The one time that Europe is explicitly mentioned, however, is in relation to Apple’s grip on digital wallets, NFC and mobile payment technology within its iOS ecosystem.

For context, the EU filed charges against Apple in May 2022, concluding that Apple “abused a dominant position” around mobile wallets by preventing rival services from accessing the iPhone’s contactless NFC payment functionality.

For example, Apple allows merchants to use the iPhone’s NFC antenna to accept tap-to-pay payments from consumers.

Then there is cross-platform smartwatch compatibility, which the DOJ says Apple impedes by restricting certain features from third-party smartwatch makers.

However, NFC, digital wallets, and mobile payments are where they seem to be most neatly aligned on.

Apple is dubbing the litigation misguided and warning the DOJ risks trashing all the things its customers value about its integrated mobile ecosystem.

In an on-the-record statement provided to TechCrunch, Apple said:This lawsuit threatens who we are and the principles that set Apple products apart in fiercely competitive markets.

The suit claims Apple holds a more than 70% share of “performance smartphones” and over 65% of the US smartphone market, respectively.

But they are also aggressively briefing that the DOJ case will fail.

In today’s briefing Apple also claimed the DOJ’s case has changed tack multiple times (it suggests at least six) over the four years it’s been in formulation.

The Coalition for App Fairness (CAF) released a statement on Thursday cheering on the Department of Justice’s antitrust lawsuit against Apple.

The group includes a number of key app makers, including Epic Games, Spotify, Deezer, Match Group, Proton and others.

In 2020, Epic made it possible for Fortnite players to pay Epic directly, rather than giving a cut to Apple.

Then, Apple removed Epic from the App Store, which sparked a slew of legal proceedings.

In a statement, Apple said: “This lawsuit threatens who we are and the principles that set Apple products apart in fiercely competitive markets.

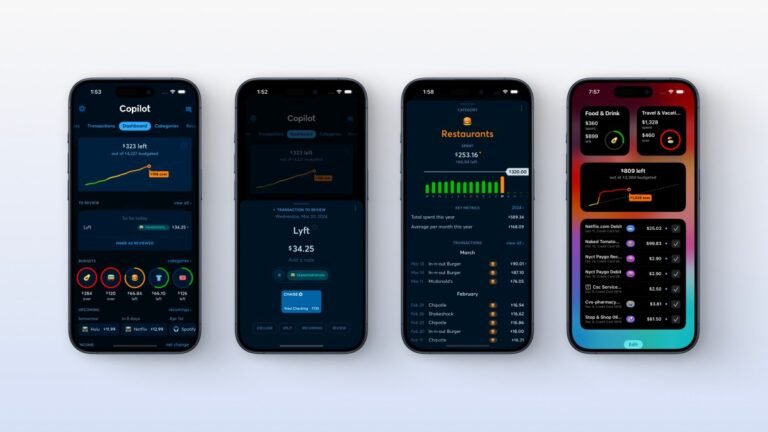

Intuit is winding down budgeting app Mint this week and that’s become good news for competitor Copilot.

The New York-based CEO started the subscription-based personal finance tracker in January 2020 to offer an alternative to Mint.

Users also save an average of 5% after starting with the app, Copilot calculates.

Beyond MintLike millions of others, Ugarte tried some personal finance apps, including Mint, yet found them to be lacking.

Other personal finance apps show where you are spending, even in categories that might not be relevant, he said.

Meanwhile, Fortnite maker Epic Games has been accusing Apple’s iOS App Store of antitrust violations for years in an ongoing, arduous legal battle.

“Apple often enforces its App Store rules arbitrarily,” the suit says.

And unlike Android devices, iPhones do not allow for sideloading apps, meaning that Apple has control over any app in its App Store.

“While Apple has reduced the tax it collects from a subset of developers, Apple still extracts 30 percent from many app makers,” the suit says.

On Thursday, the Coalition for App Fairness (CAF) – which includes Epic Games, Spotify, Deezer, Proton and other companies – released a statement in favor of the DOJ’s action against Apple.

But that’s how things are at Microsoft now: everything needs to have a Copilot angle — even its most straightforward hardware events.

“Windows 11 and Windows 365 promise a new era of AI productivity,” Melissa Grant, Microsoft’s senior director for Windows Enterprise said.

Microsoft is also betting on cloud PCs delivered through Windows 365 as a surface for the Copilot.

Microsoft says that Windows App usage has now reached over 3 million active hours since it entered preview at the Microsoft Ignite 2023 in November.

And those Windows 365 cloud PCs?

The Browser Company, which makes the Arc browser, has raised $50 million in a round led by Pace Capital at a $550 million valuation, TechCrunch has learned exclusively.

However, in January, the company released the Arc Search app on iOS, focusing on putting AI-powered search at its center.

This is ingrained in the DNA of The Browser Company.

Paul Frazee, who built a decentralized browser called Beaker, said that scaling a browser product is hard as people are set in their way and making them switch is tough.

The Browser Company has a big ambition to build an “internet computer” for users.

Watchworthy will now tell you which streaming services to cancel and which to keepTV recommendation app Watchworthy released two new features to give viewers access to more personalized recommendations, including a new recommendation category for streaming services and a collaborative watchlist to get movie suggestions for your entire friend group.

Watchworthy is best known for its “worthy” score, which tells you the likelihood that a TV show or movie is worth your time.

For instance, if you’re obsessed with home improvement shows, Watchworthy recommends Discovery+ as a top pick, listing it as 95-99% worthy.

As major streaming services continue increasing subscription costs, viewers are having a hard time deciding which subscription is worth investing in.

Watchworthy helps you discover over 200 streaming services, such as Netflix, Max, Disney+ Prime Video, Peacock, Paramount+, Apple TV+, and Hulu, among others.

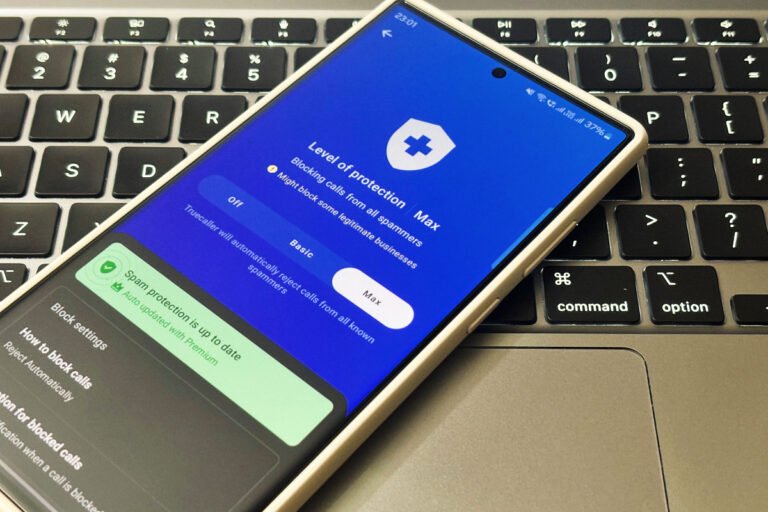

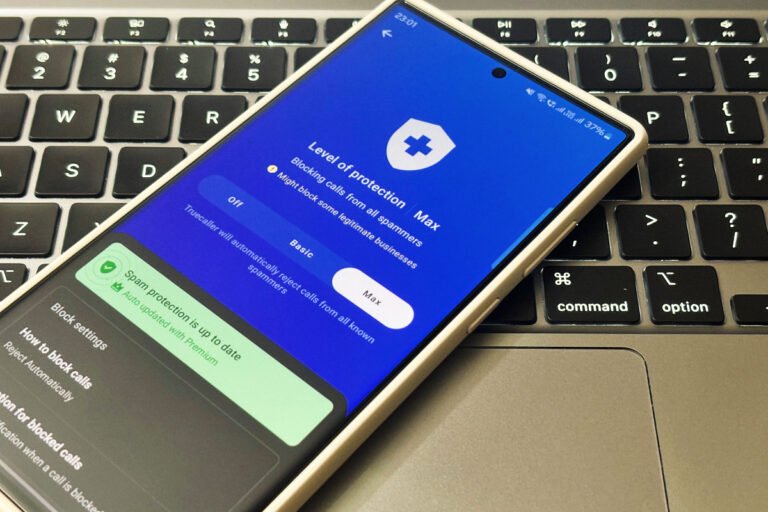

Caller ID app Truecaller today blocks between 38 and 40 billion spam calls annually for its 374 million+ users.

The update is Android-only: Apple does not allow Truecaller (or other caller ID services) to check callers’ spammer status to block calls automatically on iOS.

But to get the best out of the app, users have to engage and tweak their own lists.

This isn’t the first AI feature at Truecaller: it provides an AI assistant that screens calls to identify why the caller has dialled the user.

After updating the Truecaller app to v13.58 or later, users can find the new spam-blocking feature by going through Settings > Block.

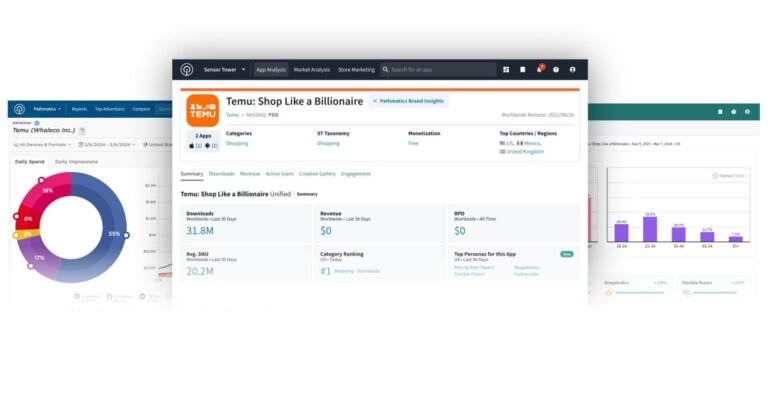

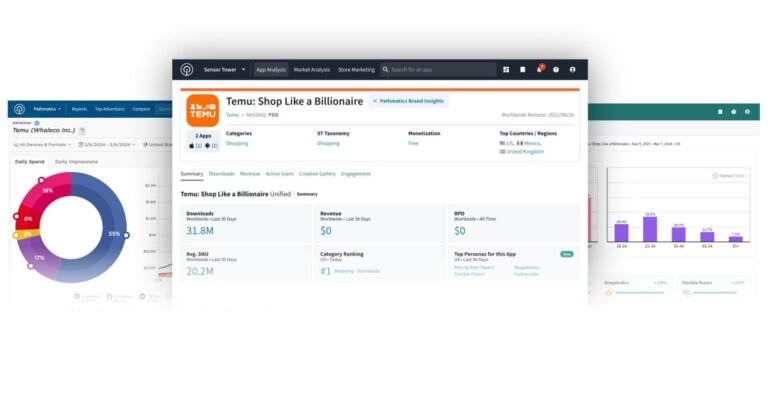

Sensor Tower, a leading app analytics firm, is acquiring rival Data.ai in a move that consolidates the mobile intelligence industry, creating a powerhouse that could dominate the sector and provide aggressively competitive insights into the app economy.

Sensor Tower didn’t disclose the financial terms of the deal but said Bain Capital and Riverwood Capital are providing credit-based financing.

Data.ai had secured over three times the amount of funding compared to Sensor Tower, according to Crunchbase.

Data.ai had raised over $157 million over various rounds, whereas Sensor Tower had raised just $46 million.

Sensor Tower issued an apology in 2020 and said the company had taken the route it did to stay competitive.