Paramount Global has reached a binding agreement to sell its stake in Reliance-controlled Indian media house Viacom18 to Reliance for $517 million, both companies said Wednesday.

The deal will increase Reliance’s stake in Viacom18, which operates dozens of TV channels as well as streaming service JioCinema, to 70.49%, Reliance said in its disclosure.

Law firm JSA Associates said late last month that it was advising the two firms for the deal.

The move follows Disney announcing plans to merge its India business with Viacom18 late last month.

Viacom18 also counts Bodhi Tree, an investment firm run by James Murdoch and Uday Shankar, among its backers.

Startups are hiring fewer workers, and paying out less in equity compListen here or wherever you get your podcasts.

Hello, and welcome back to Equity, the podcast about the business of startups, where we unpack the numbers and nuance behind the headlines.

This is our Wednesday episode, in which we dig into critical startup news to stay abreast of what founders and venture capitalists are working on.

Today on the podcast, we got through the following:

Teachers’ Venture Growth, the late-stage venture and growth investment arm of Ontario Teachers’ Pension Plan, is investing $80 million in Perfios, an Indian fintech that provides real-time credit underwriting solutions to banks and other financial institutions.

The new investment values Perfios at a valuation of over $1 billion.

Bengaluru-based Perfios provides real-time data aggregation and analysis tools to financial institutions, enabling them to streamline their customer journeys and make more informed decisions.

Perfios said it delivers 8.2 billion data points to banks and other financial institutions every year to facilitate faster decisioning, and processes 1.7 billion transactions a year with an AUM of $36 billion.

Ontario Teachers’ Pension Plan, one of Canada’s largest pension funds, has ramped up its interest in India in recent years.

Thus, SaaS startups are not category-specific, instead sharing a business model approach more than any particular industry focus.

Among myriad SaaS startups, those focused on selling to business clients — a group often called enterprise SaaS — are a magnet for venture capital.

Since then, investment into enterprise SaaS startups has slowed.

Enterprise SaaS startups raised $21.9 billion, $45.0 billion, $55.1 billion and $58.3 billion in 2017, 2018, 2019 and 2020, respectively.

Perhaps a rate cut or two and a strong enterprise IPO are the tonic required to really reignite venture investment into enterprise SaaS.

Peak XV, the venture firm formerly known as India and Southeast Asia arm of Sequoia, didn’t disclose the size of the new fund.

The new fund, called Peak XV Anchor Fund, will be funded by an internal balance sheet, the source said, requesting anonymity as the matter is private.

The fund will enable Peak XV to “create a global network for learning and collaboration,” the venture firm said, according to the LP source.

The fund will enable Peak XV Partners to have broader skin in the game with its own fund and also explore investment in newer areas, the source said.

With Peak XV Anchor Fund, the venture firm plans to partner with other “managers across regions, strategies and sectors.”Peak XV didn’t immediately respond to a request for comment.

The largest funding rounds raised by startups are becoming rarer and rarer.

The venture deceleration, and its late-stage glaciation, are not stopping the companies that want to reinvent energy from raising huge rounds.

Powering upNine-figure rounds are often called “megarounds” due to their massive heft.

Inside energy’s power surgeIn 2023, China dominated energy megarounds, with most of the money going to makers of solar panels and battery materials.

Fast forward to this year, and the picture in energy megarounds looks dramatically different.

Listen here or wherever you get your podcasts.

Hello, and welcome back to Equity, the podcast about the business of startups, where we unpack the numbers and nuance behind the headlines.

This is our Wednesday show, focused on startup and venture capital news that matters.

If you are a founder or an investor, this one is for you!

Here’s the day’s rundown:

Enter Underscore VC’s Lily Lyman, who is coming to TechCrunch Early Stage 2024 in Boston to discuss how founders can build investor relationships with the right venture capitalists.

She will discuss how to build venture relationships ahead of time, and how founders can — and should!

In today’s more stringent venture environment, founders can’t run a 2021-era playbook (unless they are building an AI foundational model company, I suppose).

So, bring your notebooks and questions to Lyman’s Early Stage session coming up next month.

She’ll be joined by a bevy of other startup folks who will be on hand to share their hard-earned wisdom.

In an unexpected move, Miles Grimshaw announced today that he is rejoining Thrive Capital after working as a general partner at Benchmark for the past three years.

Grimshaw first joined Thrive, a New York-based venture firm that Joshua Kushner founded, in 2013.

He is returning as a general partner.

When joining storied venture firm Benchmark in December of 2020, then-29-year-old Miles Grimshaw became its fifth general partner.

He had similarly joined a team of four other partners at Thrive back in 2013.

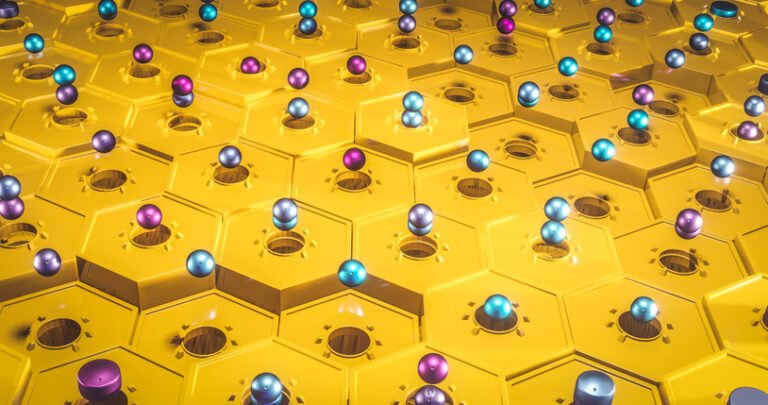

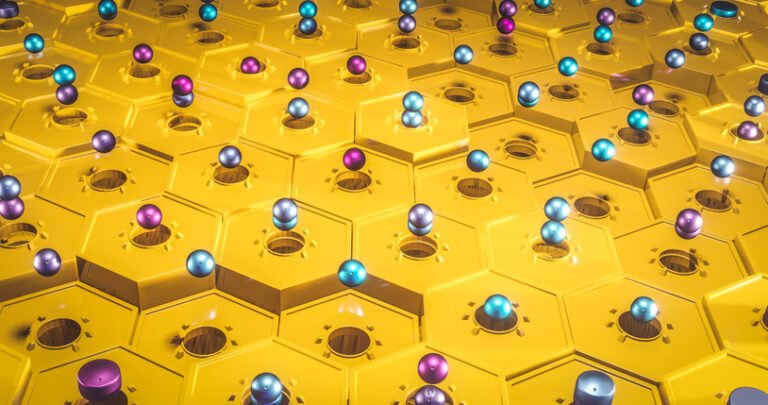

The market for high-level quantum computer science — which applies quantum principles to manage complex computations in areas like finance and artificial intelligence — appears to be quickening its pace.

In the latest development, a startup out of San Sebastian, Spain, called Multiverse Computing is announcing that it has raised €25 million (or $27 million) in an equity funding round led by Columbus Venture Partners.

The funding, which values the startup at €100 million ($108 million), will be used in two main areas.

“Multiverse’s exceptional team will soon apply their unparalleled capability to deliver quantum and quantum-inspired software solutions also within the life sciences and biotechnology markets, where Columbus Venture Partners will help to identify unmet market needs and high-profile industrial partners,” Javier Garcia, a partner at Columbus Venture Partners, in a statement.

Others competing in the same space include the Alphabet spinout Sandbox AQ, Quantum Motion, and Classiq.