Co-founders Elle Smyth and Sarah Hamer came up with the idea while working together at supply chain unicorn startup, Stord.

“We met each other and bonded over our love for the supply chain industry,” Smyth told TechCrunch.

Warehouse workers have to reference “phone book-sized” manuals of how to ship items to retailers, like Target and Walmart.

If shipping/warehouse workers don’t pack these items correctly, retailers will charge the brands fees, known as a chargeback.

RetailReady replaces those manuals with a digital version that gives workers a directed workflow on how to pack an order correctly.

The financial reporting and auditing process is not often on the list of sexy topics that technology startups want to go after.

After years of performing reporting and auditing work for companies like Miro, Autodesk, Dropbox, Flexport and Yelp, Mary Antony and Kelsey Gootnick decided reporting and auditing needed some technology love, too.

So they started San Francisco-based InScope in 2023, leveraging machine learning and large language models to provide financial reporting and auditing processes for mid-market and enterprises.

We make it possible for our customers to have effortless, but accurate and reliable financial statements every time.”InScope’s financial report drafting tool.

So much so that they could be customers, Gootnick said.

Torpago, a commercial credit card and spend management provider, is no different, but with one caveat — banks are who it builds technology for, particularly community banks.

“We started as a competitor with Brex and Ramp, as well as American Express and Capital One,” Jackson told TechCrunch.

The Torpago Powered By tools and infrastructure enable means that those banks’ to customers don’t have to leave the bank’s brand domain to get sophisticated fintech features.

Banks have all the customers, and they have all the card volume, but “they have the absolute worst credit card tools and technology,” he said.

Since making the shift to banks as customers, that was whittled down to 300 companies while it goes after bank customers.

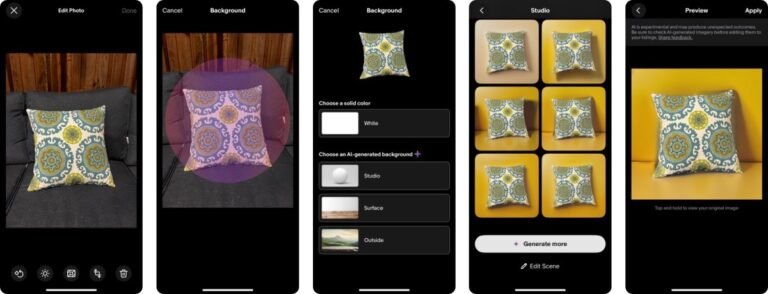

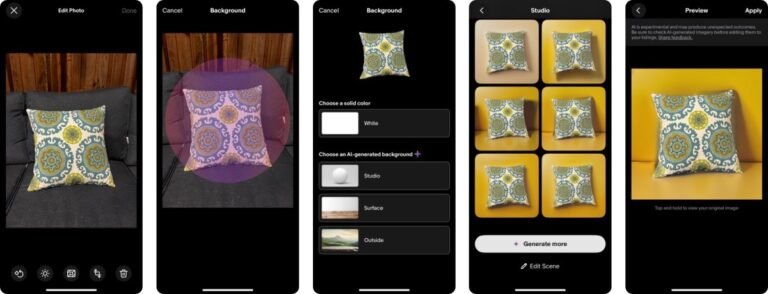

eBay’s newest AI feature allows sellers to replace image backgrounds with AI-generated backdrops.

eBay’s background enhancement tool could benefit sellers who lack the equipment or skills to take professional-looking or high-quality photos.

It may also improve on eBay’s previous offering, which used computer vision technology to give listing photos a simple, white background.

The new AI feature is powered by the open-source model Stable Diffusion.

The latest announcement comes a year after eBay introduced an AI feature that generates titles and descriptions for a product listing.

Today, Webflow announced that it acquired Intellimize, a startup leveraging AI to personalize websites for unique visitors.

The majority of the Intellimize team — around 50 people — will join Webflow.

Vlad Magdalin, the CEO of Webflow, said Intellimize was a natural fit for Webflow’s first-ever acquisition because its product meets a need many Webflow customers share: personalizing and optimizing their websites.

Intellimize will continue to be sold standalone to non-Webflow customers, but it’ll increasingly link to — and integrate with — Webflow services.

— personalization product efforts at Webflow.

Don’t blame MKBHD for the fate of Humane AI and Fisker Famed YouTuber Marques Brownlee makes a splash not for what he said — but for howHumane AI raised more than $230 million before it even shipped a product.

“It was really hard to come up with a title for this video,” Brownlee says in the video itself, which currently has over 5 million views.

The actual review was fair and balanced.”An underdog worth $800 millionCritics of MKBHD’s video are operating as though Humane AI is an underdog in the space.

In the month preceding the MKBHD review, federal safety regulators began investigating the Fisker Ocean for complaints about the brakes not working well.

The Humane AI pin was widely panned across the tech review board, but the only person receiving outsized and long-lasting criticism for his review is MKBHD, a Black man.

The “AI ClipHero” feature creates short clips from livestreamed selling events, which often last for hours.

“Shoppable ‘explainer’ videos are the most powerful video commerce medium right now, with TikTok and Instagram becoming the primary way Gen Z discovers, learns about products and purchases products.

However, creating shoppable videos [requires] significant production times,” CommentSold CEO Guatam Goswami told TechCrunch.

AI-powered clipping software isn’t new, but not many companies have developed AI-powered tools specifically designed for live commerce.

Since launching in 2017, CommentSold now helps over 7,000 small- and mid-sized businesses deliver live shopping and e-commerce experiences.

After its IPO, the platform is planning a slew of product features for the year ahead, and — spoiler alert — most of them are powered by AI.

“I think the IPO was an important milestone, but we’re just focused on building for our users,” Reddit Chief Product Officer Pali Baht told TechCrunch.

Reddit’s product roadmap includes faster loading times, more tools for moderators and developers, and an AI-powered language translation feature to bring Reddit to a more global audience.

According to Reddit’s IPO filing, in December 2023, 50% of Reddit’s daily active unique users were from non-U.S. countries.

The company will build on those updates with other new tools, like an LLM that’s trained on moderators’ past decisions and actions.

The company has rebranded to “Limitless,” and is now offering an AI-powered meeting suite and a hardware pendant that can record your conversations.

Company co-founder Dan Siroker first posted the idea of a conversation-recording pendant last October and started accepting orders at $59.

Siroker posted the final design this week, along with the news of the company’s pivot.

It’s a web app, Mac app, Windows app, and a wearable.

We plan to reimplement many of our user’s favorite Rewind features directly into Limitless,” Siroker said.

Business banking startup Mercury, founded in 2020, is now launching a consumer banking product.

“We already have a few hundred thousand users of our business banking product, and a lot of people have expressed that they want a personal banking product,” he told TechCrunch in an interview.

The person also said the fintech partner banking market as a whole has been the target of more regulatory scrutiny.

Crossing overBut success in B2B banking doesn’t automatically queue up Mercury to handle consumer banking.

Sign up for TechCrunch Fintech here.