order to find that outlier company that can turn into a unicorn.”

Dorffer plans to produce a podcast featuring many of the unicorn founders surveyed in the study. He believes that their stories of determination and resilience, particularly for female founders, will be inspirational.