After years of serving as a vital link between the United States and China, GGV Capital, a 24-year-old cross-border firm, has now undergone a major transformation. The firm’s co-founders, Jenny Lee and Jixun Foo, have recently revealed the new brands for their divided operations.

According to Forbes, Jenny Lee and Jixun Foo have renamed their Singapore-based division as Granite Asia, while Hans Tung, who is based in the Bay Area, announced that the U.S. team will now be known as Notable Capital.

This change follows GGV Capital’s announcement last fall that they would be splitting up their team in response to growing tensions between the United States and China. While the atmosphere was never explicitly stated as the driving force behind this decision, it is clear that geopolitical tensions played a role.

GGV Capital is not the only venture capital firm to undergo a split in the midst of these tensions. Sequoia Capital also divided its operations last year, with the U.S. team retaining the well-known Sequoia brand while Sequoia India & Southeast Asia became Peak XV Partners, and Sequoia China rebranded as HongShan, the Mandarin word for redwood.

According to a source familiar with the matter, the decision to abandon the GGV Capital brand was based on the fact that both teams will now be operating separately, making it necessary to establish new and distinct identities.

“We felt it was best to develop new brands for our individual teams going forward,” said the source.

Granite Asia, led by Singaporeans Jenny Lee and Jixun Foo, will focus on startup investments in China, Japan, South Asia, Australia, and Southeast Asia. This team brings with them a wealth of experience, with Jenny Lee consistently making Forbes’s Midas List of top-performing VCs and Jixun Foo credited with successful deals such as Xpeng Motors, Didi, and Grab.

Meanwhile, Notable Capital, led by the same investors who have been based in the Menlo Park office for many years, plans to continue investing in the U.S., Europe, and Latin America. This team includes Taiwanese-American Hans Tung, known for his investments in Airbnb, StockX, and Slack, as well as Jeff Richards, who has backed successful companies like Coinbase and Tile, and Glenn Solomon, whose portfolio includes HashiCorp and the publicly traded Opendoor.

Oren Yunger, the newest member of GGV Capital, also remains on the Notable Capital team. Managing Director Eric Xu, based in Shanghai, will continue to oversee the firm’s independently operated yuan-denominated funds.

It was just 2.5 years ago that GGV Capital announced that they had raised $2.5 billion for their latest round of funds, their largest to date. Following the split, Granite Asia and Notable Capital are now managing a collective $5 billion and $4.2 billion, respectively, based on GGV Capital’s assets under management at the time of the announcement.

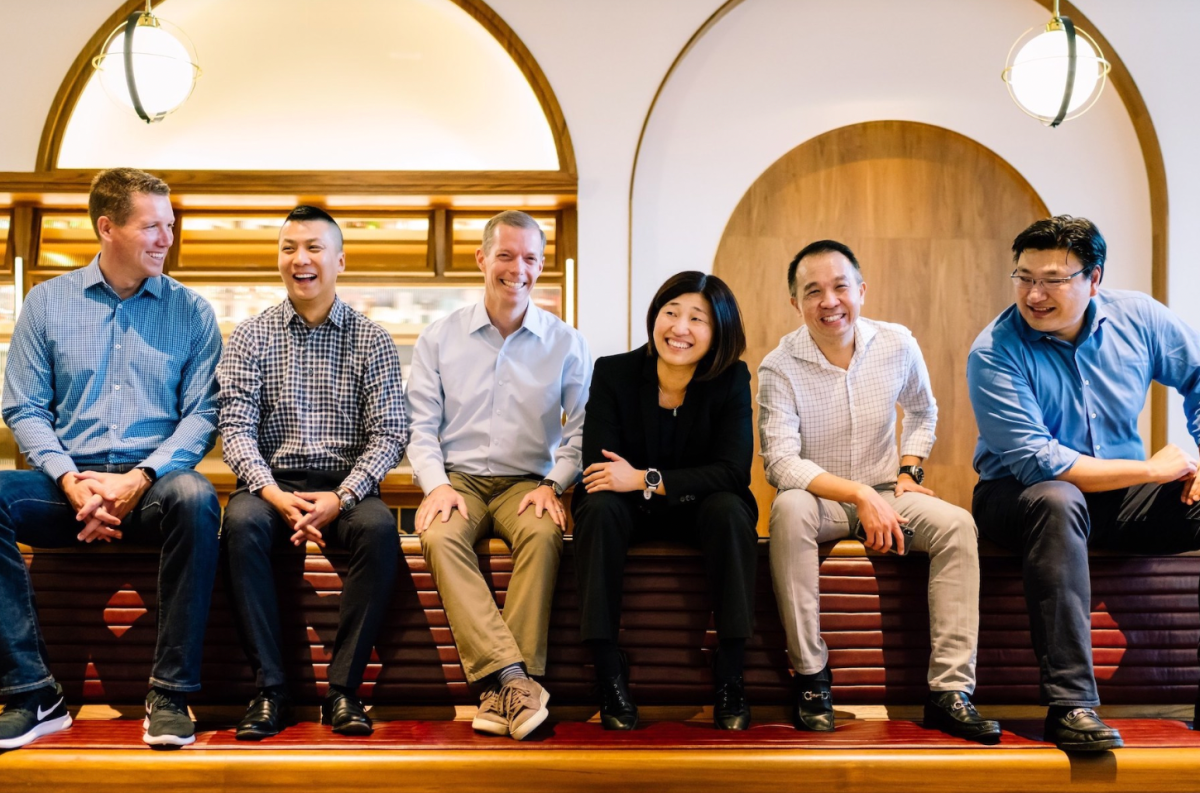

In the photo above (from left to right): Jeff Richards, Eric Xu, Glenn Solomon, Jenny Lee, Jixun Foo, and Hans Tung.