Although Ripple has been around since 2012, it and the XRP Ledger are doubling down on its global payments journey.

At the same time, it’s also aiming to become the go-to enterprise infrastructure provider, the company’s president, Monica Long, said on TechCrunch’s Chain Reaction podcast.

Distinct from the Ripple network and protocol, the XRP Ledger is a decentralized public ledger with an open source code base that anyone can contribute to or use, Long said.

“Foreign exchange is pretty concentrated in terms of the players who actually have enough capital to provide liquidity for those transactions,” Long said.

“And so when you have a lot of concentration, you have a lack of competitiveness for the pricing.”

This new impediment to securing financing opportunities for BIPOC entrepreneurs is disconcerting.

Confronted with these challenges, angel investors and investment groups that fund BIPOC entrepreneurs must remain committed to keeping vital early-stage capital flowing.

This inherent color blindness removes a structural impediment that blocks minority investing within the conventional venture capital fund structure.

Eleven percent of all campaigns on the platform Honeycomb have been run by Black founders, and SeedInvest has seen 12% of campaigns run by Black founders.

Defining intentionally inclusive criteria in your fund/syndicate may also open the door to additional funding opportunities for BIPOC entrepreneurs.

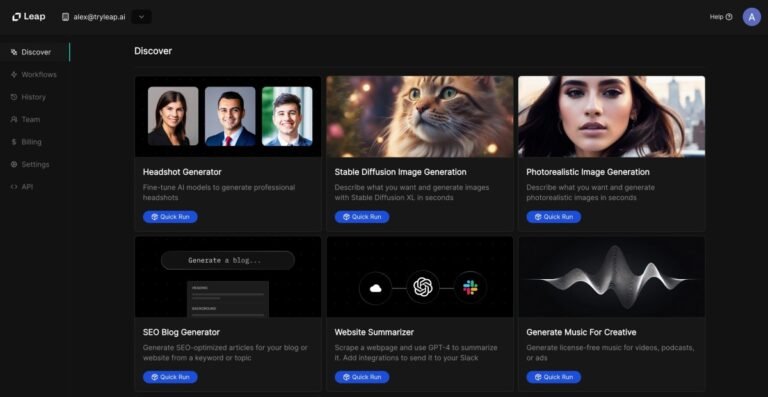

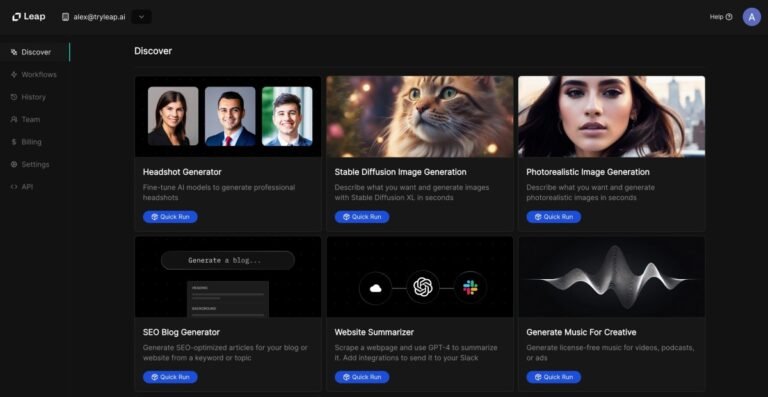

Leap AI is building a solution for these companies to easily integrate AI-powered workflows or even build their own using an easy process.

It also has plans starting from $29 per month with more credits, no limit on building workflows with customer support.

Why did the founders build Leap AI?

Another unique aspect is that we provide the interoperability between multiple models, multiple vendors, and multiple companies,” he said.

Leap AI is also working on improving context awareness of its workflows so it can leverage previously generated results.

AppDirect, a San Francisco- and Montreal-based platform for buying, selling and managing tech through a network of IT advisors, has raised $100 million from CDPQ to expand its financing program for small- and medium-sized tech businesses.

“Our Invest program is purpose-built to empower our technology advisors,” Emanuel Bertolin, AppDirect’s chief revenue officer, said in a statement.

“To keep up with today’s ever-changing market, technology merchants need fast access to capital to accelerate their growth.”AppDirect’s Capital Invest program is a loan program, providing capital for tech businesses in the form of upfront payments.

Today, AppDirect offers a set of tools that let businesses monetize — or buy — tech products across a range of different channels and devices.

We also provide the opportunity for our advisor community to procure technology for their customers directly from the AppDirect catalog.”AppDirect launched the Capital Invest program in 2021.

In lieu of stateside political momentum to build more — and better — public toilets, enterprising developers and entrepreneurs have attempted to tackle the problem in a number of ways.

Beyond maps that track the locations of public restrooms, startups like Throne are deploying high-tech, self-cleaning and self-contained portable toilets that can be reserved through a mobile app.

A new venture launching at CES 2024, Flush, wants to do just that — renting out restrooms to customers across cafes, restaurants, hotels and other high-traffic areas.

USC computer science graduate Elle Szabo founded Flush after frustrating experiences trying to find public restrooms while on a diuretic medication.

Some might argue it’s incumbent on governments, not businesses, to build and service more public restrooms — and this writer doesn’t disagree.

It’s becoming increasingly clear that businesses of all sizes and across all sectors can benefit from generative AI.

McKinsey estimates generative AI will add $2.6 trillion to $4.4 trillion annually across numerous industries.

That’s just one reason why over 80% of enterprises will be working with generative AI models, APIs, or applications by 2026.

However, simply adopting generative AI doesn’t guarantee success.

However, only 17% of businesses are addressing generative AI risks, which leaves them vulnerable.

You may be looking to switch out your current budgeting app for a better one, or perhaps you’re someone who has traditionally relied on spreadsheets.

For individuals, a good budgeting app can help you save money by creating and sticking to a monthly budget.

For startups and small businesses, a good budgeting app can help you understand your company’s financial health and make informed decisions.

Best apps for startups and small businessesFreshBooksFreshBooks is a simple tool that can help startups and small businesses create a budget and stick to it.

Although it’s marketed as a personal budgeting app, Toshl can be a good tool for new startups looking to understand and manage their finances for a fraction of the cost of budgeting apps marketed toward small businesses.

Vestwell, which provides the infrastructure for employers to power workplace savings programs, has raised $125 million in what the company describes as a “preempted” round of funding.

Vestwell CEO Aaron Schumm started the company in 2016 and launched the cloud-native platform in 2017.

Over 1 million people working across 300,000 businesses use the Vestwell platform, which the company said has helped power the savings of nearly $30 billion in assets over time.

As an extension of its partners, Vestwell says it enables a suite of programs, including retirement, health and education, such as 401(k), 403(b), IRA, 529 Education, ABLE disability and Emergency Savings programs.

“We’re now the leading partner in this field, and currently power 80% of the live state auto-IRA savings programs in this country,” he said.

Businesses are working hard to conform to traditional heuristics like Rule of 40 (i.e., the idea that the sum of revenue growth and profit margin should equal 40%+, a metric that Bessemer helped popularize).

The world has over-rotated into an FCF margin mindset over a growth mindset, which is backward for growing efficient businesses.

Long-term models show that even in tight markets, growth should be valued at least ~2x to 3x more than FCF margin.

While a margin increase has a linear impact on value, a growth rate increase can have a compounding impact on value.

We show the detailed math below, and it’s confirmed by public market valuation correlations when you backtest the relative importance of growth versus FCF margin.

Bank and technology platform Kapital continues to rake in venture capital, grabbing another $40 million in Series B dollars and $125 million in debt financing.

We previously covered Kapital’s $20 million Series A in May that included $45 million in debt.

Rene Saul and Fernando Sandoval co-founded Kapital in 2020 to provide similar financial visibility to small businesses, using data and artificial intelligence, that large enterprises have.

“Small businesses represent 90% of the world’s businesses; however, in Mexico, only 10.5% of those small businesses have access to total bank credit,” Saul said.

“That’s what we’re fixing — we give them visibility of their finances.”In 2023, Kapital’s customer base grew to 80,000 small businesses in Mexico, Colombia and Peru.