More than 20,000 electric scooters belonging to Superpedestrian will be auctioned off later this month, along with other equipment from the startup’s U.S. operations, after closing its doors December 31.

Two “global online auction” listings have appeared on the website of Silicon Valley Disposition, an online market for “surplus assets,” which will feature scooters and other paraphernalia from cities Superpedestrian operated in, like Seattle, Los Angeles, and New York City.

The first auction opens January 23, and will run for three days.

A successive auction is set to run from January 29-January 31.

Though it raised $125 million less than two years ago, the company struggled financially in 2023 as it operated its shared scooter fleets in dozens of cities around the globe.

Egyptian B2B e-commerce startup MaxAB and Wasoko, a Kenya-based e-commerce player with operations in Tanzania, Rwanda, Uganda and Zambia, are in talks to merge operations, TechCrunch has exclusively learned from multiple sources.

The merger talks come as B2B e-commerce companies in Africa continue to scale back operations due to funding scarcity.

TechCrunch learned that the company had only received $30 million by the time merger talks, which are said to be investor-led, started.

As of last year, the prospect of a merger between MaxAB and Wasoko, both asset-heaving B2B e-commerce startups, seemed unlikely.

The eight-year-old B2B e-commerce company has since expanded to Zambia and the Democratic Republic of Congo.

This year was tough for many space companies, and we aren’t trying to paper that over with our optimism.

Advanced satellite operations demonstrationsIn the broadest possible terms, a huge portion of space startups are interested in increasing the number of things a satellite can do in space.

Another hot area of satellite operations involves in-space manufacturing and satellite reentry.

Next year, we expect to see more demonstrations from startups looking to execute state-of-the-art satellite operations.

2024 should be chock full of exciting tests and new developments from other companies looking to take their slice of the launch market.

Superpedestrian, the e-scooter startup known for its self-diagnostic software, is shutting down its U.S.-based shared scooter operation and exploring a sale of its European business, TechCrunch has exclusively learned.

The company’s director of US operations, Alexander Berg, confirmed the news to his team Friday afternoon on a Zoom call.

Superpedestrian itself has gone through a series of layoffs, including one just months after closing its Series C round.

Superpedestrian used technology, and specifically diagnostic and safety software, to differentiate it from rivals like Bird and Tier.

Superpedestrian had planned to build and roll out new scooters equipped with its branded Pedestrian Defense to 25 cities across the United States and Europe in 2022.

An email, penned by newly minted president and CTO Mo Elshenawy, was sent this morning to the entire 3,800-person workforce.

Cruise is targeting non-engineering jobs in the layoffs, particularly those people who worked in the field, commercial operations and corporate staffing, according to the email.

Engineering, a category that makes up the bulk of the Cruise workforce, is largely being preserved, according to the content of the email and discussions with internal sources.

The layoffs have been largely expected at Cruise for weeks now.

GM and the Cruise board have been scrambling ever since the October 2 incident put the company in the crosshairs of state, local and federal agencies.

Pan-African e-commerce platform Jumia has disclosed its intention to discontinue its food delivery service, Jumia Food.

As a result, Jumia will cease its food delivery operations across these markets by the end of December 2023.

Jumia is redirecting its focus towards the core physical goods business and maintaining its JumiaPay operations across all 11 markets, as outlined in a recent statement.

Jumia’s decision to discontinue its food delivery business aligns with a broader trend in the industry, mirroring the recent exit of another food delivery competitor, Bolt Food, from Nigeria and South Africa.

Both exits seem to be influenced by current macroeconomic headwinds, high inflation and intensified competition within the food delivery sector across the continent.

True Anomaly has closed $100 million in new funding, a strong signal that the appetite for startups operating at the intersection of space and defense is far from abating.

The new round was led by Riot Ventures, with participation from Eclipse, ACME Capital, Menlo Ventures, Narya, 645 Ventures, Rocketship.vc, Champion Hill Ventures and FiveNine Ventures.

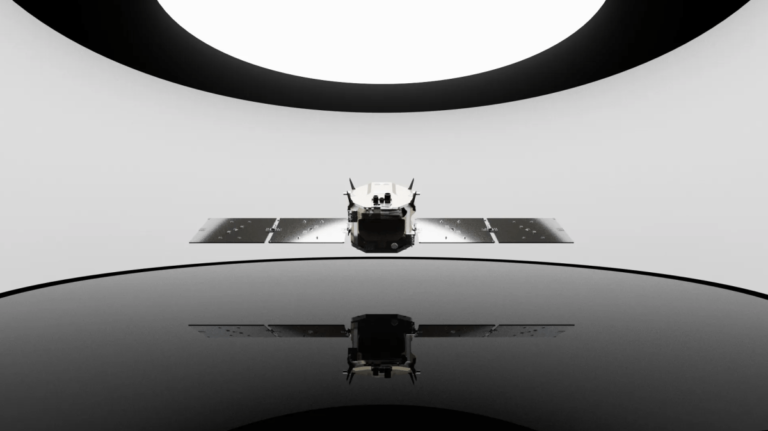

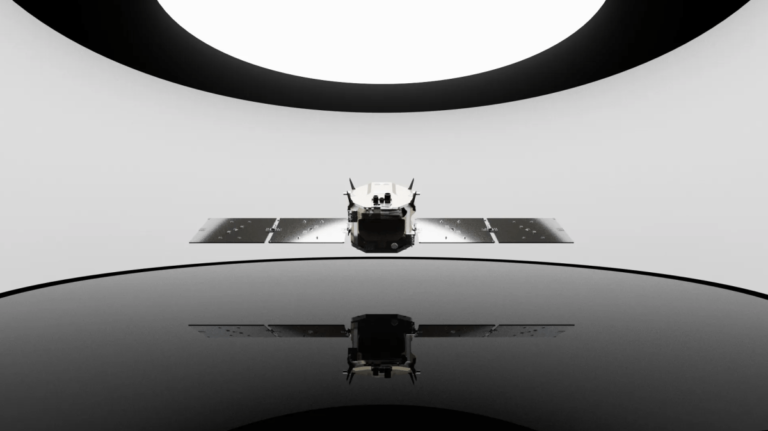

True Anomaly is looking to fill a critical gap in space situational awareness and defensive operations through software and hardware, including the line of autonomous spacecraft capable of rendezvous and proximity operations.

In previous interviews with TechCrunch, True Anomaly CEO Even Rogers called out what he sees as a critical “information asymmetry” between the U.S. and its adversaries in space.

Jackal, Mosaic and the company’s other work in space domain awareness are meant to close that gap.

The signing of the takeover agreement by Flagstar Bank is significant because it shows that regulators are supportive of the acquisition and believe that it will help to improve the…

Eazy Digital is an insurance technology company that specializes in helping small insurance companies in Southeast Asia to scale up more efficiently. Their SaaS platform enables insurers to digitize many…