Turkey has gained a well-earned reputation as a veritable cauldron of mobile games startups, leading to the rise of VCs dedicated to the sector.

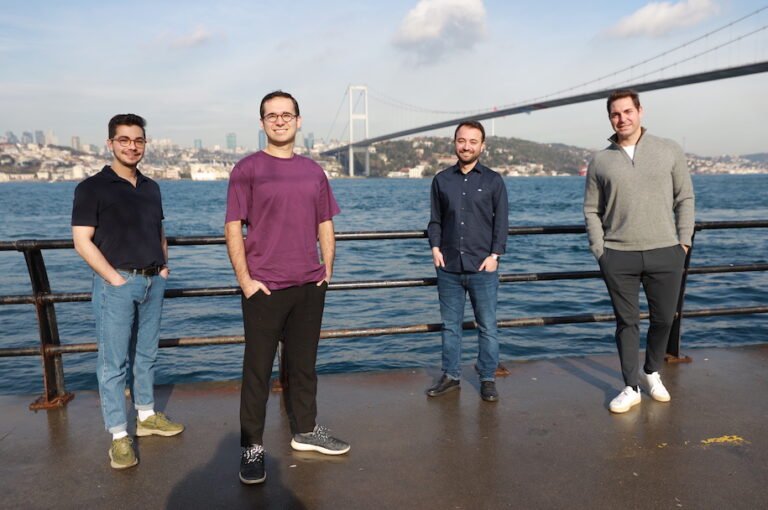

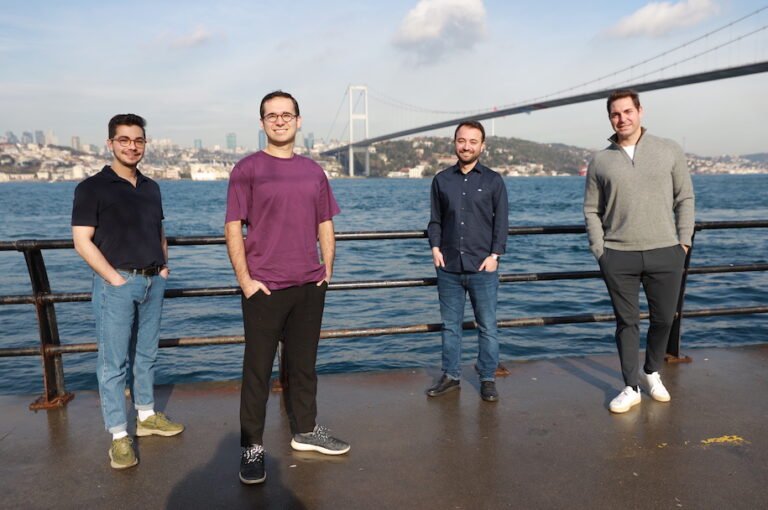

The latest to join this coterie is Laton Ventures, a new gaming-focused VC that has raised a $35 million fund.

Indeed, between 2018 and 2022 Turkish gaming start-ups raised more than $1 billion in funding.

There are now at least 25 VC funds that invest in video games startups based out of Turkey.

“We’re positioning as a bridge between the Turkish gaming ecosystem, which is booming, and the international gaming ecosystem.

But amid the buzz, one crucial question emerges: How is AI shaping the journey of founders?

TechCrunch’s Early Stage conference is set to delve deep into this inquiry, and we’re thrilled to announce a special Women’s Breakfast event on April 25 in Boston.

This exclusive gathering will focus on exploring the intricate ways in which AI is reshaping the entrepreneurial path for women in tech.

TechCrunch Early Stage 2024 promises to be a landmark event, and the Women’s Breakfast is your gateway to unlocking the full potential of AI in your entrepreneurial journey.

Is your company interested in sponsoring or exhibiting at TechCrunch Early Stage 2024?

Former president Donald Trump’s digital media company is losing money, and lots of it.

But why is that any different from other “startups,” which often struggle to post a profit for years, if they ever do?

Truth Social, the main business of TMTG, has failed to attract more than a few million users.

Truth Social, the main business of TMTG, has failed to attract more than a few million users.

By the time Trump is able to sell his shares, it’s likely this company will be worth anything like what it supposedly is today.

Climate-tech VC Satgana has reached a final close of its first fund, which targets to back up to 30 early-stage startups in Africa and Europe.

“I ran it for like five years, and about six years ago I started to really have the awakening to the extent of climate change.

“We are entering the continent to pursue green growth objectives; so deploying renewable energy, low carbon buildings, mobility solutions and so on.

Satgana is among the new funds that are dedicated to the African climate tech sector.

These funds include Africa People + Planet Fund by Novastar Ventures, Equator’s fund and the Catalyst Fund.

VNV Global attributes its fair value estimate to a valuation model based on trading multiples of public peers rather than historical funding rounds.

Funding and interest in B2B startups took off in the last decade and saw a bump in the wake of COVID-19.

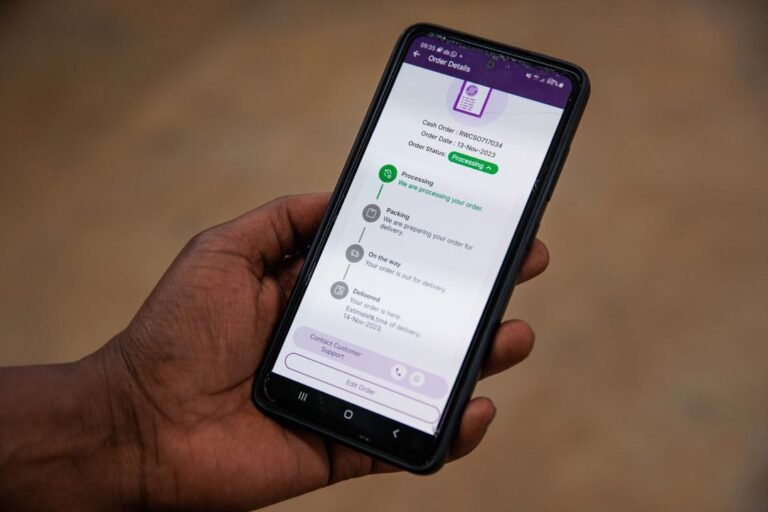

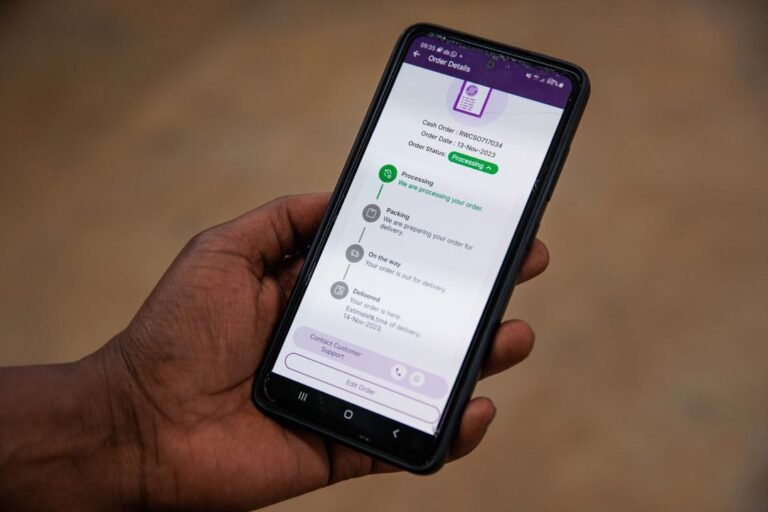

African startups, including B2B e-commerce platforms like Wasoko, have followed the same playbook as their counterparts further afield: layoffs; cost cuts; and closures are not uncommon.

In the lead-up to its merger with MaxAB, Wasoko shuttered hubs in Senegal and Ivory Coast and laid off staff in Kenya.

It operates a food and grocery B2B e-commerce platform in Egypt and Morocco, expanding to the latter following its acquisition of YC-backed WaystoCap in 2021.

1991 Ventures is the brainchild of Ukrainian brothers Denis and Viktor Gursky, who are better known for running incubation and accelerator programs inside Ukraine.

The Gursky brothers previously backed over 200 startups between 2016 and 2024, via their incubator Social Boost and their 1991 Accelerator.

Startups backed to date include LegalTech startup AXDRAFT; European toll payment app eTolls; and cybersecurity company Osavul.

Finally, TA Ventures is perhaps the best known and most active Ukrainian VC internationally, headed up by the almost-ubiquitous Viktoriya Tigipko.

Of course, many of the tech companies Ukraine will produce in the forthcoming years are likely to be either ‘dual-use’ or related to defence.

If you’re looking for comparisons, Norrsken VC is a $130 million impact VC that covers climate, while Demeter Partners last raised a €250 million fund focused on climate.

World Fund is also backed by pension funds including the UK Environment Agency Pension Fund, Wiltshire Pension Fund, and Croatia’s Erste Plavi.

World Fund has completed its raise during a war in Europe, interest rate rises, and jittery LPs.

In 2023 there was over $20 billion raised by European climate tech startups, almost matching the previous year, and bucking declining trends in other sectors, according to Dealroom.

The U.K., Sweden and Germany led for total climate tech VC in 2023 but Iceland, Lithuania and Bulgaria showed notable growth.

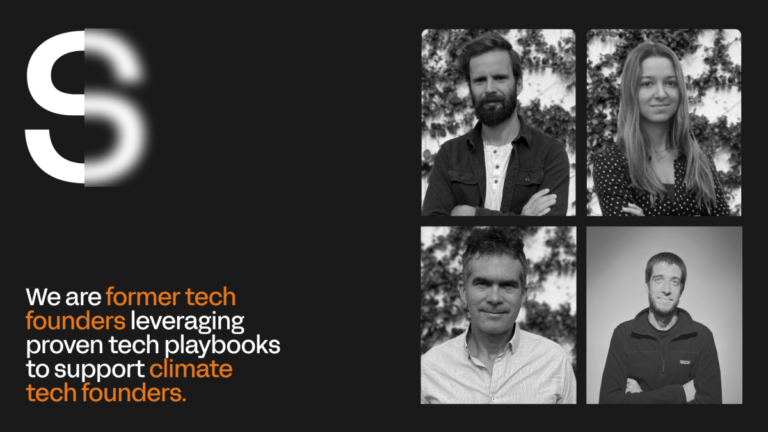

Silence wants to shake things up when it comes to climate tech investment.

This new angel-style VC firm has already raised $35 million and plans to make dozens of small investments in climate startups to help them apply the tech startup playbook.

He also founded Merlin, an hourly jobs marketplace in the U.S.With Silence, Borja wants to apply his experience to climate investment.

A silent partnerSince the first close of the fund in June 2022, Silence has already invested in 22 different companies.

So we told them ‘we’ll be your lead,’” Borja said.

Meet the first roundtable roster at TC Early Stage 2024You won’t have to search very hard or go very far to engage in compelling conversations next month at TechCrunch Early Stage 2024.

One of the most popular attractions at Early Stage are roundtables.

These expert-led, small-group conversations focus on a specific topic designed to inform, inspire and help you build a better business.

Starting roundtable roster at Early Stage 2024Adapt & Thrive: Mastering the Chameleon MindsetWith Christopher Dube (CIO, Prepare 4 VC) and Jason Kraus (CEO, Prepare 4 VC).

Book your early-bird pass to TC Early Stage 2024 right now before prices go up on March 31.

Arjun Sethi speaks with the confidence of someone who knows more than other people, or else who knows that sounding highly confident can shape perception.

Namely, if Termina is so good, why are Sethi and Tribe giving other investment firms a way to better compete?

Relatedly, why should other investors trust Termina, which ingests its customers’ data to improve over time?

This may prove doubly true given Termina’s ties to Tribe Capital.

Among these is Alex Chee, who cofounded MessageMe with Sethi, joined him at Social Capital, and subsequently co-founded both Tribe and Termina with him.