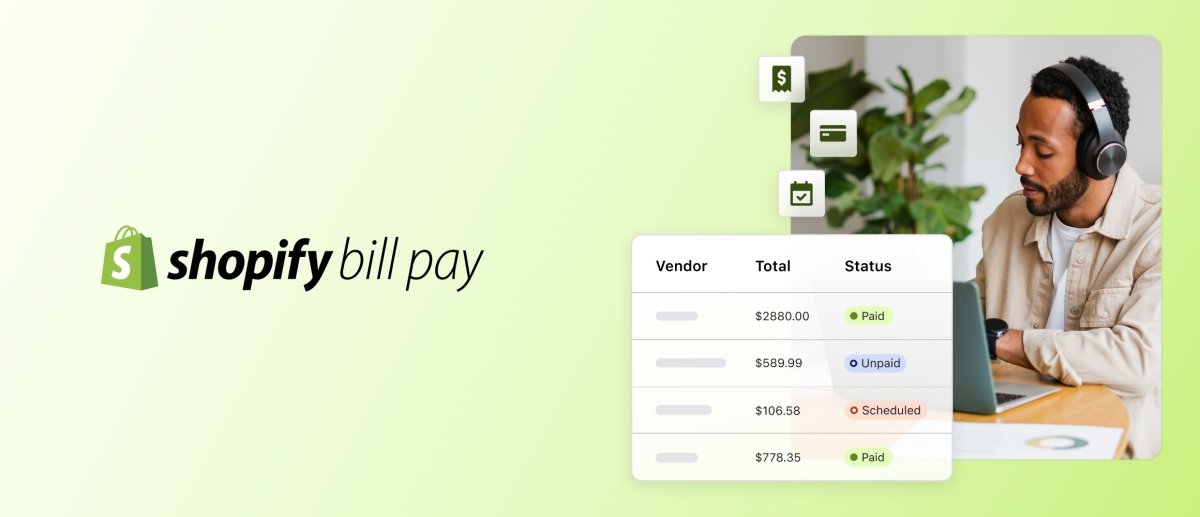

The new bill pay tool allows U.S.-based merchant customers to manage their expenses and vendors via Shopify’s platform, which could be helpful for those who want to keep track of their expenses.

Launching Shopify’s merchant services partnerships and monetization platform is another step in the e-commerce platform’s plan to straddle the intersection of fintech and commerce. The new platform allows merchants to better understand their spending patterns, assess opportunities for cost reduction, and set financial goals that correspond with their business ambitions. With this information at hand, Shopify can help merchants make the most efficient use of their dollars while also driving increased online sales.

Merchants that have been asking for money movement capabilities may feel right at home with the new features in QuickBooks. The ability to quickly combine invoices and Payments Into Jobs, as well as receive payment notifications, will make it easier for merchants to stay on top of their finances. Additionally, consolidating expenses into one place will help merchants save time and money.

Shopify is a leading e-commerce platform that offers merchants an easy way to sell their products online. In addition to its e-commerce capabilities, the company also provides merchants with payment processing and money management tools. Shopify has been on the fintech journey for a long time, and its experience benefits its customers in many ways. First, because Shopify knows a lot about payments, it can provide helpful tips and advice to merchants who are trying to take their businesses online. Second, because Shopify is familiar with the dynamics of micro and macro lending, it can help Merchants get the loans they need in order to expand their businesses

Shopify’s decision to embed its bill pay feature into its existing product was a wise one. Merchants who use the platform can easily manage their accounts payable and receivables from within the same interface, making it easier for them to stay organized. This integration is important because it ensures that Shopify’s merchant customers can run their businesses efficiently and with less hassle.

Clearly, there is a need for a more seamless and intuitive bill pay experience for consumers. The current process of paying bills through bank accounts can be cumbersome and difficult to access, which is Why companies like PayWith are so popular. PayWith allows consumers to pay their bills by converting them into a usable currency that they can use anywhere, no matter what payment method they are already subscribed to. This makes paying bills much more convenient and user-friendly, minus the headache of having to figure out which bank offers bill pay integration and managing numerous accounts

Merchants who use Shopify will be able to choose from a variety of funding methods, including a bank account, Shopify Balance, credit or debit card or an ACH bank transfer. This means they can even pay with their credit cards even if the vendor doesn’t accept them.

For merchants who want the fastest payment option and don’t mind sacrificing some cost-effectiveness, online payment processors like Shopify offer speed that can be difficult to come by from traditional banks. Plus, with pre-schedule payments and the ability to set up automatic payments, Shopify keeps merchants organized and minimize disruptions during busy times (like Christmas).

A Loyalty program is another option for encouraging customers to make repeat payments. By rewarding customers for making regular payments, merchants can retain more of their customer base. A loyalty program also makes it easier for customers to identify and track their spending patterns, increasing the likelihood that they’ll make future payment appointments.

The company claims that their new subscription model will make bill pay easier for small merchants and that they have listened to feedback from those who complained about the difficulty in paying bills.

A bill pay feature would also give Shopify insights into how customers are spending and which vendors they’re spending with. This could help them develop better marketing strategies, as well as provide a better experience for their customers.

A startup called Upstart is looking to change that by using data analysis and consulting to help small businesses save money and grow their businesses. By partnering with banks, Upstart expects to give small businesses the insights they need to compete with larger companies.

In light of Amazon’s recent acquisition of Whole Foods, it is clear that the retail giant is serious about becoming a major player in the food industry. However, Amazon faces several challenges in this area, including competition from brick-and-mortar stores and online retailers such as Shopify. Despite these challenges, Shopify remains one of the most popular ecommerce platforms for small businesses and entrepreneurs. Indeed, it has reportedly worked with “millions of merchants

In recent years, there has been an increasing focus on the use of blockchain technology in the financial industry. This is due to its potential to streamline transactions, reduce costs and improve security. In fact, a number of leading banks